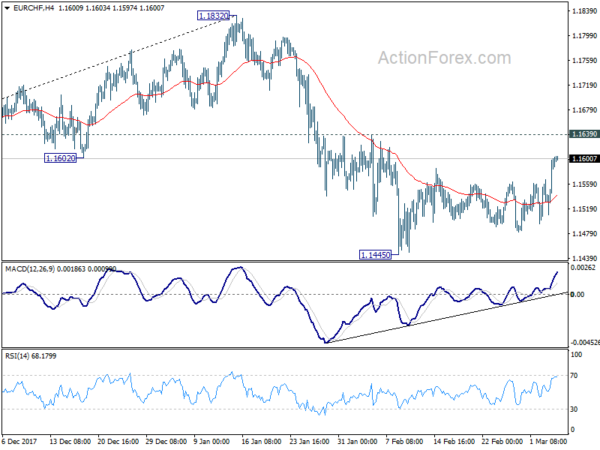

Daily Pivots: (S1) 1.1535; (P) 1.1567; (R1) 1.1626; More…

EUR/CHF reaches as high as 1.1603 so far as rebound from 1.1445 extends. However, price actions from 1.1445 are viewed as a corrective pattern. Hence, intraday bias remains neutral. Also, near term outlook will remain bearish as long as 1.1639 resistance holds. On the downside, break of will resume the corrective fall from 1.1832 and target 1.1355 cluster support (38.2% retracement of 1.0629 to 1.1832 at 1.1372.) At this point, we’d expect strong support from there to contain downside and bring rebound. Nevertheless, break of 1.1639 will suggest short term reversal and turn bias back to the upside for 1.1832 high.

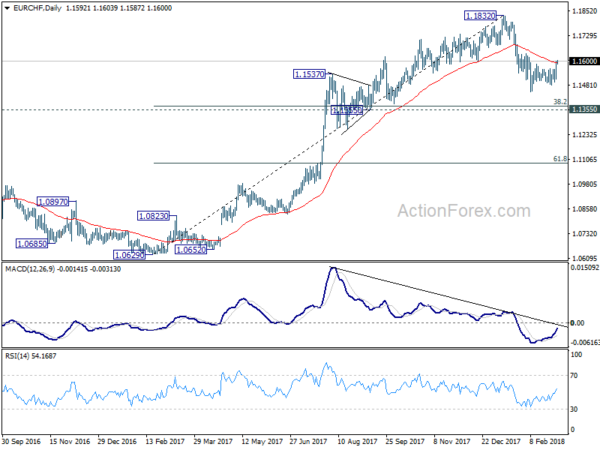

In the bigger picture, a medium term top should be in place at 1.1832 on bearish divergence condition in daily MACD. But there is no indication of long term reversal yet. As long as 1.1198 resistance turned support holds, we’d still expect another rise through prior SNB imposed floor at 1.2000.