Global stock market rout extends into Asian session today. At the time of writing Japanese Nikkei is down -2.2% and Hong Kong HSI is down -1.6%. The currency markets are relatively mixed, though. Aussie and Yen are both trading mildly higher, but neither one display any sign of conviction. Dollar pares back some of Friday’s gain. And the greenback is still looking bearish against Europeans. It’s believed the current risk aversion is driven by the increasing expectation of global monetary stimulus withdrawal. And, such expectation intensified after the strong employment data from US. So far, commodities currencies are the biggest victim and Swiss Franc is the largest beneficiary of the theme.

Yellen: Disappointed for not given a second term

Janet Yellen stepped down as Fed Chair and Jerome Powell is taking over the job today. Yellen said in an interview with CBS Sunday Morning that it has been common for Fed chairs to serve a second term. And she noted that "I do feel a sense of disappointment," for not being nominated by President Donald Trump. Nonetheless, she hailed that Powell is "thoughtful, balanced, dedicated to public service." Regarding the achievements of the Fed during her era, she said that "the financial system is much better capitalized. The banking system is more resilient." And, "our overall judgment is that, if there were to be a decline in asset valuations, it would not damage unduly the core of our financial system."

Germany coalition talk enters extra time

In Germany, Chancellor Merkel’s CDU/CSU and the Social Democrats couldn’t conclude the coalition negotiations in time to meet the self-imposed deadline of Sunday. The talks will enter into extra time today. On the positive side, agreements were made on housing and digital economy. But, it’s believed that two key issues remain on the table, including SPD’s demand to tighten up rules for businesses to grant temporary contracts, and aligning doctors pay between private and public health care.

Barnier, May and Davis to meet again on Brexit talks

EU Brexit negotiator Michel Barnier will meet with UK Prime Minister Theresa May and Brexit Secretary David Davis in Downing Street today. That’s the first meeting between the trio since December as the negotiation is now in its second phase. However, it’s clear that key figures of May’s Conservatives don’t have any consensus regarding the future relationship with EU yet. Tensions intensified last week on the topic of whether UK will stay in the EU customs union, or just strike some custom arrangements. And there are criticisms on the Cabinet being vague and divided with May sticking to one policy while the Chancellor advocate another.

BoE Super Thursday to highlight the week

Three central banks will meet this week, RBA, RBNZ and BoE. All are expected to keep monetary policies unchanged. BoE will be the major focus with quarter Inflation Report featured. There are increasing speculations that BoE would pull ahead the next rate hike. In a Bloomberg survey, 13 out of 32 economists predicted the next hike coming as soon as in May. Another 5 predicted it to happen in August. The economic projections to be published in the Inflation Report will be a key to such market expectations. But the determining factor would be the outcome of the Brexit transition agreement with EU.

There are also some important economic data to watch, including UK PMI services and productions, US ISM services, Australia retail sales, New Zealand employment; Canada employment and China trade balance, CPI.

- Monday: Eurozone PMI services final, Sentix investor confidence, retail sales; UK PMI services; US ISM services

- Tuesday: RBA rate decision, Australia retail sales, trade balance; German factory orders; Eurozone retail PMI; Canada trade balance, Ivey PMI; US trade balance

- Wednesday: New Zealand employment; Japan labor cash earnings, leading indicators; German industrial production; Swiss foreign currency reserves; Canada building permits

- Thursday: RBNZ rate decision; Japan current account; China trade balance; Germany trade balance; ECB monthly bulletin; BoE rate decision; Canada housing starts, new housing price index; US jobless claims

- Friday: Australia home loans; China CPI and PPI; Japan tertiary industry index; Swiss unemployment; UK productions, trade balance; Canada employment

USD/JPY Daily Outlook

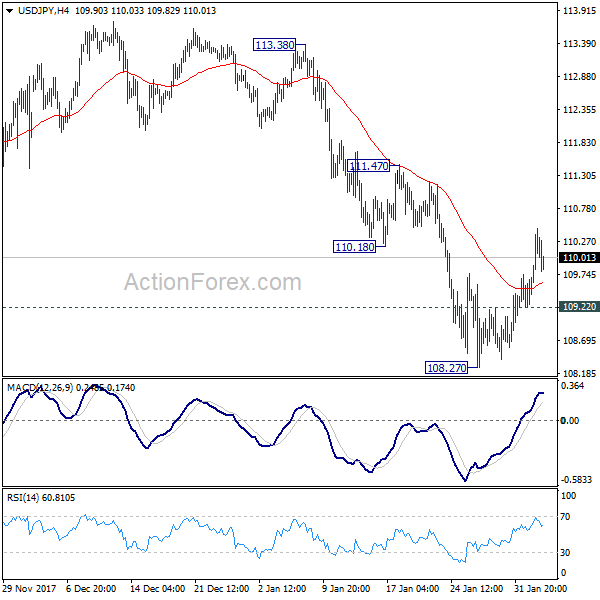

Daily Pivots: (S1) 109.45; (P) 109.97; (R1) 110.65; More…

USD/JPY retreats mildly today but stays above 109.22 minor support. Intraday bias remains on the upside for further rise to 111.47 resistance. As noted before, a short term bottom was also in place at 108.27. Sustained break of 111.47 will also have 55 day EMA (now at 111.33) firmly taken out. In such case, further rise would be seen back to 113.38/114.73 resistance zone. On the downside, however, below 109.22 minor support will turn focus back to 108.27 instead.

In the bigger picture, current development argues that the corrective pattern from 118.65 is extending. There is risk of dropping further to 61.8% retracement of 98.97 to 118.65 at 106.48. But this level should provide strong support to contain downside and bring resumption of rise from 98.97. However, sustained break of 106.48 will now likely send USD/JPY through 98.97 to resume the corrective fall from 125.85 (2015 high).

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:00 | AUD | CBA Australia PMI Services Jan | 53.8 | 55.1 | ||

| 0:00 | AUD | TD Securities Inflation M/M Jan | 0.30% | 0.10% | ||

| 1:45 | CNY | Caixin China PMI Services Jan | 54.7 | 53.5 | 53.9 | |

| 8:45 | EUR | Italy Services PMI Jan | 55.9 | 55.4 | ||

| 8:50 | EUR | France Services PMI Jan F | 59.3 | 59.3 | ||

| 8:55 | EUR | Germany Services PMI Jan F | 57 | 57 | ||

| 9:00 | EUR | Eurozone Services PMI Jan F | 57.6 | 57.6 | ||

| 9:30 | GBP | Services PMI Jan | 54.1 | 54.2 | ||

| 9:30 | EUR | Eurozone Sentix Investor Confidence Feb | 33.2 | 32.9 | ||

| 10:00 | EUR | Eurozone Retail Sales M/M Dec | -1.00% | 1.50% | ||

| 14:45 | USD | US Services PMI Jan F | 53.3 | 53.3 | ||

| 15:00 | USD | ISM Non-Manufacturing/Services Composite Jan | 56.6 | 55.9 |