Quick update: US initial jobless claims dropped -9k to 221k in the week ended Feb 3. Four week averaged dropped by -10k to 224.5k, lowest since March 1973. Continuing claims dropped -33k to 1.92m.

Sterling jumps after BoE stands pat and indicates that it may raise interest rates earlier than expected. In the accompanying statement, the central bank noted "were the economy to evolve broadly in line with the February Inflation Report projections, monetary policy would need to be tightened somewhat earlier and by a somewhat greater extent over the forecast period than anticipated at the time of the November Report, in order to return inflation sustainably to the target." That is seen as the main trigger for the buying in the Pound. Other than that, there are many surprises. The votes on keeping the Bank rate at 0.50% and asset purchase at GBP 435b were unanimous. 2018 GDP forecast was raised to 1.8%, up from 1.6%. 2019 GDP forecast was raised to 1.8%, up from 1.7%.

ECB: Broad economic expansion to continue

ECB monthly bulletin noted that the broad based expansion in Eurozone is likely to continue. The report noted that "the ongoing broad and solid economic expansion is expected to continue beyond the near term" And, "the prevailing strong cyclical momentum could lead to further positive growth surprises in the near term." Also, "downside risks continue to relate primarily to global factors, including developments in foreign exchange markets."

ECB Chief Economist Peter Praet reiterated the three criteria for ending the asset purchase program. And, "if the flow of incoming data were to confirm the expectation of a gradual build-up of inflationary pressures, this would not necessarily be sufficient to affirm a sustained adjustment, as less supportive monetary policy conditions could imperil the inflation trajectory." The three criteria are inflation on track to 2% target, there is confidence that inflation would be met on a sustainable basis, and inflation outlook is not overly dependent on monetary support.

BoJ Kuroda: We need to stick with powerful monetary easing

BoJ Governor Haruhiko Kuroda told the parliament today that "we haven’t reached the point where we should talk about the timing of an exit or exit strategies" And, "we need to stick with our powerful quantitative easing." BoJ board member Hitoshi Suzuki said that "the BOJ will patiently continue its powerful monetary easing now." And "if it becomes clear that more time would be needed (to achieve the BOJ’s price target), there’s a chance of modifying our policy framework to make it more sustainable and allow us to continue monetary easing for a longer period of time."

RBA Lowe: No strong case for near term hike

RBA Governor Philip Lowe said that the board "does not see a strong case for a near-term adjustment in monetary policy." He pointed out that "we are still some way from what could be considered full employment and our central scenario for inflation is for it to remain below the midpoint of the medium-target range for the next couple of years." Also, Lowe noted RBA didn’t lower interest rate to that "extraordinarily low levels seen elsewhere after the financial crisis." And, "Just as we did not move in lock-step on the way down, we do not need to do so in the other direction."

RBNZ stands pat, lowered inflation forecasts

As widely anticipated, RBNZ left the OCR unchanged at 1.75%. Owing to the downside surprise in 4Q17 inflation, policymakers revised lower their inflation forecast, mainly driven by tradeable inflation. Meanwhile, the central bank now sees currency appreciation a less concern, as NDZUSD has retreated to a one-month low, and indicates that the positive impacts of fiscal stimulus (including KiwiBuild and the increase in minimum wages) have diminished. The overall monetary stance remains neutral with the first hike unlikely coming before the 2Q19. More in RBNZ Downgraded Inflation Forecasts, First Rate Hike Unlikely Until 2019.

Separately, RBNZ Assistant Governor John McDermott said in a Reuters interview that "Core inflation is sitting a little bit below the midpoint… it still needs a little shove to get it towards the midpoint. That strategy hasn’t changed." He reiterated RBNZ’s "neutral stance". And he added that "there is a significant probability that the next rate move could be an increase sometime in the future, and there’s also a substantial probability that the next move could actually be a cut."

On the data front

German trade surplus narrowed to EUR 21.4b in December. UK RICS house price balance was unchanged at 8 in January. Japan current account surplus narrowed to JPY 1.48T in December. China trade surplus narrowed sharply to CNY 136b, or USD 20.3b in January. Australia NAB business confidence dropped to 6 in Q4.

