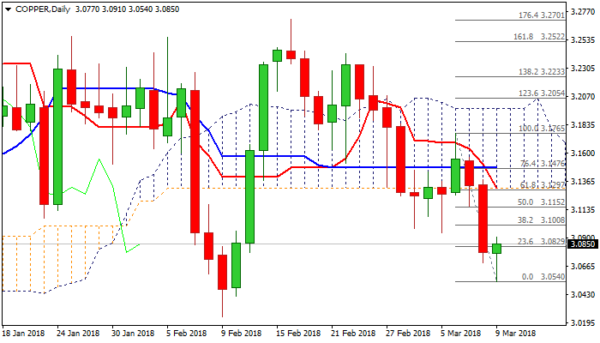

Copper hit one-month low at $3.0540 on Friday, in extension of strong fall in past two days which accelerated on Thursday as the greenback rallied across the board.

Traders are estimating possible impact on US tariffs on metal imports, which is one of the key factors that keeps the metal price under pressure.

Friday’s dip was so far limited as subsequent bounce reduced persisting downside pressure, however, risk of fresh weakness which could result I final push towards key s/t support at 3.0250 (09 Feb low) remains in play.

Firm bearish setup of daily techs supports scenario, seeing recovery attempts as positioning for fresh leg lower, with upticks to face solid resistance at $3.10 zone (Fibo 38.2% of $3.1765/$3.0540) where corrective rallies should be ideally capped.

Expectations for strong US jobs data which could firm dollar, support negative near-term scenario for copper price.

Alternative scenario sees rally through $3.10 pivot and bullish acceleration towards daily cloud base at $3.1312.

Res: 3.0910, 3.1000, 3.1152, 3.1312

Sup: 3.0695, 3.0540, 3.0415, 3.0250