Quick update: BoC left interest rate unchanged at 0.50% as widely expected.

Dollar recovers mildly today but remains the weakest major currency for the week so far. Consumer inflation data from US looks promising. Headline CPI rose 0.3% mom, 2.1% yoy in December, accelerated from November’s 1.7% yoy. Core CPI rose 0.2% mom, 2.2% yoy, accelerated from prior month’s 2.1% yoy. Both met market expectations. Technically, the declines in Dollar and treasury yields seem to be losing some momentum. But volatility is anticipated on Donald Trump’s inauguration data this Friday. Meanwhile, it should be noted that after all the rhetorics and speculations, fed fund futures are still pricing in 67.8% change of another rate hike by Fed by June. That hasn’t changed much in recent weeks.

Released from UK, jobless claims dropped -10.1k in December, better than expectation of 5.0k rise. Unemployment rate was unchanged at 4.8 in the three months to November. Total unemployment dropped -52k to 1.6m, lowest in more than a decade since 2006. Wages also showed solid growth with average weekly earnings increased 2.8% 3moy, comparing to expectation of 2.6% 3moy. Sterling pared back some of this week’s gain and turned mixed for the week. Yesterday, UK prime minister Theresa May delivered her speech on Brexit. May indicated that UK would seek a free-trade deal with the EU outside the single market. That will be a new customs relationship for to negotiate trade deals around the world with "frictionless" cross-border trade. She seeks to have a a "phased implementation process" at the end of the two-year period of negotiations. Importantly, May confirmed that "the government will put the final deal… to a vote in both Houses of Parliament before it comes into force".

Elsewhere, Eurozone CPI was finalized at 1.1% yoy in December with core CPI at 0.9% yoy. German CPI was finalized at 1.7% Yoy in December. Australia Westpac consumer confidence rose 0.1% in January.

USD/JPY Mid-Day Outlook

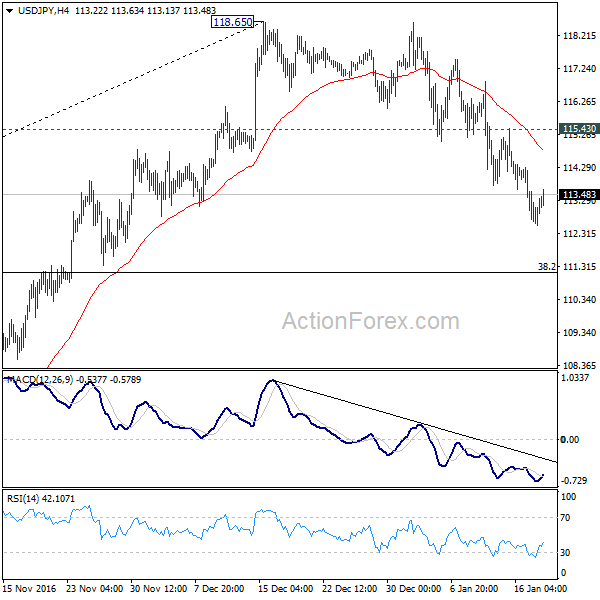

Daily Pivots: (S1) 112.04; (P) 113.16; (R1) 113.72; More…

With 115.43 minor resistance intact, fall from 118.65 is expected to extend to 38.2% retracement of 98.97 to 118.65 at 111.13. At this point, we’d expect strong support from there to contain downside and bring rebound. Above 115.43 minor resistance will turn bias to the upside for retesting 118.65 high. However, sustained break of 111.13 will argue that whole rise from 98.97 has completed and bring deeper fall to 61.8% retracement at 106.48 and below.

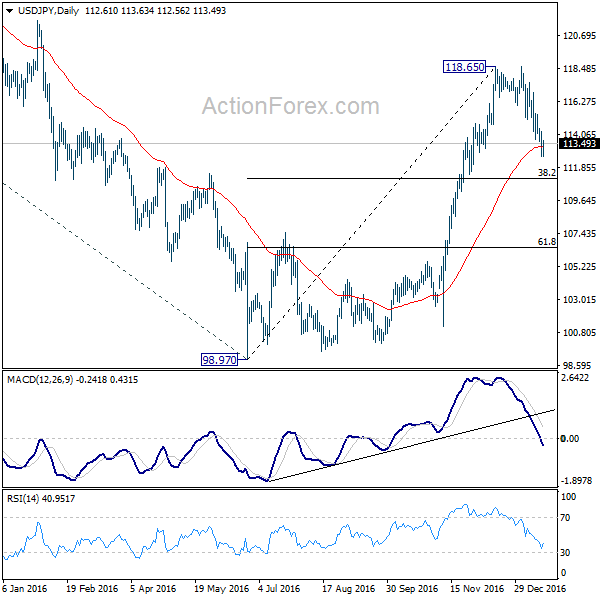

In the bigger picture, price actions from 125.85 high are seen as a corrective pattern. The impulsive structure of the rise from 98.97 suggests that the correction is completed and larger up trend is resuming. Decisive break of 125.85 will confirm and target 61.8% projection of 75.56 to 125.85 from 98.97 at 130.04 and then 135.20 long term resistance. Rejection from 125.85 and below will extend the consolidation with another falling leg before up trend resumption.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Consensus | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | AUD | Westpac Consumer Confidence Jan | 0.10% | -3.90% | ||

| 07:00 | EUR | German CPI M/M Dec F | 0.70% | 0.70% | 0.70% | |

| 07:00 | EUR | German CPI Y/Y Dec F | 1.70% | 1.70% | 1.70% | |

| 09:30 | GBP | Jobless Claims Change Dec | -10.1k | 5.0k | 2.4k | |

| 09:30 | GBP | Claimant Count Rate Dec | 2.30% | 2.30% | 2.30% | |

| 09:30 | GBP | Average Weekly Earnings 3M/Y Nov | 2.80% | 2.60% | 2.50% | 2.60% |

| 09:30 | GBP | ILO Unemployment Rate 3M Nov | 4.80% | 4.80% | 4.80% | |

| 10:00 | EUR | Eurozone CPI M/M Dec F | 0.50% | 0.50% | -0.10% | |

| 10:00 | EUR | Eurozone CPI Y/Y Dec F | 1.10% | 1.10% | 1.10% | |

| 10:00 | EUR | Eurozone CPI – Core Y/Y Dec F | 0.90% | 0.90% | 0.90% | |

| 13:30 | USD | CPI M/M Dec | 0.30% | 0.30% | 0.20% | |

| 13:30 | USD | CPI Y/Y Dec | 2.10% | 2.10% | 1.70% | |

| 13:30 | USD | CPI Core M/M Dec | 0.20% | 0.20% | 0.20% | |

| 13:30 | USD | CPI Core Y/Y Dec | 2.20% | 2.20% | 2.10% | |

| 14:15 | USD | Industrial Production Dec | 0.80% | 0.60% | -0.40% | -0.70% |

| 14:15 | USD | Capacity Utilization Dec | 75.50% | 75.40% | 75.00% | 74.90% |

| 15:00 | USD | NAHB Housing Market Index Jan | 67 | 69 | 70 | 69 |

| 15:00 | CAD | BoC Rate Decision | 0.50% | 0.50% | 0.50% | |

| 19:00 | USD | Fed’s Beige Book | ||||

| 21:00 | USD | Net Long-term TIC Flows Nov | 21.3B | 9.4B |

Subscribe to our daily and mid-day newsletter to get this report delivered to your mail box