Sterling tumbles sharply today after EU Brexit negotiator Michel Barnier warned that a transition deal is "not a given". That came as Barnier concludes the week long technical discussion between civil servants of UK and EU. And he pointed out there are three "substantial" disagreements remained over the transition period. Firstly, UK wants the rights of EU citizens coming in during the transition period to be different from those who come in before. Secondly, UK wants to retain the right to object to new EU laws during the period. Thirdly, it’s uncertain how UK could have a role in new EU justice and home affairs policies during the transition.

US budget deal approved after midnight drama

After some mid-night drama and temporary government shutdown, the US Congress finally approved the 2 year budget deal that would also suspend the debt limit through March 1, 2019. A delay was forced upon by Rand Paul in the Senate as he demanded a vote to keep budget caps in place. Finally, Senate voted 71 to 28 while House voted 240 to 186. Included in the bill is a short term funding for the government through March 23. And the lawmakers now have six weeks to detail the legislation regarding funding at the new level.

RBA lowered unemployment forecast

In the monetary statement published today, RBA lowered unemployment rate forecasts but kept projections on growth and inflation unchanged. Year average GDP growth is projected to be at 3% in 2018 and 3.25% in 2019. CPI is projected to be at 2.25% by the end of 2018 and stay at 2.25% by the end of 2019. Unemployment rate, though, is forecast to drop from current 5.5% to 5.25% by the end of 2018, revised down from 5.50%. Unemployment is forecast to stay at 5.25% till end of 2019.

RBA noted that "financial market volatility has picked up in recent days, most notably in equity markets as market participants have begun to reassess the outlook for global inflation and the withdrawal of monetary accommodation". And, "an important consideration for the outlook is how far inflation picks up as the global economy strengthens." It added that "a larger-than-expected increase in inflation would have implications both for financial market pricing and exchange rates."

On the data front

Canada employment dropped -88k in January, much worse than expectation of 10k rise. Unemployment rate also jumped 0.2% to 5.9%. UK industrial production dropped -1.% mom, rose 0.0% yoy in December, manufacturing production rose 0.3% mom, 1.4% yoy. Trade deficit widened to GBP -13.6b in December. Swiss unemployment rate was unchanged at 3.0% in January. Japan tertiary industry index dropped 00.2% mom in December, M2 rose 3.4% yoy in January. Australia home loans dropped -2.3% mom in December. China CPI slowed to 1.5% yoy in January, PPI slowed to 4.3% yoy.

Also from Australia, home loans dropped more than expected by -2.3% mom in December.

GBP/USD Mid-Day Outlook

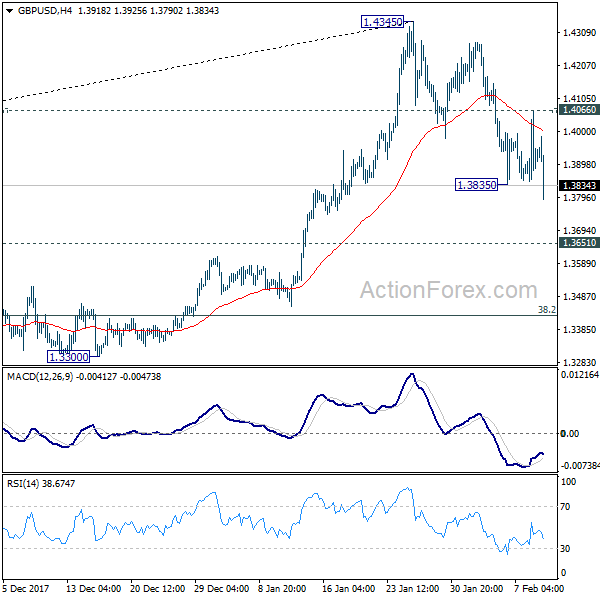

Daily Pivots: (S1) 1.3814; (P) 1.3940; (R1) 1.4035; More…..

