The financial markets show that investors are well prepared for the steel and aluminum tariff by the US. Dow closed down just -0.33% overnight, at 24801.36. 10 year yield gained 0.006 to 2.883, staying in near term sideway consolidation. Nikkei is trading up 0.5% at the time of writing while HSI is up 1.4%. In the currency markets, Yen is paring some gains as risk aversion recedes and commodity currencies recover today. In particular, Canadian Dollar responded rather positively to the news that the country will be temporarily excluded from the tariffs. Meanwhile, Euro is broadly softer today, digesting recent gains and as traders are preparing for ECB.

Trump to sign tariff order today, exclude Canada and Mexico temporarily

US President Donald Trump is set to ignore all the oppositions from Republicans and business leaders and sign the order for steel and aluminum tariffs on Thursday afternoon at the White House. It’s being planned to hold at 3:30pm ET in the Roosevelt Room. A top White House trade advisor Peter Navarro said “the proclamation will have a clause that does not impose these tariffs immediately on Canada and Mexico”. But whether there will be permanent exclusion will depend on NAFTA negotiations. Press secretary also gave similar comments as “there are potential carve-outs for Canada and Mexico based on national security, and possibly other countries as well”.

EU responded formally yesterday on the counter measures in a statement. Commissioner for Trade Cecilia Malmström said after the meeting of the College of Commissioners that “we have made clear that if a move like this is taken, it will hurt the European Union. It will put thousands of European jobs in jeopardy and it has to be met by firm and proportionate response. And she pointed to “the root cause of the problem in the steel and aluminium sector is global overcapacity” and, ” a lot of steel and aluminium production takes place under massive state subsidies, and under non-market conditions.”

Fed Bostic: No certainty to what products would be pulled into trade wars

Atlanta Fed President Raphael Bostic offered some direct comments on monetary policies. He said the tax cuts “were forcing us to more aggressive policy” But, “the trade stuff is uncertainty in the other direction” referring to Trump’s initiative to impose steel and aluminum tariffs. He added that “the U.S. in this latest round has identified aluminum and steel as issues. Europe has signaled they would hit a whole host of other products that are not aluminum or steel. There is just not certainty as to which products are going to get pulled into this.” And, “anyone who is engaged in any kind of international trade space has got to be concerned.”

BOC Left Rates On Hold, More Concerned About US Trade Policy

As widely anticipated, BOC left the policy rate unchanged at 1.25% yesterday. The accompanying statement was more cautious than the previous one, over the trade outlook. Policymakers suggested that ‘trade policy developments are an important and growing source of uncertainty for the global and Canadian outlooks’, in addition to reiteration of the need for remaining ‘cautious in considering future policy adjustments’. Expectations of another rate hike in April diminished after the announcement.

More on BoC: BOC Left Rates On Hold, More Concerned About US Trade Policy

Australia recorded massive AUD 1.06b trade surplus in January

Australia recorded massive trade surplus of AUD 1.06b in January, a turnaround from December’s AUD -1.15b trade deficit. Exports jumped 4% mom to AUD 33.9b, with 4% rise in non-rural goods, 54% rise in non-monetary gold. Much more than offsetting -8% fall in rural goods. Imports, on the other hand, dropped -2% to AUD 32.9b. Consumption goods dropped -7%, non-monetary gold dropped -19%, capital goods dropped 1%.

China pledges “justified and necessary response” to trade wars”

China Foreign Minister Wang Yi pledged to have “justified and necessary response” to trade wars. He said that “A trade war has never been the right way to solve the problem, especially under globalization.” And, these conflicts “will only harm everyone and China will surely make a justified and necessary response.”

At the same time China’s trade surplus widened to USD 33.7b in January, or CNY 225b. Both were way better than expectation of USD -8.5b or CNY -71b deficit. Exports rose 44.5% yoy. Imports rose 6.3% yoy.

ECB as the main focus ahead

ECB is widely expected to keep interest rate and asset purchase program unchanged today. The main question to the markets is when the central bank will start tweaking its forward guidance to pave the way for ending QE. This topic will certainly be discussed during the meeting. But it’s uncertain whether ECB will take this meeting to do it. In particular, there could be some concerns over resurgence of Euro sceptics shown in Italian election. And, the intensification of risks of trade war with the US could also concerns policymakers much. But it should be noted that, the reactions in Euro could be huge even if ECB apply a “small dose” of chance in the language.

In addition, Swiss will release unemployment rate. Germany will release factory orders. Canada will release housing starts, new housing price index and building permits. US will release jobless claims as usual on a Thursday.

