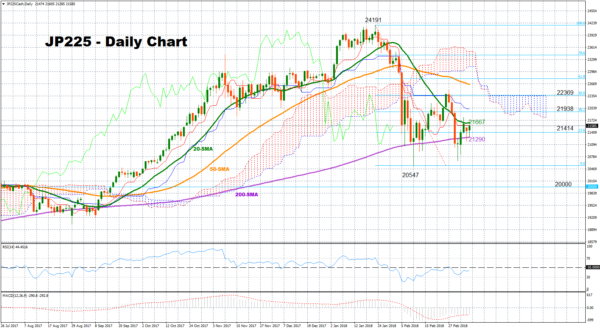

Since its deep fall towards four-month lows in early February, the Japan 225 stock has been going back and forth below the 50% Fibonacci retracement of its long way down from 24191 to 20547, creating a base around the 200-day simple moving average line (SMA). The technical picture supports that the range bound is likely to continue in the short-term.

Looking at momentum indicators, the RSI is lacking direction slightly below it neutral threshold of 50, suggesting that the market could keep consolidating in the near term. MACD is in the negative territory but is currently embraced by its red signal line supporting this view as well.

In the wake of negative pressures, the market could meet support at the 23.6% Fibonacci of 21414 before it heads lower to the 200-day SMA, currently at 21290. A successful close below this level could see a retest of the previous low of 20547, while in case of steeper declines, the index could breach this trough, diving to the 20000 psychological mark which used to provide resistance during last summer.

On the flip side, a move to the upside could see immediate resistance at the 20-day SMA at 21667 but should the market increase positive momentum above this area, the 38.2% Fibonacci of 21938 could be the next level in focus. A stronger barrier, though, could be found at the 50% Fibonacci of 22369 since any strong violation of this point could increase chances for further gains probably towards the 50-day SMA.

Turning to the medium-term picture, the market seems to be in bearish mode given that the index trades below the 50-day SMA. But as long as the bullish cross between the 50- and the 200-day SMA remains intact, there is hope that the market could return to bullish phase.