GBP/USD’s recovery was limited by 4 hour 55 EMA. Subsequent break of 1.3835 indicates resumption of decline from 1.4345 and intraday bias is turned to the downside for 1.3651 resistance turned support. At this point, it’s still unsure whether decline from 1.4345 is correcting rise from 1.3038, or that from 1.1946, or it’s reversing the trend. Break of 1.3651 will turn focus to key fibonacci level at 1.3429. For the moment, further decline will remain expected as long as 1.4066 minor resistance holds.

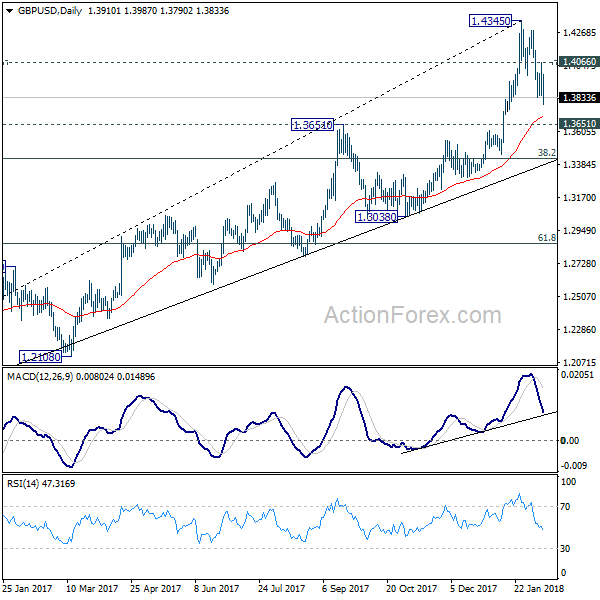

In the bigger picture, sustained break of 1.3835 key resistance level indicates that rebound from 1.1946 is at least correcting the long term down from from 2007 high at 2.1161. Further rise should now be seen back to 38.2% retracement of 2.1161 (2007 high) to 1.1946 (2016 low) at 1.5466. Medium term outlook will stay bullish 38.2% retracement of 1.1946 to 1.4345 at 1.3429, in case of deep pull back.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Japan Money Stock M2+CD Y/Y Jan | 3.40% | 3.60% | 3.60% | |

| 00:30 | AUD | Home Loans M/M Dec | -2.30% | -1.00% | 2.10% | 1.60% |

| 00:30 | AUD | RBA Monetary Policy Statement | ||||

| 01:30 | CNY | CPI Y/Y Jan | 1.50% | 1.50% | 1.80% | |

| 01:30 | CNY | PPI Y/Y Jan | 4.30% | 4.20% | 4.90% | |

| 04:30 | JPY | Tertiary Industry Index M/M Dec | -0.20% | 0.10% | 1.10% | |

| 06:45 | CHF | Unemployment Rate Jan | 3.00% | 3.00% | 3.00% | |

| 09:30 | GBP | Industrial Production M/M Dec | -1.30% | -0.90% | 0.40% | 0.30% |

| 09:30 | GBP | Industrial Production Y/Y Dec | 0.00% | 0.40% | 2.50% | 2.60% |

| 09:30 | GBP | Manufacturing Production M/M Dec | 0.30% | 0.30% | 0.40% | 0.20% |

| 09:30 | GBP | Manufacturing Production Y/Y Dec | 1.40% | 1.20% | 3.50% | 3.80% |

| 09:30 | GBP | Construction Output M/M Dec | 1.60% | -0.10% | 0.40% | 0.10% |

| 09:30 | GBP | Visible Trade Balance (GBP) Dec | -13.6B | -11.5B | -12.2B | -12.5B |

| 12:00 | GBP | NIESR GDP Estimate Jan | 0.50% | 0.50% | 0.60% | |

| 13:30 | CAD | Net Change in Employment Jan | -88.0K | 10K | 78.6K | |

| 13:30 | CAD | Unemployment Rate Jan | 5.90% | 5.80% | 5.70% | |

| 15:00 | USD | Wholesale Inventories M/M Dec F | 0.20% | 0.20% |