The initial response to Jerome Powell’s first Congressional Testimony as Fed Chair was muted as his prepared speech provided nothing new. Nonetheless, stocks tumbled while Dollar surged as Powell offered an upbeat outlook in his Q&A. There are notable increase in chance of continuous rate hikes towards the end of the year as indicated by fed fund futures. DOW ended down -299.24 pts or -1.16% at 25410.03. S&P 500 dropped -35.32 pts or -1.27% to close at 2744.28. 10 year yield regained 2.9 handle by rising 0.049 to 2.908. Dollar index jumped to as high as 90.49 and is heading back towards 91.01 key structural resistance.

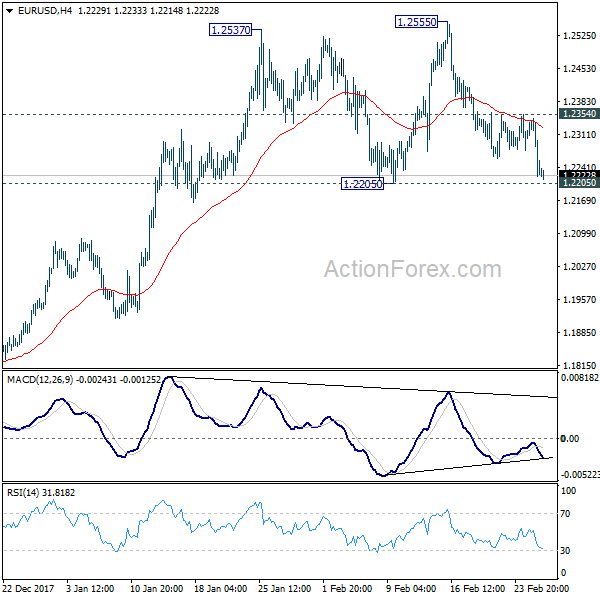

In the currency markets, Dollar is now trading as the strongest major currency for the week, followed by Yen and then Swiss Franc. Commodity currencies are the weakest ones. Nonetheless, we’d like to point out that Dollar is still holding below recent resistance against other currencies. The key levels are 1.2205 support in EUR/USD, 1.3764 in GBP/USD, 0.7758 in AUD/USD, 0.9469 resistance in USD/CHF and 108.27 in USD/JPY.

Fed Powell: Economy has strengthened since December

Described by some analysts as direct and forthcoming, Powell offered his optimistic view on the economic outlook. He told the House Financial services Committee that "my personal outlook for the economy has strengthened since December." And, "we’ve seen some data that will in my case add some confidence to my view that inflation is moving up to target. We’ve also seen continued strength around the globe, and we’ve seen fiscal policy become more stimulative."

Powell acknowledged that "fiscal policy changes can have an effect, changes of this size can have an effect, and that can be seen in the path of policy." But he added that "it’s very hard to say in advance what that would be."

The key take away from his prepared speech is regarding recent financial market volatility. He said "we do not see these developments as weighing heavily on the outlook for economic activity, the labor market and inflation." This suggested the path is unlikely to be altered by the market volatility.

Let’s take a look at fed fund futures pricing. They’re now indicating 33.7% chance of a total of four hikes by December to raise the federal funds rate from 1.25-1.50% to 2.25-2.50%. That’s notably higher than 26.9% a day ago and 22.6% a month ago.

UK Gfk consumer confidence stayed negative

UK Gfk consumer confidence dropped to -10 in February, down from -9. The series has not be positive since February 2016. Gfk noted that "ongoing concerns about sluggish household income, rising prices paid by consumers in the shops and the prospect of inflation-busting council tax and interest rate hikes has dented confidence after last month’s surprising rally". And, "the two-year trend of negative sentiment proves consumers feel pessimistic about the state of household finances and the wider UK economy." "Consumers have good reason to feel jittery and depressed." BRC shop price index dropped -0.8% yoy in February.

NAB forecasts one RBA hike in 2018, instead of two

In Australia, the National Australia Bank lowered its RBA interest rate forecast for the year. NAB now expects only one RBA hike this year, instead of two. The bank said in its report that "weak wages growth and slow progress reducing unemployment means it is now less likely that the RBA will raise rates twice in 2018." It explained that "while total wages did increase a touch 0.55%, there was no acceleration in private wages growth." Nonetheless, "wage increases are overdue" and " tightness in employers’ ability to find suitable labour, may finally see private sector wages start to moderately edge up." And, "we now see the RBA raising rates only once in late 2018 with November 2018 as the most likely start date for a gradual RBA rate hiking cycle." However, there is still a change for RBA to stand pat depending on data flow.

New Zealand business confidence stayed pessimistic

New Zealand ANZ business confidence improved to -19.0 in February, up from -37.8. That is, a net 19% of business were pessimistic about the year ahead. ANZ noted in the release that "a slower housing market, a small dip in net migration, difficulty finding credit and already-stretched construction and tourism sectors are making acceleration hard work from here." Meanwhile, "strong terms of trade and a positive outlook for wage growth are providing a push." And, "the rebound in business confidence is consistent with our belief that while no longer at top speed, this business cycle has legs yet. In particular, incomes are set to be supported by the strong terms of trade and higher wage growth."

