Risk sentiments are generally positive this week so far. DOW gained 399.28 pts or 1.58% to close at 25709.27 overnight. The rebound from 23360.29 resumed with solid momentum and is set to extend to retest 26616.71 record high. Comparatively, NASADAQ was even strongly, up 11.15% to 7421.46, just inches below 7500.61 record high. Asian markets follow with Nikkei trading up over 300 pts, or 1.4%, at the time of writing. Pull back in treasury yields was a factor helping stocks as 10 year yield dipped -0.012 to 2.859 after recent rally lost momentum. The currency markets are mixed though, with major pairs and crosses stuck in range. Euro is mildly firmly against the others but there is no clear momentum.

Things to watch in Fed Powell’s testimony

Fed Chair Jerome Powell’s first Congressional testimony will be the major focus today. While Powell is not expected to deviate much from Fed’s FOMC minutes and Monetary Policy Report last week, there are still a few points of interest to note. Firstly, the January FOMC meeting was held before the Congress passed the two year budget with USD 300b increase in federal outlays. Powell might offer his view on how the fiscal stimulus would give another boost to the economy.

Secondly, one of the key arguments of Fed doves against tightening is that after a few hikes, policy rate would be closer to neutral rates. And by then, policy will be restrictive. The markets would like to know Powell’s view on where the neutral rate stands, and whether the neutral rate has moved up again after sustained recovery in the economy. Thirdly, there have been talks about so called price-level targeting in recent markets. The markets would like to know more about the discussion within Fed on this topic.

But after all, for now, the markets should be firmly expecting three Fed hikes this year. The question is on whether there will be a fourth hike. If Powell doesn’t offer any clue, we’ll have to wait for new economic projections to be published at the March FOMC meeting before having a conclusive expectation.

Fed Quarles offered upbeat outlook

Fed Governor Randal Quarles offered an optimistic view on the economic outlook of the US. He said that "Some of the factors that have been holding back growth in recent years could shift, moving the economy onto a higher growth trajectory." He also pointed to the tax cuts and said they "will also likely boost investment and increase the capital stock." He supported gradual removal of monetary policy accommodation. And he added that "this higher policy path would be motivated by sustained stronger growth and improved economic conditions, not a greater desire to slow the economy."

On the other hand, Fed dove St. Louis Fed President James Bullard warned again that "if the Committee raises the policy rate substantially from here without other changes in the data, the policy setting could become restrictive." And he’s concerned that FOMC "goes too far too fast" in tightening.

ECB Draghi sounded cautious again

ECB President Mario Draghi sounded cautious again in his comments yesterday. He warned that "given the uncertainty surrounding the measurement of economic slack, the true amount may be larger than estimated, which could slow down the emergence of price pressures." And therefore, the "right blend" of stimulus measures is still needed.

Nonetheless, he said "these factors should wane as the economic expansion continues and unemployment further declines." "The relationship between growth and inflation remains largely intact, even if it has temporarily weakened in recent years to the extent that the speed of adjustment in inflation towards our aim has been affected." But he remained confident that " headline inflation will resume its gradual upward adjustment, supported by our monetary policy measures."

Draghi’s comments suggested that ECB is still in no rush to exit stimulus. And the comments echoed the January meeting minutes that "changes in communication were generally seen to be premature at this juncture, as inflation developments remained subdued despite the robust pace of economic expansion." ECB is not even ready to change its forward guidance yet.

EU to publish draft Brexit treaty

The EU is set to publish 100-page draft Brexit treaty this Wednesday, detailing how it expects Brexit to happen and the terms of the transition period. That will come just two days before UK Prime Minister Theresa May’s speech on future trade relationship with EU. It’s believed the EU’s document will be sole from EU’s perspective for the negotiation ahead. Meanwhile, it draws criticism from UK that EU is only trying to push its agenda, rather than producing something that reflects the positions of both sides.

On the data front

New Zealand trade balance showed NZD -566m deficit in January. Eurozone M3 and confidence indicators will be released in European session. German CPI will also be featured. US will release trade balance, wholesale inventories, durable goods orders, house price indices and consumer confidence.

