Dollar is broadly pressured on news of White House economic advisor Gary Cohn’s resignation. The dollar index dipped to as low as 89.42 and staying below 90 handle. EUR/USD is staying comfortably back above 1.24 and is set to have a take on 1.2555 key resistance. Meanwhile, USD/JPY might take the lead and test 105.24 support. Canadian Dollar remains the weakest one for the week as Canada, as the closest ally of the US, would be severely hurt if a trade war starts. Also, the ongoing NAFTA renegotiation is not seeing an end yet.

Stock markets are pretty steady though. DOW closed 8- 0.04% at 24884.12 overnight. S&P 500 rose 0.26% while NASDAQ rose 0.26%. Nikkei trades slightly lower by -0.7% at the time of writing. Hong Kong HSI is down -0.35%. Gold breached 1340 handle briefly on this week’s strong rebound. But after all, Gold is staying in near term range between 1300/1365.

Markets not too surprised at Cohn’s resignation

White House economic top economic adviser Gary Cohn resigned yesterday . It’s reported that the decision was made hours after direct confrontation with Trump regarding the steel and aluminum tariffs. Trump requested Cohn to publicly support the tariff plan. But Cohn, as a free trade advocate, didn’t answer. The meeting with industry executives, arranged by Cohn for persuading Trump not to impose the tariffs, was also canceled.

Cohn said in a statement that “it has been an honor to serve my country and enact pro-growth economic policies to benefit the American people, in particular the passage of historic tax reform.”

Trump said regarding Cohn that “Gary has been my chief economic adviser and did a superb job in driving our agenda, helping to deliver historic tax cuts and reforms and unleashing the American economy once again.” And, “he is a rare talent, and I thank him for his dedicated service to the American people.”

Stock markets reaction to the news was quiet muted. DOW continued to struggle around 55 H EMA, closed up 0.04% at 24884.12/. Technically, it’s also in proximity to 25000 handle, 50% retracement of 25800.35 to 24127.47 at 25008.91. This will a key near term hurdle for DOW to overcome.

Fed Brainard: Mounting tailwinds tip the balance of policy considerations

Fed Brainard: Mounting tailwinds tip the balance of policy considerations

Fed Governor Lael Brainard said that in the early period of recovery “strong headwinds sapped the momentum” and “weighed down the path of policy. However, “today, with headwinds shifting to tailwinds, the reverse could hold true.” And, there will be “substantial” boost from tax cuts and public spending. She pointed out that “mounting tailwinds at a time of full employment and above-trend growth tip the balance of considerations.” And, “with greater confidence in achieving the inflation target, continued gradual increases in the federal funds rate are likely to be appropriate.”

RBA Low: No strong case for a near term hike

RBA Governor Philip Lowe expressed his optimism on the economy and said it’s going to be “stronger” in 2018. He pointed to better business conditions “at any time since before the financial crisis.” The economy is “moving in the right direction” and it’s likely that the next move in interest rates is “up, no down”. However, the board does not see a strong case for a near-term adjustment of monetary policy”, thanks to slow progress in unemployment and inflation.

Regarding the steel and aluminum tariffs of the US, Lowe slammed it as “highly regrettable and bad policy”. He added that “history is very clear here. Protectionism is costly.” If it’s confined to steel and aluminum tariffs, Lowe believed “it’s manageable for the world economy.” However, he warned that “this could turn very badly, though, if it escalates.”

RBA is generally expected to keep rates on hold throughout 2018, except that NAB predicts one hike. Slowing growth figure in Q4 and risk of trade wars would add to the case for RBA to stand pat.

Australia GDP grew 0.4% qoq in Q4, below expectation of 0.5% qoq and slowed from prior 0.7% qoq. In the release Chief Economist for the ABS, Bruce Hockman, said that “growth this quarter was driven by the household sector, with continued strength in household income matched by growth in household consumption.”

Looking ahead

BoC rate decision is the main focus of the day. It’s widely expected to keep interest rate unchanged at 1.25%. Considering the risks regarding NAFTA and trade, there is little chance for the central bank to hike again soon. Elsewhere, Swiss will release Foreign currency reserves in European session. Eurozone will release Q4 GDP final. US will release ADP employment, non-farm productivity and trade balance. Fed will also release Beige Book economic report. Canada will release labor productivity and trade balance.

