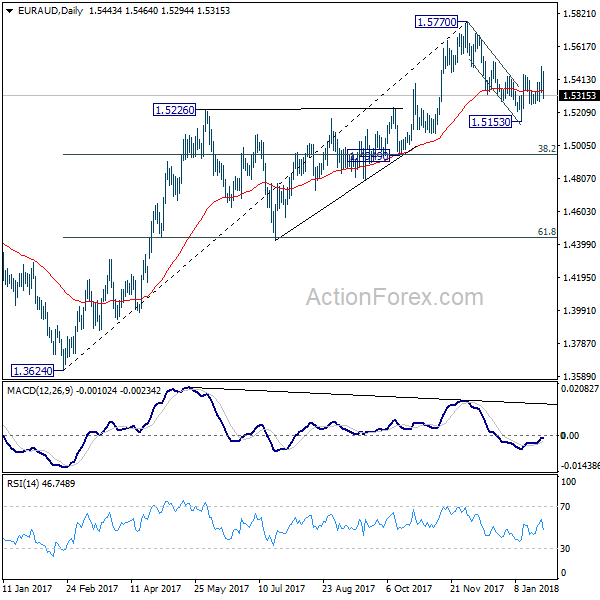

EUR/AUD edged higher to 1.5494 last week but reversed from there and dropped sharply. Initial bias is neutral this week first. Current development suggests that price actions from 1.5153 is corrective in nature. That is decline from 1.5770 is not completed yet. Below 1.5259 will turn intraday bias to the downside for 1.5153. Break will target 1.4949 cluster support (38.2% retracement of 1.3624 to 1.5770 at 1.4950).

In the bigger picture, price actions from 1.5770 so far suggests that it’s corrective in nature. That is, medium term rise from 1.3624 is not completed yet. Break of 1.5770 will extend the rise to retest 1.6587 (2015 high). However, considering bearish divergence condition in daily MACD, sustained break of 1.4949 cluster support (38.2% retracement of 1.3624 to 1.5770 at 1.4950) will indicate medium term reversal. And there is prospect of retesting 1.3624 low in that bearish case.

In the longer term picture, the rise from 1.1602 long term bottom (2012 low) isn’t over yet. We’ll keep monitoring the development but there is prospect of extending the rise to 61.8% retracement of 2.1127 to 1.1602 at 1.7488 and above. However, sustained trading below 1.3671 should indicate long term reversal and target 1.1602 long term bottom again.