The US will see the release of its retail sales data for February on Wednesday at 1230 GMT. While consumer spending softened in January, it’s projected to have bounced back in February. If confirmed by the actual data, this would be an encouraging development for Fed policymakers, who are widely anticipated to raise interest rates at their upcoming meeting next week.

US retail sales are forecast to have risen by 0.3% on a monthly basis in February, a rebound following a 0.3% decline in the previous month. The core figure – which excludes automobile sales – is also expected to have climbed by 0.3%, after stagnating in January.

Consumer sentiment indicators were particularly upbeat during the month, supporting the forecasts for a rebound. The Conference Board consumer confidence index surged to reach a high last seen in 2000, while the University of Michigan print that the Fed pays close attention to rose as well, almost reaching multi-year highs. More broadly, while the gains in US wages were somewhat subdued in February, the labor market continued to add jobs at a robust pace and the unemployment rate remained very low, painting a bright picture for consumer spending. Enhancing this argument, are the recently-enacted US tax cuts, which may result in a modest increase in the disposable incomes of consumers.

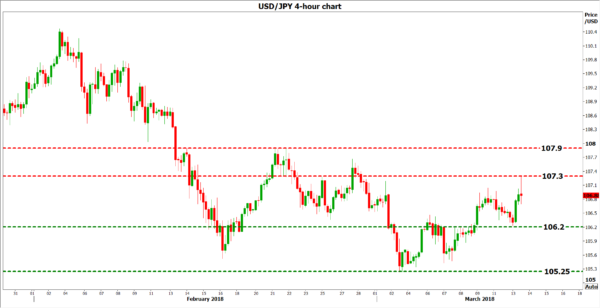

At the time of writing, markets have fully priced in two quarter-point rate hikes by the Fed this year according to the Fed funds futures, and also see a 90% probability for a third one. In case the retail sales data come in stronger than anticipated, that could seal the deal for three hikes this year and may even raise speculation for a fourth, thereby helping the dollar to regain some of its latest losses. Dollar/yen is likely to edge up in this scenario and challenge the 107.30 resistance zone again, marked by the peaks of February 25 and March 13. A potential upside break of that area would shift the focus to the 107.90 hurdle, identified by the highs of February 21.

On the flip side, in case of a disappointment in these data, markets may become even more skeptical regarding whether the Fed will indeed deliver a third hike, something that would likely weigh on the greenback. Dollar/yen could fall back below the 106.20 hurdle, marked by the lows of March 13, and perhaps aim for a test of its recent troughs at 105.25.