Dollar’s broad based weakness continued last week and ended as the worst performing major currency. Stronger than expected consumer inflation reading listed treasury yield and raised the chance of a March Fed hike. Fed fund futures are now pricing in 83% chance of a March hike. But that provided just very brief support to the greenback. Dollar index extended the long term down trend to new three year low, suffering the worst weekly decline since September. Some pointed to Friday’s rebound as a sign of reverse in fortune in Dollar. But we’ll, for now, take a more cautious stance on it first. Elsewhere, Canadian Dollar and Australian Dollar ended as the second and third weakest ones. Yen, Kiwi and Pound were the strongest.

The correlation between dollar and treasury yield continued to break down last week. Initial reaction to CPI release was as expected as both Dollar and yields surged. But then, while yields retreated, they stayed resilient. Dollar, on the other hand, suffered steep selloff and resumed recent down trend. There are various explanations to the break down in correlation. But we’d like to point out one fundamental question first. That is, does higher yield make dollar assets more attractive? Or does it reflect the relative unattractiveness of dollar assets?

Many, including us, got it wrong until recently. It worked before, in particular seen in USD/JPY in most of the low interest rate era, that higher US yields will lift the Dollar. But now, as we’re existing this era, it’s just reflection that Dollar assets are getting less attractive. In the background, Fed’s shrinking of the balance sheet this year is going to flood the markets with extra supply in bonds. And then, investors, domestic and overseas, are getting more willing to take risks than parking them in bonds. The US markets, continuously making record runs, is a good place for investments. But some find other markets, like EU and Asia, at least as attractive. Also, the money flow could be seen as a vote of "no confidence" in US President Donald Trump in his deficit booming fiscal policies (with the tax cut), as well as protectionist trade policies. We’re not expecting the positive correction to return, until we seen solid evidence.

10 year yield (TNX) edged higher to 2.888 before closing at 2.877. It’s the second week that TNX closed lower than weekly open. And it’s starting to look tired ahead of 3.036 key resistance. Nonetheless, as long as 2.736 near term support holds, outlook will stays bullish. Region between 3.036 and 3.318 (100% projection of 1.336 to 2.621 from 2.034) is the real long term trend defining junction for TNX. On the downside break of 2.7.36 will at least bring deeper correction towards 55 day EMA (now at 2.618) first.

Dollar index resumed last long term down trend from 103.82 and edged lower to 88.25 last week. Notable buying was seen last Friday to bring a recovery in the greenback. DXY closed back inside recently established rate at 89.10. 50% retracement of 72.69 to 103.82 at 88.25 could still be providing strong support to DXY. But it’s far too early to talk about reversal. Near term resistance zone between 90.56 and 91.01 must be overcome first before having any chance of a trend reversal. That would be equivalent to a break of 1.2205 support in EUR/USD. Otherwise, the down trend from 103.82 is more likely than not to extend to next key cluster support at 84.75, 61.8% retracement of 72.69 to 103.82 at 84.58, before completion.

DOW was initially sold off after strongest than expected US CPI release but quickly reversed. It indeed extended the rebound from 22360.29 to close solidly to 25219.38. As we pointed out during the week, the reactions could be interpreted as "the worst in stocks was over". The steep selloff from 26616.71 to 23360.29 was based on worries over tightening by Fed. As seen in fed fund futures, chance of a March hike continued to rise to 83% after the CPI release. But stocks were resilient. So, that selloff was probably an over-reaction. The coming days will be important as sustained trading above 61.8% retracement of 26616.71 to 23360.29 at 25372.75 will establish DOW in, at worst, a sideway consolidation pattern, rather than a downward correction pattern.

Position trading strategy

We’re holding on to our GBP/CHF short (sold at 1.3105). We’re still bearish in the cross for 38.2% retracement of 1.1638 to 1.3491 at 1.2783 as the first target, and 61.8% retracement at 1.2346 as second. But the lack of downside momentum is disappointing. And as mentioned above, there is a risk that the worst in risk markets was over. Hence, we’ll lower the stop to break even at 1.3105. For those who’d like to move on, exiting on a dip this week is ok too. Though, we’ll give it a little bit more time.

USD/JPY Weekly Outlook

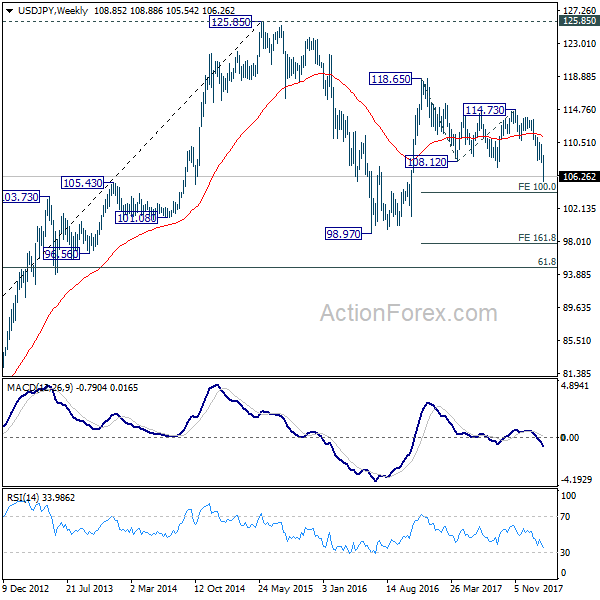

USD/JPY’s down trend continued last week and reached as low as 105.54. A temporary low was formed with 4 hour MACD crossed above signal line. Initial bias is neutral this week for consolidation first. But recovery should be limited below 108.72 support turned resistance and bring fall resumption. Below 105.54 will target 100% projection of 118.65 to 108.12 from 114.73 at 104.20 next.

In the bigger picture, current development argues that the corrective pattern from 118.65 is extending. The solid break of 61.8% retracement of 98.97 to 118.65 at 106.48. now suggests that the pattern from 125.85 high is possibly extending. Deeper fall could be seen through 98.97 key support (2016 low). This bearish case will now be favored as long as 110.47 resistance holds.

In the long term picture, the rise from 75.56 (2011 low) long term bottom to 125.85 top is viewed as an impulsive move, no change in this view. Price actions from 125.85 are seen as a corrective move which could still extend. In case of deeper fall, downside should be contained by 61.8% retracement of 75.56 to 125.85 at 94.77. Up trend from 75.56 is expected to resume at a later stage for above 135.20/147.68 resistance zone.