Yen and Swiss Franc jump broadly today as the recovery in global stock markets lose steam again. At the time of writing, both DAX and CAC 40 are trading in red even though FTSE is mildly higher. That followed -0.65% decline in Nikkei earlier in the day. US futures also point to another day of loss. Sterling follows as the third strongest one for the day after higher than expected consumer inflation reading. On the hand, commodity currencies, and Dollar, are trading generally lower.

UK CPI unchanged at 3.0% yoy, beat expectation

UK headline CPI was unchanged at 3.0% yoy in January, above expectation of 2.9% yoy. Core CPI accelerated to 2.7% yoy, up from 2.5% yoy and beat expectation of 2.6% yoy. RPI slowed by 0.1% yoy to 4.0% yoy. PPI input slowed to 4.7% yoy, PPI output slowed to 2.8% yoy, PPI output core dropped to 2.2% yoy. Also from UK, house price index rose 5.2% yoy in December.

With CPI staying above 2% target level for 12 straight month, it adds to the case for BoE to pull ahead this year’s rate hike to May. BoE known hawk Ian McCafferty said yesterday that the economy is "holding up well" with improvements globally too. But there are a "great deal of uncertainty around the Brexit negotiation and how that might affect both business and consumer confidence. And therefore, "we will be watching the data and making our decisions on a month by month basis."

Also from Europe, Swiss PPI was unchanged at 1.8% yoy in January.

Japan PMI Abe expects BoJ to continue with "bold steps"

In Japan, Prime Minister Shinzo Abe told the parliament that "surveys show banks’ lending attitudes to small- and medium-sized companies remain healthy even after the introduction of negative rates." And he expected BoJ to "continue to take bold steps to achieve price stability in response to movements in prices and the economy." Abe also said he hasn’t made the decision on whether to give Haruhiko Kuroda a second term as BoJ Governor yet. But Finance Minister Taro Aso said that fluent English is a "very important condition" to head BoJ. This is seen by some as endorsement to Kuroda. Kuroda was a former head of the Asian Development Bank and top Japanese currency diplomat.

Released from Japan, machine tool orders rose 48.8% yoy in January. Domestic CGPI rose 2.7% yoy in January.

Australia business confidence hit 9 month high

Australia NAB business confidence rose 2 points to 12 in January, hitting a 9-month high. Business condition index rose 6 points to 19. NAB chief economist Alan Oster noted in the release that "while forward orders have eased a little, they remain above average and capacity utilisation has been trending up which is a good sign for both future investment and employment."

RBA Ellis: Wage growth to be gradual

RBA Assistant Governor Luci Ellis said that wages are forecast to "pick up from here", but "not immediately and then only gradually". She added that "firms are increasingly using other creative ways to attract and keep staff without paying across-the-board wage rises." And, "they are especially reluctant to grant wage rises, because this would increase one of their most important costs." Meanwhile, Australia is still "a bit further behind" some other advanced economies and "it might take a bit longer for the turnaround in inflation to happen here than elsewhere."

USD/JPY Mid-Day Outlook

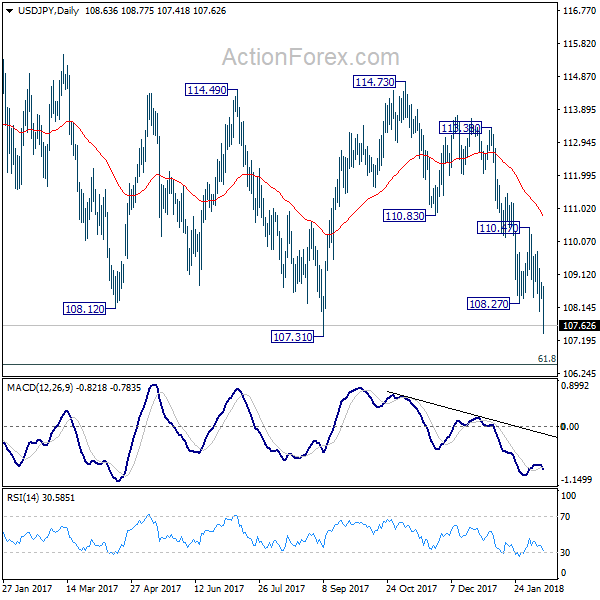

Daily Pivots: (S1) 108.43; (P) 108.65; (R1) 108.88; More…

USD/JPY’s decline continues today and reaches as low as 107.41 so far. Intraday bias remains on the downside and break of 107.31 will target 106.48 fibonacci level. We’d look for strong support around there to bring rebound. However, on the upside, break of 108.80 minor resistance is needed to be the first sign of short term bottoming. Otherwise, outlook will remain bearish in case of recovery.

In the bigger picture, current development argues that the corrective pattern from 118.65 is extending. There is risk of dropping further to 61.8% retracement of 98.97 to 118.65 at 106.48. But this level should provide strong support to contain downside and bring resumption of rise from 98.97. However, sustained break of 106.48 will now likely send USD/JPY through 98.97 to resume the corrective fall from 125.85 (2015 high).

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Domestic CGPI Y/Y Jan | 2.70% | 2.70% | 3.10% | 3.00% |

| 0:30 | AUD | NAB Business Conditions Jan | 10 | 12 | 13 | |

| 0:30 | AUD | NAB Business Confidence Jan | 12 | 10 | 11 | |

| 6:00 | JPY | Machine Tool Orders Y/Y Jan P | 48.80% | 48.30% | ||

| 8:15 | CHF | PPI M/M Jan | 0.30% | 0.20% | 0.20% | |

| 8:15 | CHF | PPI Y/Y Jan | 1.80% | 0.90% | 1.80% | |

| 9:30 | GBP | CPI M/M Jan | -0.50% | -0.60% | 0.40% | |

| 9:30 | GBP | CPI Y/Y Jan | 3.00% | 2.90% | 3.00% | |

| 9:30 | GBP | Core CPI Y/Y Jan | 2.70% | 2.60% | 2.50% | |

| 9:30 | GBP | RPI M/M Jan | -0.80% | -0.70% | 0.80% | |

| 9:30 | GBP | RPI Y/Y Jan | 4.00% | 4.10% | 4.10% | |

| 9:30 | GBP | PPI Input M/M Jan | 0.70% | 0.60% | 0.10% | |

| 9:30 | GBP | PPI Input Y/Y Jan | 4.70% | 4.10% | 4.90% | 5.40% |

| 9:30 | GBP | PPI Output M/M Jan | 0.10% | 0.20% | 0.40% | |

| 9:30 | GBP | PPI Output Y/Y Jan | 2.80% | 3.00% | 3.30% | |

| 9:30 | GBP | PPI Output Core M/M Jan | 0.30% | 0.20% | 0.30% | |

| 9:30 | GBP | PPI Output Core Y/Y Jan | 2.20% | 2.30% | 2.50% | 2.40% |

| 9:30 | GBP | House Price Index Y/Y Dec | 5.20% | 4.90% | 5.10% | 5.00% |