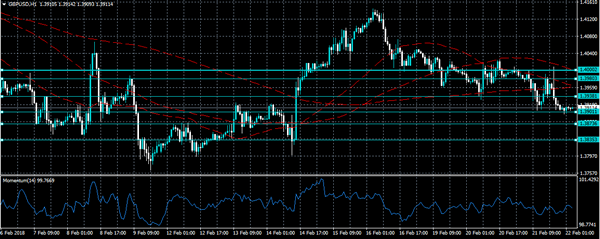

The British pound continues to hold around the price-lows of the week against the U.S dollar, as traders remain cautious ahead of the release of key economic data from the United Kingdom. The GBPUSD pair currently trades just above the 1.3900 handle, ahead of the release of the second estimate of fourth fiscal quarter UK Gross Domestic Product. Moving into Thursday’s European trading session, a clear break of the 1.3901 to 1.3938 price-range is likely to define the pairs intraday directional bias.

The GBPUSD pair is likely to experience further losses below the 1.3901 level, key downside support is then found at the 1.3873 and 1.3835 levels.

Should GBPUSD price-action move above the 1.3938 resistance level, buyers may attack the 1.3980 and 1.4000 resistance areas.