Elsewhere

Japan retail sales rose 1.6% yoy in January versus expectation of 2.5% yoy. Japan industrial production dropped -6.6% mom in January versus expectation of -4.2% mom. China manufacturing PMI dropped to 50.3 in February, down from 51.3, missed expectation of 51.2. China non-manufacturing PMI dropped to 54.4, down from 55.3, missed expectation of 55.0.

Looking ahead

Eurozone CPI flash will be a major focus in European session. Germany will release unemployment and Gfk consumer sentiment. Swiss will release KOF leading indicator. Laster in the day, US will release GDP revision, Chicago PMI, pending home sales. Canada will release IPPI and RMPI.

EUR/USD Daily Outlook

Daily Pivots: (S1) 1.2187; (P) 1.2266 (R1) 1.2312; More….

EUR/USD drops to as low as 1.2214 so far but it’s still staying above 1.2205 key near term support. Intraday bias remains neutral at this point. As noted before, break of this important 1.2205 support will confirm rejection by 1.2516 key fibonacci level and trend reversal. IN that case, further decline should be seen back to 1.1553 support next. On the upside, above 1.2354 minor resistance will bring retest of 1.2555 high. Break of 1.2555 will revive the bullish case of up trend resumption and target 100% projection of 1.0569 to 1.2091 from 1.1553 at 1.3075.

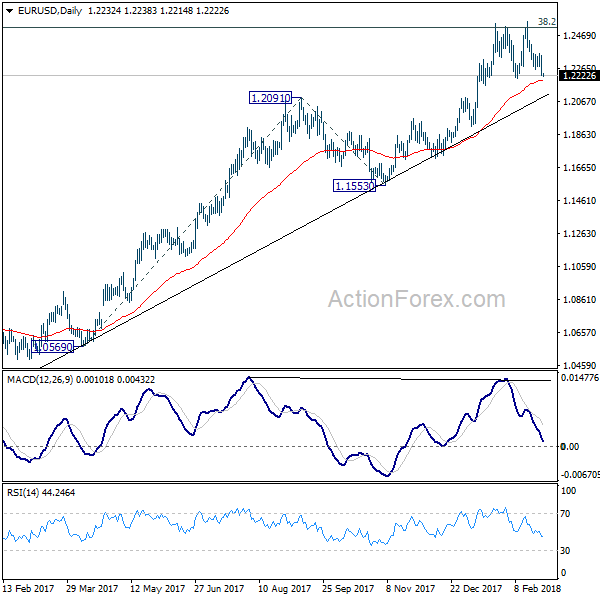

In the bigger picture, key fibonacci level at 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516 remains intact despite attempts to break. Hence, rise from 1.0339 medium term bottom is still seen as a corrective move for the moment. Rejection from 1.2516 will maintain long term bearish outlook and keep the case for retesting 1.0039 alive. However, sustained break of 1.2516 will carry larger bullish implication and target 61.8% retracement of 1.6039 to 1.0339 at 1.3862.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Retail Trade Y/Y Jan | 1.60% | 2.50% | 3.60% | |

| 23:50 | JPY | Industrial Production M/M Jan P | -6.60% | -4.20% | 2.90% | |

| 0:00 | NZD | ANZ Business Confidence Feb | -19.0 | -37.8 | ||

| 0:01 | GBP | GfK Consumer Confidence Feb | -10 | -10 | -9 | |

| 0:01 | GBP | BRC Shop Price Index Y/Y Feb | -0.80% | -0.60% | -0.50% | |

| 1:00 | CNY | Manufacturing PMI Feb | 50.3 | 51.2 | 51.3 | |

| 1:00 | CNY | Non-manufacturing PMI Feb | 54.4 | 55 | 55.3 | |

| 5:00 | JPY | Housing Starts Y/Y Jan | -4.70% | -2.10% | ||

| 7:00 | EUR | German GfK Consumer Confidence Mar | 10.9 | 11 | ||

| 7:45 | EUR | French GDP Q/Q Q4 P | 0.60% | 0.60% | ||

| 7:45 | EUR | French GDP Y/Y Q4 P | 2.40% | 2.40% | ||

| 8:00 | CHF | KOF Leading Indicator Feb | 106 | 106.9 | ||

| 8:55 | EUR | German Unemployment Change Feb | -17K | -25K | ||

| 8:55 | EUR | German Unemployment Rate Feb | 5.40% | 5.40% | ||

| 10:00 | EUR | Eurozone CPI Estimate Y/Y Feb | 1.20% | 1.30% | ||

| 10:00 | EUR | Eurozone CPI Core Y/Y Feb A | 1.00% | 1.00% | ||

| 13:30 | CAD | Industrial Product Price M/M Jan | -0.10% | |||

| 13:30 | CAD | Raw Materials Price Index M/M Jan | -0.90% | |||

| 13:30 | USD | GDP Annualized Q/Q Q4 S | 2.50% | 2.60% | ||

| 13:30 | USD | GDP Price Index Q4 S | 2.40% | 2.40% | ||

| 14:45 | USD | Chicago PMI Feb | 64.6 | 65.7 | ||

| 15:00 | USD | Pending Home Sales M/M Jan | 0.50% | 0.50% | ||

| 15:30 | USD | Crude Oil Inventories | -1.6M |