EUR/GBP Mid-Day Outlook

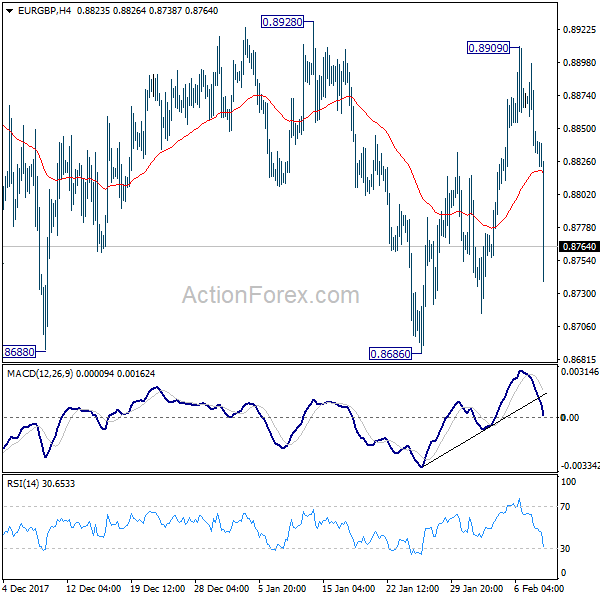

Daily Pivots: (S1) 0.8812; (P) 0.8855; (R1) 0.8876; More…

EUR/GBP drops sharply on hawkish BoE, but it’s still bounded in range of 0.8686/8928. Intraday bias remains neutral for the moment. And, near term outlook will remain mildly bearish as long as 0.8928 resistance holds. On the downside, firm break of 0.8686 will resume whole decline from 0.9305. As 61.8% retracement of 0.8312 to 0.9305 should then be taken out too. Deeper decline would be seen to retest 0.8303/8312 support zone. Nonetheless, on the upside, break of 0.8928 will indicate near term reversal and turn outlook bullish for 0.9304 resistance.

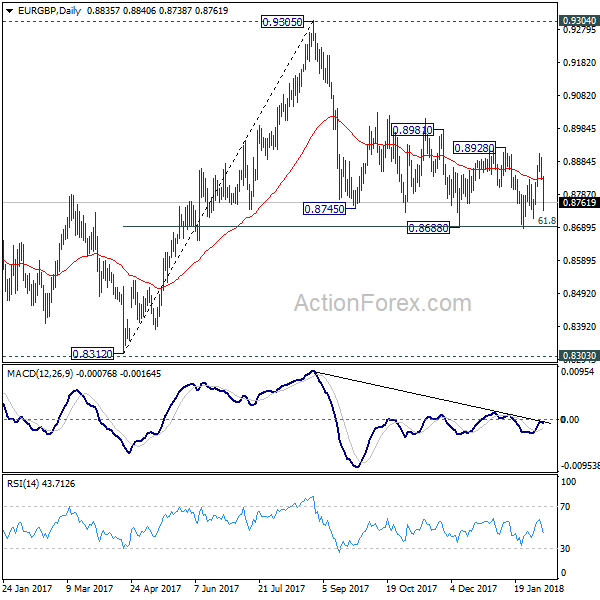

In the bigger picture, there are various ways to interpret price actions from 0.9304 high. But after all, firm break of 0.9304/5 is needed to confirm up trend resumption. Otherwise, range trading will continue with risk of deeper fall. And in that case, EUR/GBP could have a retest on 0.8303. But we’d expect strong support from 0.8116 cluster support (50% retracement of 0.6935 to 0.9304 at 0.8120) to contain downside.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 20:00 | NZD | RBNZ Rate Decision | 1.75% | 1.75% | 1.75% | |

| 23:50 | JPY | Current Account (JPY) Dec | 1.48T | 1.66T | 1.70T | |

| 0:01 | GBP | RICS House Price Balance Jan | 8.00% | 5.00% | 8.00% | |

| 0:30 | AUD | NAB Business Confidence Q4 | 6 | 7 | 8 | |

| 2:00 | CNY | Trade Balance (CNY) Jan | 136B | 325B | 362B | |

| 3:45 | CNY | Trade Balance (USD) Jan | 20.3B | 54.9B | 54.7B | |

| 5:00 | JPY | Eco Watchers Survey Current Jan | 49.9 | 53.6 | 53.9 | |

| 7:00 | EUR | German Trade Balance Dec | 21.4b | 21.0b | 23.7b | |

| 9:00 | EUR | ECB Economic Bulletin | ||||

| 12:00 | GBP | BoE Rate Decision | 0.50% | 0.50% | 0.50% | |

| 12:00 | GBP | BoE Asset Purchase Target Feb | 435B | 435B | 435B | |

| 12:00 | GBP | MPC Official Bank Rate Votes | 0–0–9 | 0–0–9 | 0–0–9 | |

| 12:00 | GBP | MPC Asset Purchase Facility Votes | 0–0–9 | 0–0–9 | 0–0–9 | |

| 12:00 | GBP | BoE Inflation Report | ||||

| 13:15 | CAD | Housing Starts Jan | 216K | 211K | 218K | |

| 13:30 | CAD | New Housing Price Index M/M Dec | 0.00% | 0.20% | 0.10% | |

| 13:30 | USD | Initial Jobless Claims (3 FEB) | 221K | 236K | 230K | |

| 15:30 | USD | Natural Gas Storage | -99B |