Yen continues to trade higher in calm markets. DOW closed up 0.16% at 24640.45 overnight as consolidation continued. Nikkei also opened higher initial trading but turns flat since then. Hong Kong HSI is up 0.75% in thin trading ahead of lunar new year holidays. While USD/JPY dip extended recent decline, EUR/JPY and GBP/JPY are held by the temporary lows established earlier. The greenback remains one of the weakest and will look into CPI and retail sales from US today for inspirations.

Fed Powell: Global economy recovering strongly

New Fed Chair Jerome Powell said in his swearing-in ceremony yesterday that the global economy is "recovering strongly for the first time in a decade." Fed is in the progress of "gradually normalizing both interest rate policy and our balance sheet with a view to extending the recovery and sustaining the pursuit of our objectives." And, he would purse monetary policy "without concern for short-term political pressures." Additionally, Powell pledged to "preserve the essential gains in financial regulation while seeking to ensure that our policies are as efficient as possible."

Separately, the Wall Street Journal reported that the White House is considering to nominate Cleveland Fed President Loretta Mester for Vice Fed Chair. On the other hand, CNBC reported that San Francisco Fed President John Williams was also being considered for the post.

ECB Draghi: Not his job to regulate Bitcoin

ECB President Mario Draghi said it’s "not the ECB’s responsibility" to regulate Bitcoins. He acknowledge the blockchain technology as "quite promising" that could bring "many benefits". But he warned that "it’s still not secure for central banking and therefore we need to look through it and investigate it more." And when asked by the public on whether he should buy Bitcoin, Draghi said "frankly i would think it carefully".

NAB predicts two RBA hikes this year

NAB chief economist said in a note that he forecasts RBA to hike twice this year, in August and November. He noted that "lower unemployment, and evidence of wages growth moving upwards – even gradually – should be enough to give the RBA confidence that inflation will eventually lift above the bottom of the band." However, higher AUD exchange rate could threaten this outlook.

On the data front

Japan GDP rose 0.1% qoq in Q4, below expectation of 0.2% qoq. GDP deflator rose 0.01% yoy. Australia Westpac consumer confidence dropped -2.3% in February. Eurozone and Germany GDP will be the main focus in European session where Eurozone industrial production will also be featured Later in the day, US CPI and retail sales will be the main focus.

USD/JPY Daily Outlook

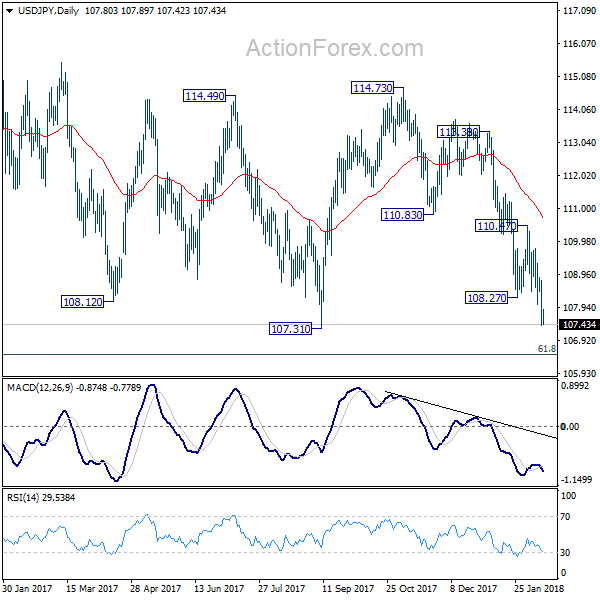

Daily Pivots: (S1) 107.22; (P) 107.99; (R1) 108.59; More…

Intraday bias in USD/JPY remains on the downside for the moment. Current fall should extend to 106.48 fibonacci level. We’d look for strong support around there to bring rebound. However, on the upside, break of 108.80 minor resistance is needed to be the first sign of short term bottoming. Otherwise, outlook will remain bearish in case of recovery.

In the bigger picture, current development argues that the corrective pattern from 118.65 is extending. There is risk of dropping further to 61.8% retracement of 98.97 to 118.65 at 106.48. But this level should provide strong support to contain downside and bring resumption of rise from 98.97. However, sustained break of 106.48 will now likely send USD/JPY through 98.97 to resume the corrective fall from 125.85 (2015 high).

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | AUD | Westpac Consumer Confidence Feb | -2.30% | 1.80% | ||

| 23:50 | JPY | GDP Q/Q Q4 P | 0.10% | 0.20% | 0.60% | |

| 23:50 | JPY | GDP Deflator Y/Y Q4 P | 0.00% | 0.00% | 0.10% | 0.20% |

| 02:00 | NZD | RBNZ 2-Year Inflation Expectation Q1 | 2.10% | 2.00% | ||

| 07:00 | EUR | German GDP Q/Q Q4 P | 0.60% | 0.80% | ||

| 07:00 | EUR | German CPI M/M Jan F | -0.70% | -0.70% | ||

| 07:00 | EUR | German CPI Y/Y Jan F | 1.60% | 1.60% | ||

| 10:00 | EUR | Eurozone Industrial Production M/M Dec | 0.10% | 1.00% | ||

| 10:00 | EUR | Eurozone GDP Q/Q Q4 P | 0.60% | 0.60% | ||

| 13:30 | USD | CPI M/M Jan | 0.30% | 0.10% | ||

| 13:30 | USD | CPI Y/Y Jan | 1.90% | 2.10% | ||

| 13:30 | USD | CPI Core M/M Jan | 0.20% | 0.30% | ||

| 13:30 | USD | CPI Core Y/Y Jan | 1.70% | 1.80% | ||

| 13:30 | USD | Retail Sales Advance M/M Jan | 0.20% | 0.40% | ||

| 13:30 | USD | Retail Sales Ex Auto M/M Jan | 0.50% | 0.40% | ||

| 15:00 | USD | Business Inventories Dec | 0.30% | 0.40% | ||

| 15:30 | USD | Crude Oil Inventories | 1.9M |