Here are the latest developments in global markets:

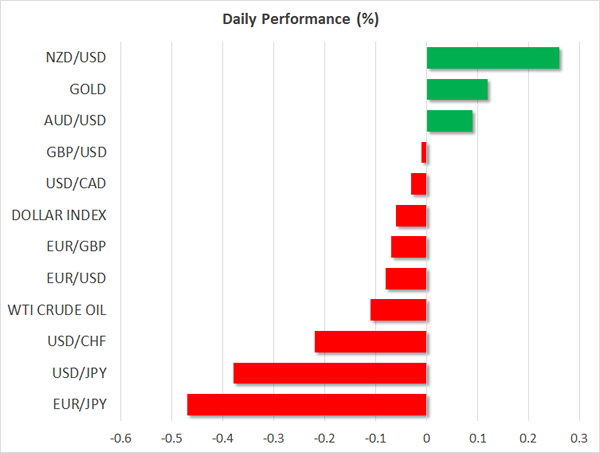

FOREX: The dollar declined versus a basket of currencies on Thursday after previously rising to a six-week high. Negative momentum for the US currency, which came on the back of a trade tariff decision by the US administration, is carrying through into today’s trading, with losses being limited though.

STOCKS: US markets experienced another day of sharp declines on Thursday, as worries over President Trump’s new tariffs on steel and aluminum imports amplified concerns that the situation could escalate into a retaliatory tit-for-tat trade war. The Dow Jones led the decline, falling by 1.7%, while both the S&P 500 and the Nasdaq Composite closed 1.3% lower. Moreover, futures tracking the Dow, S&P and Nasdaq 100 are all flashing red at the moment, pointing to a negative open. Asian markets felt the heat of the trade concerns as well, with practically every major benchmark being in negative territory. In Japan, the Nikkei 225 and the Topix fell by 2.5% and 1.8% respectively, while in Hong Kong, the Hang Seng was lower by 1.6%. Europe did not escape unscathed either, as futures tracking all the major indices were a sea of red today.

COMMODITIES: In energy markets, oil prices were slightly lower, with WTI and Brent crude both falling by roughly 0.1%. Today, oil traders will turn their sights to the release of the US Baker Hughes oil rig count for fresh signs of whether US production continues to accelerate or is slowing down. In precious metals, gold was higher by 0.1%, extending some of the gains it posted yesterday as concerns over a potential trade war brought the safe-haven “back in fashion”. It is currently trading near $1317 per ounce, not far from the $1320 resistance zone.

Major movers: Dollar retreats as trade protectionism is back on the table

US President Donald Trump’s decision to impose tariffs on imported steel and aluminum led to a shift in momentum for the dollar, with the currency reversing the gains that saw the dollar index record a six-week high of 90.93 on Thursday and instead finishing the day lower by 0.3%. The dollar index is also down during Friday’s trading, though not by much.

Equity markets also responded negatively to the administration’s decision, with Wall Street’s three major indices all shedding more than 1% to record their third straight day of notable losses. Concerns for a trade war are back on the table.

The implication is that companies will have to raise prices in the face of higher costs of materials due to the tariffs and subsequently pass the cost onto the consumers, thus weighing on consumption and consequently the outlook for growth in the world’s largest economy. This is seen as the reason behind the dollar’s decline.

Before the news on tariffs, the dollar seemed to be firmly on a positive footing as Fed chief J. Powell’s comments were interpreted by market participants as leaving the door open for even four quarter percentage point interest rate increases by the US central bank in 2018. Markets have now fully priced in three such moves, with a fourth now also being partially priced in. Before Powell’s remarks less than three hikes were expected by markets.

Dollar/yen was 0.4% down at 105.85, not far above the near 16-month low of 105.52 that was recorded on February 16. The Japanese currency tends to gain at times of uncertainty and risk aversion such as the one the markets are currently experiencing.

Euro/dollar was not much changed at 1.2259 after also posting gains to bounce from a multi-week low versus the greenback on Thursday. Risk events for the common currency are Sunday’s Italian elections and the German SPD’s decision on whether to revive its “grand coalition” with Chancellor Merkel’s conservative bloc also due on Sunday. Euro/yen was notably lower, specifically by 0.5%, falling to 129.65 at its lowest, a level last experienced last September.

Pound/dollar was roughly flat at 1.3765. This compares to Thursday’s near two-month low of 1.3710. A speech by PM Theresa May due later on Friday on how she sees the future relationship between the UK and the EU after Brexit will be in focus.

