Dollar remains generally in range after getting some mild support from FOMC statement. While there was sign of building up of downward pressure prior to FOMC, it seems that traders are holding their bets ahead of Friday’s non-farm payroll report. Price patterns in most dollar pairs suggest that they are turning into more prolonged near term consolidation. There is still no clear sign of reversal yet. Elsewhere in the forex markets are also mixed as the actions are mostly consolidative.

FOMC on hold, statement slightly hawkish

Overnight, FOMC voted unanimously to leave the Fed funds rate unchanged at 1.25-1.5%. There were some minor changes in the accompanying statement but the theme continues to suggest that that gradual removal of monetary stimulus remains on track. Policymakers eventually took out the impacts of hurricanes in its economic forecasts and continued to see ‘solid’ growth in’ employment, household spending and business fixed investment’. Meanwhile, they acknowledged that core inflation has stopped declining, thus allowing them to maintain the view that inflation would strengthen this year then stabilize at around the 2% objective.

The Fed reaffirmed the pledge to monitor the development closely. The market viewed the meeting outcome as slightly hawkish, sending Treasury yields modestly higher. CME’s 30-day Fed funds futures suggest that the market has now priced in 80% chance of rate hike in March, up from 74% before the announcement. Other barometers have suggested that chance of a March rate hike has increased to 90%. More in FOMC More Optimistic On Inflation Outlook, Indicated ‘Further Increase’ In Interest Rates

Also on FOMC:

- January FOMC: Moving In the Right Direction

- Yellen’s Final FOMC Meeting a Non-Event as Rates Held Steady

- Fed Leaves Rates Steady in Yellen’s Last Meeting as Chair

China Caixin PMI manufacturing showed resilience

China Caixin PMI manufacturing was unchanged at 61.6 in January, meeting expectations. The survey showed resilience in the small to mid-sized manufacturing sector in the country. Zhengsheng Zhong, director of macroeconomic analysis at CEBM Group, a subsidiary of Caixin, noted that "the manufacturing industry had a good start to 2018. Going forward, we should keep a close eye on the stability of the demand side."

Also from Asia pacific, Australia import price index rose 1.5% qoq in Q4. Building approvals dropped sharply by -20% mom in December. Japan PMI manufacturing was revised up by 0.4 to 54.8 in January.

Looking ahead

Manufacturing data will be the key focuses today. Swiss will release PMI manufacturing, retail sales and SECO consumer confidence. Eurozone will release PMI manufacturing revision. UK will also release PMI manufacturing. From US, ISM manufacturing will be featured, together with Challenger job cuts, non-farm productivity, jobless claims and construction spending.

AUD/USD Daily Outlook

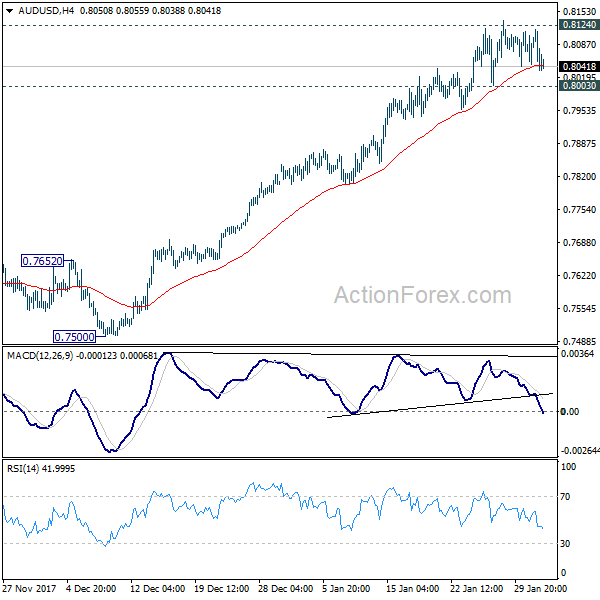

Daily Pivots: (S1) 0.8021; (P) 0.8069; (R1) 0.8104; More…

AUD/USD is staying in consolidation below 0.8124 key resistance and intraday bias remains neutral for the moment. Again, as long as 0.8003 support holds, further rally is expected. Sustained break of 0.8124 resistance will resume whole medium term rebound from 0.6826 and target key fibonacci level at 0.8451. However, on the downside, break of 0.8003 support will indicate short term topping, likely with bearish divergence condition in 4 hour MACD. And in such case, intraday bias will be turned back to the downside for 55 day EMA (now at 0.7851).

In the bigger picture, current development suggests that medium term rebound from 0.6826 is still in progress and could be resuming. Such rise could target 38.2% retracement of 1.1079 (2011 high) to 0.6826 (2016 low) at 0.8451. As such rise is seen as a corrective move, we’d expect strong resistance from 0.8451 to limit upside and bring reversal.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 0:30 | AUD | Import price index Q/Q Q4 | 1.50% | 1.50% | -1.60% | |

| 0:30 | AUD | Building Approvals M/M Dec | -20.00% | -7.60% | 11.70% | 12.60% |

| 0:30 | JPY | PMI Manufacturing Jan F | 54.8 | 54.4 | ||

| 1:45 | CNY | Caixin PMI Manufacturing Jan | 51.5 | 51.5 | 51.5 | |

| 6:45 | CHF | SECO Consumer Confidence Jan | 2 | -2 | ||

| 8:15 | CHF | Retail Sales Y/Y Dec | -0.20% | |||

| 8:30 | CHF | PMI Manufacturing Jan | 64.1 | 65.2 | ||

| 8:45 | EUR | Italy Manufacturing PMI Jan | 57.3 | 57.4 | ||

| 8:50 | EUR | France Manufacturing PMI Jan F | 58.1 | 58.1 | ||

| 8:55 | EUR | Germany Manufacturing PMI Jan F | 61.2 | 61.2 | ||

| 9:00 | EUR | Eurozone Manufacturing PMI Jan F | 59.6 | 59.6 | ||

| 9:30 | GBP | PMI Manufacturing Jan | 56.5 | 56.3 | ||

| 12:30 | USD | Challenger Job Cuts Y/Y Jan | -3.60% | |||

| 13:30 | USD | Nonfarm Productivity Q4 P | 1.10% | 3.00% | ||

| 13:30 | USD | Unit Labor Costs Q4 P | 1.00% | -0.20% | ||

| 13:30 | USD | Initial Jobless Claims (JAN 27) | 236K | 233K | ||

| 14:45 | USD | Manufacturing PMI Jan F | 55.5 | 55.5 | ||

| 15:00 | USD | Construction Spending M/M Dec | 0.40% | 0.80% | ||

| 15:00 | USD | ISM Manufacturing Jan | 58.6 | 59.7 | ||

| 15:00 | USD | ISM Prices Paid Jan | 69.5 | 69 | ||

| 15:30 | USD | Natural Gas Storage | -288B |