Global markets are generally in recovery mode today. European indices are all in black at the time of writing. US futures also point to higher open as markets await Trump’s infrastructure plan. Major forex pairs and crosses are staying gin Friday’s range, except AUD/NZD. But it should be noted that the retreats in Dollar and Yen are shallow and weak so far. There could be renew interests in these two currencies if risk sentiments turn sour again later in US session.

Trump to unveil USD 1.5T infrastructure plan

In the US, President Donald Trump is set to unveil an infrastructure plan today. Under the proposal, the government will spend USD 200b over 10 years, inform of grants to encourage states and cities to start their projects on infrastructure, including rebuild of highways, bridges, railroads, airports etc. . And, the White House estimated that would eventually results in USD 1.5T in new investments. However, it’s believed that the plan itself will start facing big hurdles. Thee two main problems are firstly, it’s not as much as the Democrats want, and secondly, there is not clear information on how to pay for the funding.

BoE Haldane in no rush to hike

Over the weekend, BoE chief economist Andy Haldane said that the central bank is in no rush to rate hikes. Haldane did acknowledge that inflation developments are "currently ahead of our target" and "on the balance of probabilities, it seems likely that some further tightening of policy might be needed over the period ahead." Nonetheless, he added that "we’re in no rush, rates won’t remotely go back to levels we’ve seen in the past, but nonetheless keeping the cost of living under control is, we think, the single best and most important thing we can do to help the economy."

BoE MPC member Gertjan Vlieghe sounded upbeat today and said there was "increased evidence that tight labour markets are finally starting to have some upward effect on wages". Also, "if there is less credit headwind to UK economy, then maybe ready for higher rates.,"

ECB concerned with US political influence on exchange rate

ECB Governing Council member Ewald Nowotny said the central bank is "certainly concerned about attempts by the United States to politically influence the exchange rate." And he added "that was a theme of economic discussions in Davos, where the ECB addressed this, and it will certainly be a theme at the upcoming G20 summit." Regarding the US economy, Nowotny said that President Donald Trump "started with a good inheritance" from the pervious government. And the current low unemployment, robust growth and tame inflation stem from Trump’s predecessor, not his own policies.

BoJ Kuroda will get a second term

In Japan, it’s reported that Prime Minister Shinzo Abe has finally made up his mind to give BoJ Governor Haruhiko Kuroda a second five-year term. And if that happens, Kuroda will be the first BoJ Governor to server two consecutive terms since Masamichi Yamagiwa, back in 1956 to 1964. Recent global stock market crash could be the trigger for Abe as stability is all that important for him to continue with his Abenomics. And this would be a strong message that BoJ will continue with it’s massive stimulus, and more importantly, in a cautious way. Barring another disastrous day from US, Tokyo will likely open with a positive note in the upcoming Asian session, back from holiday.

GBP/USD Mid-Day Outlook

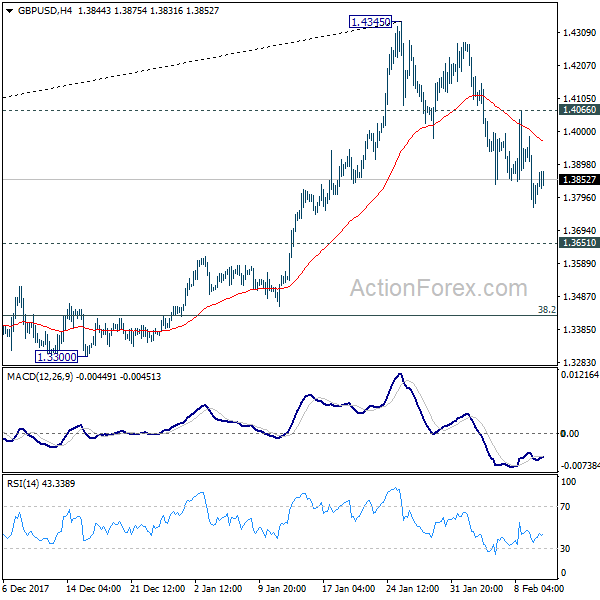

Daily Pivots: (S1) 1.3814; (P) 1.3940; (R1) 1.4035; More…..

At this point, intraday bias remains on the downside. The decline from 1.4345 is still in progress for 1.3651 resistance turned support. It’s still unsure whether decline from 1.4345 is correcting rise from 1.3038, or that from 1.1946, or it’s reversing the trend. Break of 1.3651 will turn focus to key fibonacci level at 1.3429. For the moment, further decline will remain expected as long as 1.4066 minor resistance holds.

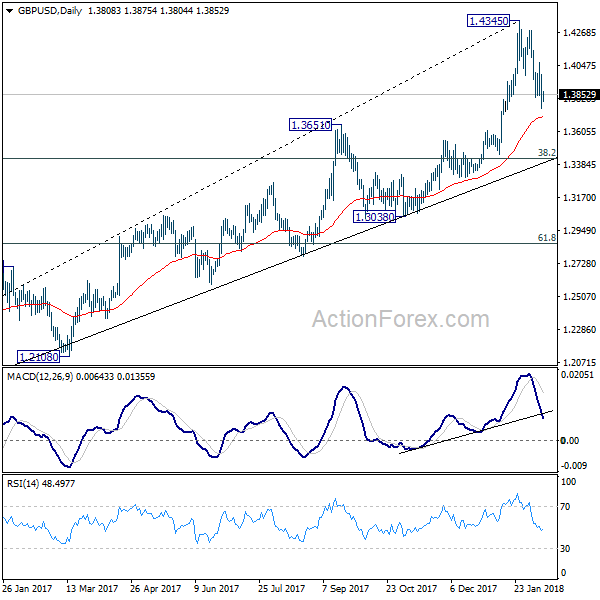

In the bigger picture, as long as 1.3038 support holds, medium term outlook in GBP/USD will remains bullish. Rise from 1.1946 is at least correcting the long term down from 2007 high at 2.1161. Further rally would be seen back to 38.2% retracement of 2.1161 (2007 high) to 1.1946 (2016 low) at 1.5466. However, GBP/USD fails to sustain above 55 month EMA (now at 1.4279 so far. Break of 1.3038 support, will suggests that rise from 1.1946 has completed and will turn outlook bearish for retesting this low.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 8:15 | CHF | CPI M/M Jan | -0.10% | -0.20% | 0.00% | |

| 8:15 | CHF | CPI Y/Y Jan | 0.70% | 0.80% | 0.80% | |

| 19:00 | USD | Federal Budget Balance Jan | 50.2B | -23.2B |