USD/JPY Daily Outlook

Daily Pivots: (S1) 105.82; (P) 106.14; (R1) 106.43; More…

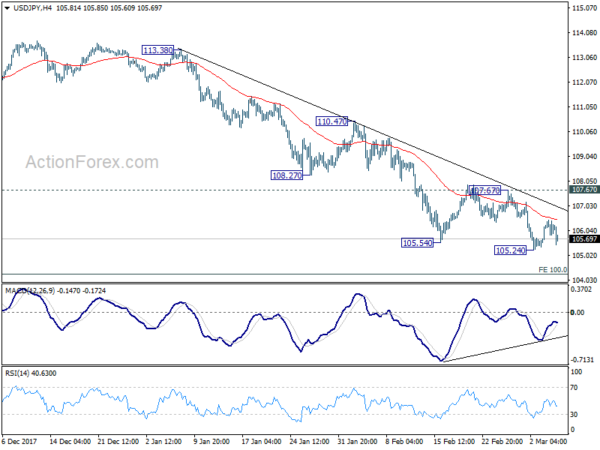

USD/JPY’s recovery was limited below 4 hour 55 EMA and weakened. But still, it’s staying in range above 105.24 temporary low. Intraday bias remains neutral first. Again, as long as 107.67 resistance holds, near term outlook will remain bearish. Break of 105.24 will resume larger decline from 118.65 and target 100% projection of 118.65 to 108.12 from 114.73 at 104.20 next. Firm break there will pave the way to 98.97 key support level and below. However, break of 107.67 will indicate short term bottoming, on bullish convergence condition in 4 hour MACD. In such case, stronger rebound would be seen back to 55 day EMA (now at 108.92) first.

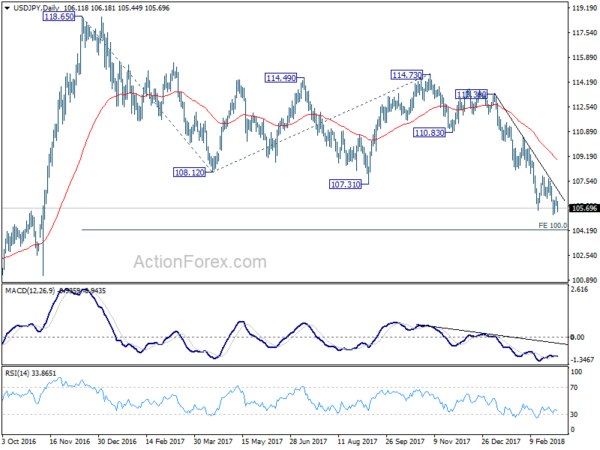

In the bigger picture, current development argues that the corrective pattern from 118.65 is extending. The solid break of 61.8% retracement of 98.97 to 118.65 at 106.48 now suggests that the pattern from 125.85 high is possibly extending. Deeper fall could be seen through 98.97 key support (2016 low). This bearish case will now be favored as long as 110.47 resistance holds.

Economic Indicators Update

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:30 | AUD | GDP Q/Q Q4 | 0.40% | 0.50% | 0.60% | 0.70% |

| 05:00 | JPY | Leading Index CI Jan P | 106.1 | 107.4 | ||

| 08:00 | CHF | Foreign Currency Reserves (CHF) Feb | 735B | 731B | ||

| 10:00 | EUR | Eurozone GDP Q/Q Q4 F | 0.60% | 0.60% | ||

| 13:15 | USD | ADP Employment Change Feb | 200K | 234K | ||

| 13:30 | USD | Nonfarm Productivity Q4 F | -0.10% | -0.10% | ||

| 13:30 | USD | Unit Labor Costs Q4 F | 2.10% | 2.00% | ||

| 13:30 | USD | Trade Balance Jan | -52.6B | -53.1B | ||

| 13:30 | CAD | Labor Productivity Q/Q Q4 | -0.60% | |||

| 13:30 | CAD | International Merchandise Trade (CAD) Jan | -2.50B | -3.2B | ||

| 15:00 | CAD | BoC Rate Decision | 1.25% | 1.25% | ||

| 15:30 | USD | Crude Oil Inventories | 3.0M | |||

| 19:00 | USD | Federal Reserve Beige Book |