Sunrise Market Commentary

- Rates: Consolidation ahead of Powell’s testimony?

Sentiment on core bond markets turned more neutral last week, especially in Europe. The Bund approaches first resistance. We expect some consolidation today amid an uninspiring eco calendar and ahead of German CPI data and Fed chair Powell’s testimony in front of US Congress. - Currencies: Dollar struggles as markets await Powell’s hearing before Congress

The USD rebound slowed last week. US yields eased and strong US equities currently are a negative rather than a positive for the dollar. USD traders are looking forward to Fed Powell’s testimony before Congress. Later this week, the news flow might be tentatively USD supportive/euro negative. Sterling traders keep an eye at a key speech of labour leader Corbyn

The Sunrise Headlines

- US equity markets closed last week on a strong footing, ending around 1.5% higher. Asian risk sentiment remains positive this morning with China and Japan outperforming.

- China’s ruling Communist Party set the stage for President Xi Jinping to stay in office indefinitely, with a proposal to remove a constitutional clause limiting presidential service to just two terms in office.

- S&P raised Russia’s foreign sovereign credit rating into investment grade (BBB- from BB+, positive outlook) citing the country’s “prudent policy response” in the face of lower commodity prices and international sanctions.

- The White House plans to promote an adviser known for his hawkish views on trade policy, giving economic nationalists a stronger voice in internal debates as the Trump administration nears decisions on high-profile trade issues. (WSJ)

- The EU is set to publish a draft Brexit withdrawal agreement that omits key compromise language on Northern Ireland inserted by Britain in December’s divorce deal, the FT reports, citing three officials familiar with the text.

- The opposition Labour Party is poised to announce a new strategy aimed at forcing Britain to maintain close economic ties with the EU after it leaves the bloc. Jeremy Corbyn will clarify the party’s position today.

- Today’s eco calendar contains US new home sales. Several central bankers are scheduled to speak and the Kingdom of Belgium probably launches its debut green OLO via syndication (OLO 86 Apr2033).

Currencies: Dollar Struggles As Markets Await Powell’s Hearing Before Congress

USD struggles ahead of Powell’s policy assessment

USD trading was technically-driven on Friday. Core yields eased, but rate differentials were little changed. Equities traded mixed in Europe, but staged an impressive rebound in the US. The rally failed to guide USD trading. EUR/USD hovered near 1.23 (close 1.2295). USD/JPY traded with a minor negative bias and finished the day at 106.89.

This morning, Asian equities join the rally from WS on Friday, but the gains area more modest. Risk-on sentiment is weighing slightly on the dollar as was often the case of late. EUR/USD trades in the 1.2325 area. USD/JPY is drifting south in the 106 big figure (currently 106.60).

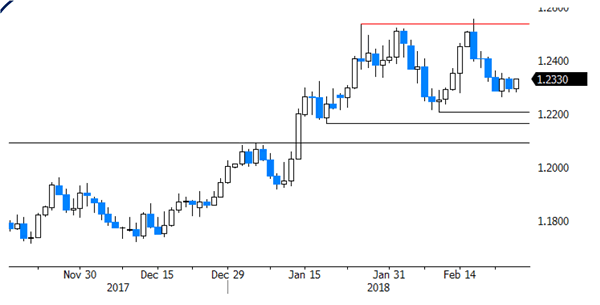

Today, the US calendar contains regional activity surveys and new home sales. The data will only be of intraday significance for USD trading. Several Fed members give their view on the economy and on policy. However, the focus will be on tomorrow’s hearing of Fed’s Powell before Congress. He might confirm that solid US growth requires further normalization of monetary policy. This message could be mildly USD supportive. Later this week, there are plenty of eco data, including US PCE deflators (Thursday) and EMU February inflation, expected at a soft 1.2% Y/Y (Wednesday). There will also be headlines on political risk in EMU as markets look forward to the Italian elections and the approval of the German government coalition by the SPD next weekend. The news flow might be slightly supportive for USD and tentatively negative for the euro. However, the USD recently didn’t profit much from good news. Last week, we advocated consolidation on the ST USD rebound. We maintain that view. LT US yields are near key resistance, but aren’t ready for a break, further slowing the USD rebound. First support in EUR/USD is coming in at 1.2206/1.2165. It might be too early for a test. European political event risk is a wildcard, but we don’t assume it to be a big negative for the euro. Equities remain a wildcard.

This weekend, BoE’s Ramsden signaled that UK interest rates could be raised sooner rather than later. Today the focus for GBP-trading turns to a speech of Labour leader Corbyn. He is expected to support the case of the UK to maintain a customs union with the EU. This could cause further division within the conservative party, but sterling might profit from rising chances of a soft Brexit. EUR/GBP might drift further south in the 0.9033/0.8690 trading range. For now, we assume that this range bottom will hold short-term

EUR/USD: dollar rally slows as markets look forward to Fed Powell’s hearing before Congress