Japanese Yen trades broadly higher today as supported by upbeat economic data. In particular, USD/JPY has now taken out 110.18 support (last week’s low). Recent fallcould be extending towards next key support level at 107.31. Dollar is again back under pressure with weakness most notable against Sterling. In other markets, Nikkei is trading in red by -0.6% at the time of writing. That followed mixed US markets. S&P 500 and NASDAQ extended the record runs but DOW closed flat.

Japan PMI manufacturing hits near 4 year high

Japan PMI manufacturing rose to 54.4 in January, up from 54.0 and beat expectation of 54.3. The index has now stayed in expansionary region above 50 for the 17th consecutive month. January’s reading was also the highest since February 2014. IHS Markit economist Joe Hayes noted in the statement that "the strongest reading in the PMI since February 2014 was supported by quickened rates of output and employment growth."

Also from Japan, adjusted trade balance showed surplus of JPY 86.8b, below expectation of JPY 270b. Nonetheless, the set of data is pretty strong. Exports rose 9.3% yoy to JPY 7.3T, largest since September 2008. Exports to China, the biggest trading partner, jumped 15.8% yoy and hit record JPY 1.5T. Imports jumped even larger by 13.9% yoy.

Powell confirmed as 16th Fed chair

Jerome Powell was confirmed by the Senate to be the 16th chairman of Fed. The final vote of the Senate was overwhelming by 84 to 13. Powell will officially take over the role from Janet Yellen early next month and is given a four-year term. Senate Banking Committee chairman Mike Crapo hailed that Powell will be "central to ensuring a safe and sound financial system while supporting a vibrant, growing economy." And he "will play a key role in rightsizing federal regulations and alleviating unnecessary burdens."

Nine Democrats and four Republicans opposed to the nomination. With progressive Democrat Elizabeth Warren expressing her concerns that Powell will " begin weakening the new rules Congress and the Fed put in place after the 2008 financial crisis."

Looking ahead

Eurozone PMIs and UK job data are the main focuses of today. The Euro has been trading mixed this week despite up beat confidence data. On the other, Sterling is lifted by hope of a good Brexit deal and is trading as the strongest one. Price actions in EUR/GBP suggest that it’s heading down to 0.8688 near term support. And today’s data might trigger some movements in the cross.

Later in the day, US will release PMIs, house price index and existing home sales.

USD/JPY Daily Outlook

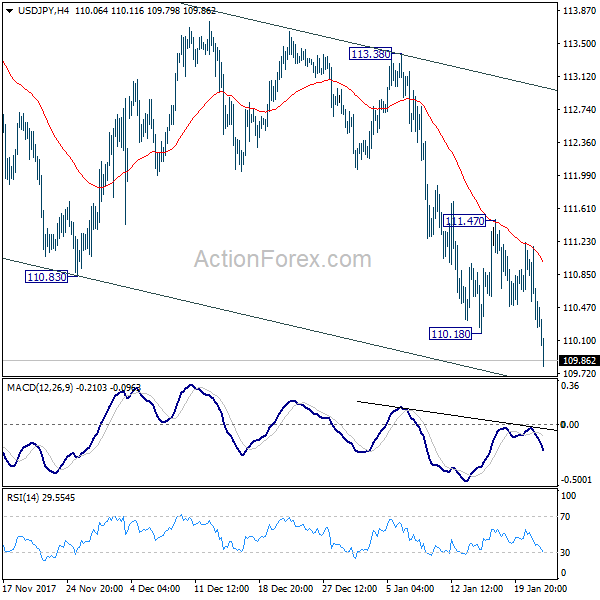

Daily Pivots: (S1) 109.96; (P) 110.57; (R1) 110.88; More…

USD/JPY’s fall resumed by taking out 110.18 and reaches as low as 107.09 so far. Intraday bias is back on the downside for lower channel support (now at 109.55). We’ll look for bottoming signal around there. but Break of 111.47 resistance is needed to indicate short term bottoming. Otherwise, deeper decline is expected. Firm break of the channel support would pave the way to retest 107.31 low.

In the bigger picture, we’re holding on to the view that correction from 118.65 is completed at 107.31. And medium term rise from 98.97 (2016 low) is going to resume soon. Sustained break of 114.73 should affirm our view and send USD/JPY through 118.65. However, break of 107.31 will dampen this view and extend the medium term fall back to 98.97 low.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | AUD | Westpac Leading Index M/M Dec | 30% | 0.10% | ||

| 23:50 | JPY | Trade Balance (JPY) Dec | 0.09T | 0.27T | 0.36T | 0.29T |

| 0:30 | JPY | PMI Manufacturing Jan P | 54.4 | 54.3 | 54 | |

| 8:00 | EUR | France Manufacturing PMI Jan P | 58.6 | 58.8 | ||

| 8:00 | EUR | France Services PMI Jan P | 58.9 | 59.1 | ||

| 8:30 | EUR | Germany Manufacturing PMI Jan P | 63 | 63.3 | ||

| 8:30 | EUR | Germany Services PMI Jan P | 55.5 | 55.8 | ||

| 9:00 | EUR | Eurozone Manufacturing PMI Jan P | 60.3 | 60.6 | ||

| 9:00 | EUR | Eurozone Services PMI Jan P | 56.4 | 56.6 | ||

| 9:30 | GBP | Jobless Claims Change Dec | 2.3K | 5.9K | ||

| 9:30 | GBP | Claimant Count Rate Dec | 2.30% | |||

| 9:30 | GBP | Average Weekly Earnings 3M/Y Nov | 2.50% | 2.50% | ||

| 9:30 | GBP | ILO Unemployment Rate 3Mths Nov | 4.30% | 4.30% | ||

| 14:00 | USD | House Price Index M/M Nov | 0.40% | 0.50% | ||

| 14:45 | USD | US Manufacturing PMI Jan P | 55 | 55.1 | ||

| 14:45 | USD | US Services PMI Jan P | 54.4 | 53.7 | ||

| 15:00 | USD | Existing Home Sales Dec | 5.72M | 5.81M | ||

| 15:30 | USD | Crude Oil Inventories | -6.9M |