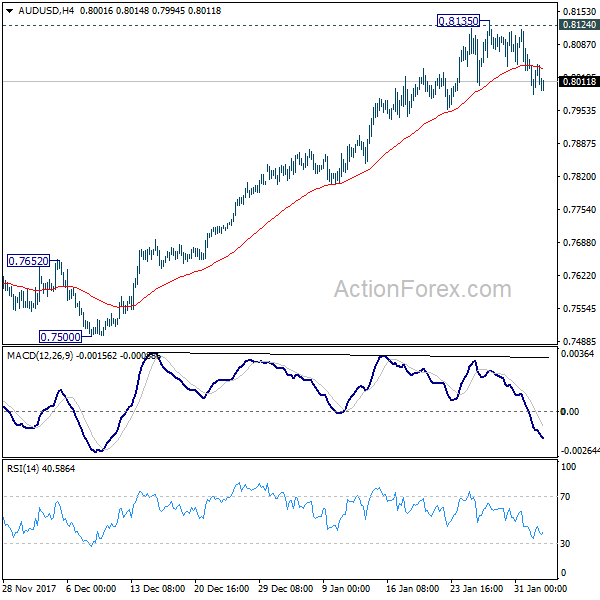

Daily Pivots: (S1) 0.7994; (P) 0.8031; (R1) 0.8074; More…

As noted before, a short term top was formed at 0.8135 after failing to sustain above 0.8124 resistance. Intraday bias remains on the downside for 55 day EMA (now at 0.7856). At this point, we’d expect strong support from there to bring rebound. But sustained trading below the EMA will bring retest of 0.7500 key near term support. On the upside, sustained break of 0.8124 will resume whole medium term rebound from 0.6826 and target key fibonacci level at 0.8451.

In the bigger picture, current development suggests that medium term rebound from 0.6826 is still in progress and could be resuming. Such rise could target 38.2% retracement of 1.1079 (2011 high) to 0.6826 (2016 low) at 0.8451. As such rise is seen as a corrective move, we’d expect strong resistance from 0.8451 to limit upside and bring reversal. Break of 0.7500 support will indicate that the medium term trend has reversed.