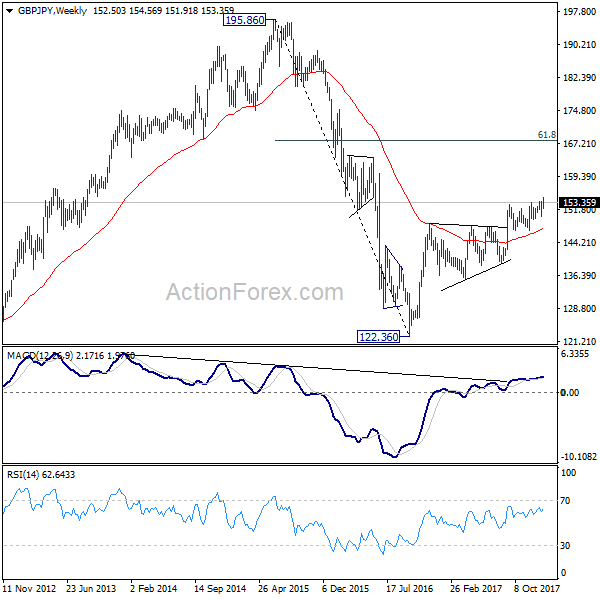

GBP/JPY’s up trend resumed last week and reached as high as 154.56. As a temporary top was formed there, initial bias is neutral this week first. Outlook will stay bullish as long as 150.18 support holds. Above 154.56 will extend the medium term up trend to 61.8% projection of 139.29 to 152.82 from 146.96 at 155.32. Break will target 100% projection at 160.49

In the bigger picture, as long as 146.96 key support holds, medium term outlook remains bullish. Rise from 122.36 is in favor to extend to 61.8% retracement of 195.86 to 122.36 at 167.78. However, break of 146.96 support will indicate trend reversal. And there would be prospect of retesting 122.36 in that case.

In the longer term picture, down trend from 195.86 (2015 high) has already completed at 122.36. Focus is now on 55 month EMA (now at 154.75). Firm break there will suggest that rise from 122.36 is developing into a long term move that target 195.86 again. And, price actions from 116.83 (2011 low) is indeed a sideway pattern that could last more than a decade.