USD/CAD Daily Outlook

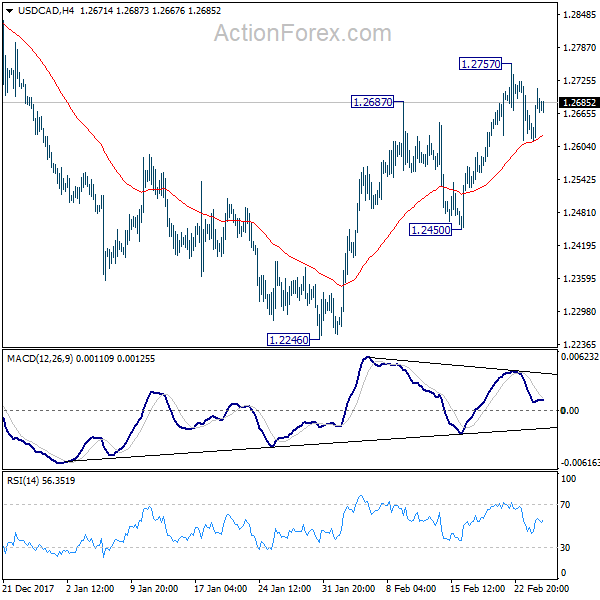

Daily Pivots: (S1) 1.2628; (P) 1.2670; (R1) 1.2725; More….

USD/CAD is staying in tight range below 1.2757 and intraday bias remains neutral first. On the upside, above 1.2757 will resume the rebound from 1.2246 and target a test on 1.2919 key resistance. We’d be cautious on strong resistance from there to limit upside. On the downside, below 1.2450 will turn bias back to the downside for 1.2246 support.

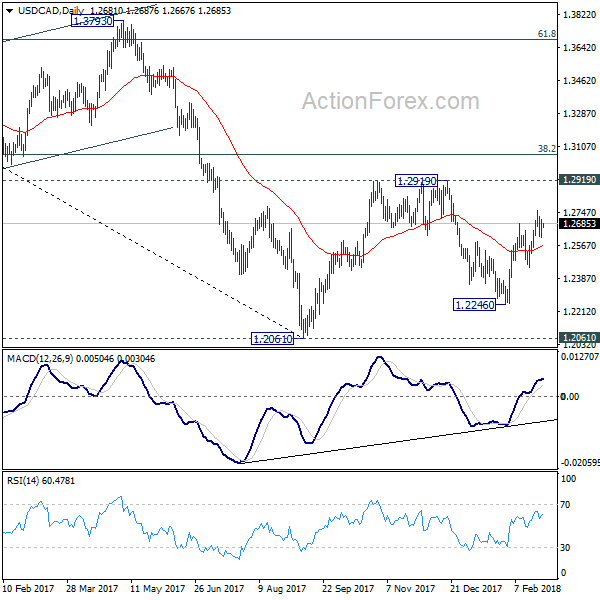

In the bigger picture, the rebound from 1.2246 is mixing up the medium term outlook. Nonetheless, USD/CAD is staying below falling 55 week EMA (now at 1.2771), hence, the bearish case is in favor. That is, fall from 1.4689 is not completed yet. Sustained break of 1.2061 key support will carry larger bearish implication and target 61.8% retracement of 0.9406 to 1.4689 at 1.1424. However, firm break of 1.2919 will revive the case of medium term reversal and turn outlook bullish.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Trade Balance Jan | -566M | -2710M | 640M | 596M |

| 9:00 | EUR | Eurozone M3 Money Supply Y/Y Jan | 4.60% | 4.60% | ||

| 10:00 | EUR | Eurozone Business Climate Indicator Feb | 1.47 | 1.54 | ||

| 10:00 | EUR | Eurozone Economic Confidence Feb | 114 | 114.7 | ||

| 10:00 | EUR | Eurozone Industrial Confidence Feb | 8 | 8.8 | ||

| 10:00 | EUR | Eurozone Services Confidence Feb | 16.3 | 16.7 | ||

| 10:00 | EUR | Eurozone Consumer Confidence Feb F | 0.1 | 0.1 | ||

| 13:00 | EUR | German CPI M/M Feb P | 0.50% | -0.70% | ||

| 13:00 | EUR | German CPI Y/Y Feb P | 1.50% | 1.60% | ||

| 13:30 | USD | Fed Powell’s Congressional Testimony | ||||

| 13:30 | USD | Advance Goods Trade Balance Jan | -72.3B | -72.3B | ||

| 13:30 | USD | Wholesale Inventories M/M Jan P | 0.30% | 0.40% | ||

| 13:30 | USD | Durable Goods Orders Jan P | -2.50% | 2.80% | ||

| 14:00 | USD | House Price Index M/M Dec | 0.40% | 0.40% | ||

| 14:00 | USD | S&P/Case-Shiller Composite-20 Y/Y Dec | 6.30% | 6.40% | ||

| 15:00 | USD | Consumer Confidence Index Feb | 126 | 125.4 |