EUR/USD Daily Outlook

Daily Pivots: (S1) 1.2381; (P) 1.2413 (R1) 1.2441; More….

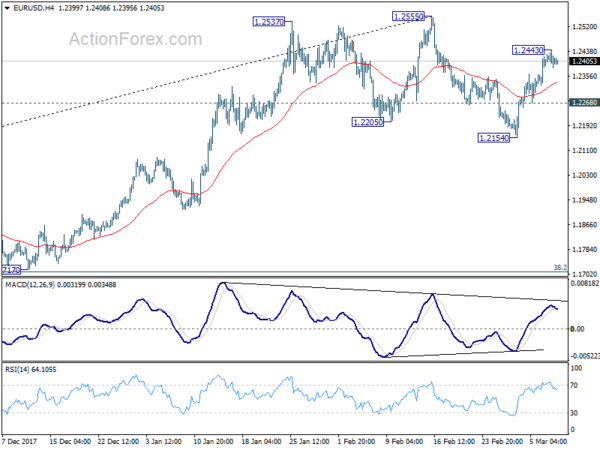

A temporary top is in place at 1.2443 in EUR/USD with 4 hour MACD crossed below signal line. Intraday bias is turned neutral first. For the moment, further rise will remain mildly in favor as long as 1.2268 minor support holds. Firm break of of 1.2555 and 1.2516 long term fibonacci level will carry larger bullish implications. On the downside, below 1.2268 minor support will turn bias back to the downside for 1.2154 instead.

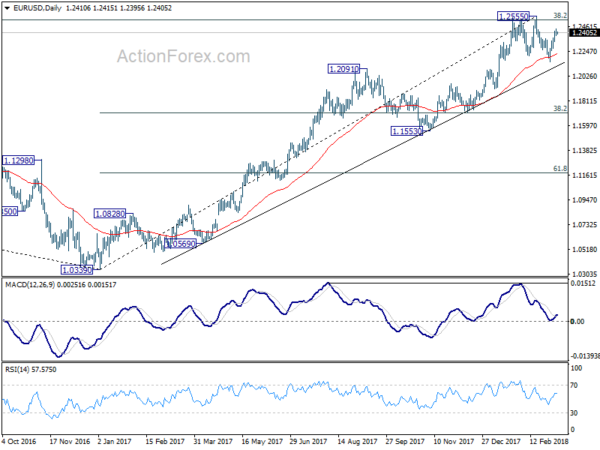

In the bigger picture, key fibonacci level at 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516 remains intact despite attempts to break. Hence, rise from 1.0339 medium term bottom is still seen as a corrective move for the moment. Rejection from 1.2516 will maintain long term bearish outlook and keep the case for retesting 1.0039 alive. Firm break of 1.1553 support will add more medium term bearishness. However, sustained break of 1.2516 will carry larger bullish implication and target 61.8% retracement of 1.6039 to 1.0339 at 1.3862.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Manufacturing Activity Q4 | 2.80% | 0.50% | ||

| 23:50 | JPY | Current Account (JPY) Jan | 2.02T | 1.76T | 1.48T | 1.68T |

| 23:50 | JPY | GDP Q/Q Q4 F | 0.40% | 0.20% | 0.10% | |

| 23:50 | JPY | GDP Deflator Y/Y Q4 F | 0.10% | 0.00% | 0.00% | |

| 0:01 | GBP | RICS House Price Balance Feb | 0% | 7% | 8% | |

| 0:30 | AUD | Trade Balance Jan | 1.06B | 0.22B | -1.36B | -1.15B |

| 2:00 | CNY | Trade Balance (USD) Feb | 33.7B | -8.5B | 20.3B | |

| 2:00 | CNY | Trade Balance (CNY) Feb | 225B | -71B | 136B | |

| 6:45 | CHF | Unemployment Rate Feb | 2.90% | 3.00% | ||

| 7:00 | EUR | German Factory Orders M/M Jan | -1.60% | 3.80% | ||

| 12:30 | USD | Challenger Job Cuts Y/Y Feb | -2.80% | |||

| 12:45 | EUR | ECB Rate Decision | 0.00% | 0.00% | ||

| 13:15 | CAD | Housing Starts Feb | 220K | 216K | ||

| 13:30 | CAD | New Housing Price Index M/M Jan | 0.00% | |||

| 13:30 | CAD | Building Permits M/M Jan | 4.80% | |||

| 13:30 | USD | Initial Jobless Claims (MAR 3) | 216K | 210K | ||

| 15:30 | USD | Natural Gas Storage | -78B |