In commodity-linked currencies: the aussie and the kiwi were rising versus their US counterpart, with the loonie being little changed. The Canadian dollar initially recorded considerable declines versus the US currency after the tariff announcement as Canada stands to lose more from such a decision, though it later managed to rebound.

Day ahead: Theresa May’s keynote Brexit speech in focus; UK and Canadian data eyed; euro awaits for political risk events

The economic calendar is relatively light today, with the most noteworthy data releases coming out of the UK and Canada. Moreover, speeches by the UK Prime Minister and the Governor of the Bank of England will also attract the attention of sterling traders.

In the UK, the construction PMI for February is due out at 0930 and expectations are for the index to have risen to 50.5 from 50.2 previously. Such an increase would signal that the sector has picked up some momentum and may thus be a pleasant development for sterling bulls. That said, investors trying to gauge whether the economy has picked up steam will pay more attention to the services PMI that is due on Monday, as the service sector accounts for a far larger portion of UK GDP.

Staying in the UK, Prime Minister Theresa May is expected to deliver a speech outlining what she seeks to achieve on the crucial issue of free trade between the UK and EU. Some parts of this speech have already been leaked and suggest the PM will continue to call for an ambitious UK-specific trade deal.

Developments on this front are worth monitoring closely. The negotiations seem to have hit a brick wall lately, with the UK rejecting the EU’s proposals on the Irish border, and the EU expressing dissatisfaction with the slow pace of the talks. On top of these, PM May’s scarce political capital seems to be eroding further, as recent reports suggest her Cabinet and the Tory party are heavily divided on what kind of deal the UK should seek. Sterling has tumbled as these concerns came back to the forefront, and unless May can provide some clarity today, the currency may continue to feel the heat from political uncertainties.

In the eurozone, producer prices for January are projected to have slowed to 1.6% in yearly terms, from 2.2% previously.

In Canada, all eyes will be on the GDP data for the final quarter of 2017. On an annualized basis, the economy is anticipated to have grown by 2.0%, an acceleration from the 1.7% in Q3. Such an acceleration could help the loonie to recover some of its recent losses, ahead of the Bank of Canada’s policy meeting next week.

Out of the US, the final University of Michigan consumer sentiment index for February is due out and expectations are for the final figure to be revised notably higher.

In energy markets, the Baker Hughes oil rig count for the week ended February 23 is scheduled for release at 1800 GMT. While the number of active US rigs has increased notably in recent months alongside US oil production, the pace at which rigs are rising slowed last week, perhaps due to the decline in oil prices throughout February. Any fresh signs that US production is slowing down would probably help to alleviate some downward pressure on oil prices.

In equity markets, movements are likely to continue to be dictated by trade concerns and any updates in that narrative. Investors will be looking at how major economies like China and the EU will respond to the US tariffs, with any signs of further escalation in trade tensions likely to provide more pain for stocks.

As for policymaker appearances, besides UK PM May, Bank of England Governor Mark Carney will deliver remarks to the inaugural Scottish Economics Conference at 1000 GMT.

Looking ahead, euro pairs could well open with gaps on Monday, as there are two significant political events taking place on Sunday. In Italy, citizens will head to the polls to elect their new leader while in Germany, the SPD will announce whether it will enter in a coalition with Merkel’s conservatives and finally form a government.

Technical Analysis: USDCAD looking bullish in short-term after recording 2½-month high

USDCAD has advanced considerably after hitting a five-month low of 1.2248 on January 31. During Thursday’s trading it touched 1.2895, its highest in around two-and-a-half months. The Tenkan-sen line remains above the Kijun-sen line, continuing to project a positive picture in the short-term. However, the Chikou Span might be pointing to an overextended market, rendering a pullback in the near-term possible.

Stronger-than-projected growth figures out of Canada later on Friday are anticipated to push the pair lower, with support potentially coming around the 1.28 handle. The area around this level was congested in the past. Steeper declines would turn the attention to the current level of the Tenkan-sen at 1.2724.

On the upside and in case of weak Canadian GDP numbers, the pair is likely to continue advancing. Resistance could come around yesterday’s high of 1.2895, with the range around it also encapsulating the eight-month high of 1.2919 from December 19.

Lastly, it should be mentioned that developments on the trade front (this being mentioned within the context of the latest tariff decision by the US administration) also have the capacity to spur movements in the pair.