Dollar ended the week broadly lower, except versus Canadian Dollar. The Loonie was pressured after the "dovish" BoC rate hike which indicates cautiousness of next move. On the background, there was also a lot of uncertainty surrounding NAFTA renegotiation. Euro and Yen followed closely as the third and fourth weakest, ahead of BoJ and ECB meeting. On the other hand, Sterling ended as the strongest one as markets are increasing optimistic on the Brexit deal. Indeed, businessmen and investors could be starting to prepare for a smooth Brexit transition. Australian Dollar followed as the second strongest as solid job data boosts the chance of a rate hike in the second half of the year.

The persistence in Dollar weakness left some markets participants and economists puzzling. There is so far no satisfactory explanation for the selloff. The economy in the US remains healthy, with strong job markets. While inflation has been sluggish, Fed is still on course for three rate hikes or more this year. Fed fund futures are pricing in over 74% chance of a March hike, comparing to just 57% chance a month ago. Stocks performed well with DOW, S&P 500 and NASDAQ extending record runs. Treasury yield was also strong with 10 year yield closing at 2.637, finally took out 2.621 key resistance.

Some said that the concerns over Government shutdown was a factor weighing down the greenback. But Dollar has been weak for some time already. Another view is that Dollar is merely extending 2017 down trend, which was based on disappointment over President Donald Trump’s ability to deliver election promises. But as we mentioned a couple of times, the Republicans have found a way to work with Trump already, by ignoring his political rants. And the passage of the tax plan proved that the Republicans have delivered. Some pointed out the political risks of mid term election this year but that’s a bit far away.

Global diversifications from Dollar assets could be a factor driving the greenback down. It’s also in line with the medium to long term movements in the dollar index. But some more evidence is needed to prove it. Other explanations include worsening of US external accounts, deteriorating fiscal position after the tax cuts. Anyway, for now, until there is clear sign of a turnaround, the greenback will stay bearish.

DXY stays bearish for 84.58/75

Dollar index’s medium term fall from 103.82 resumed by taking out 91.01 key support level decisively. With the index staying well below falling 55 week EMA, it’s should be target 61.8% projection of 103.82 to 91.01 from 95.15 at 87.23. For now, as this decline is seen as a correction, we’d expect strong support from 84.75 (61.8% retracement of 72.69 to 103.82 at 84.58) to finally contain downside and bring reversal.

TNX resuming rise from 1.336

10 year yield finally took 2.621 key resistance last week. The development indicates TNX is resuming the medium term rebound from 1.336. Further rise should be seen to 61.8% projection of 1.336 to 2.621 from 2.034 at 2.827 first. But the key resistance level will be 2015 high at 3.036.

Trading strategy

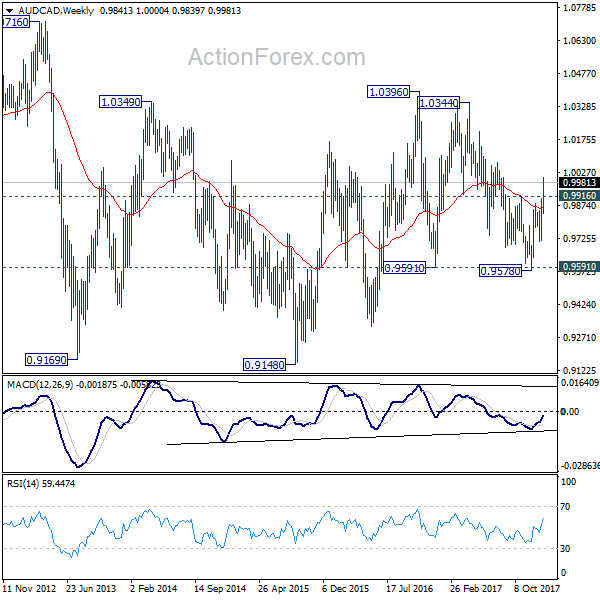

The selloff in Canadian Dollar was quite disappointing to some considering the BoC did deliver the rate hike. And for that reason, we’d expect some more Loonie weakness ahead and would look for opportunity to sell if this week. Despite the rebound in the last two weeks’ EUR/CAD was limited well below 1.5371 key resistance and lacked upside momentum. Hence, we’d won’t consider this pair. USD/CAD has the potential of bottoming at 1.2354, drawing support from 61.8% retracement of 1.2061 to 1.2919 at 1.2389. But it’s still well off 1.2623 near term resistance level.

The rebound in AUD/CAD was much more promising. The decline from 1.0344 should have completed at 0.9578, after hitting 0.9591 support. This is supported by the break of 0.9916 resistance and 55 week EMA. The corrective pattern from 1.0396 could also have finished with three waves down to 0.9578 too. Hence, we’ll buy AUD/CAD at market this week, with a stop at 0.9840. 1.0344 is the first target. We’ll look at upside momentum of the next move to assess the prospect of resuming the rise fro 0.9148.

GBP/USD Weekly Outlook

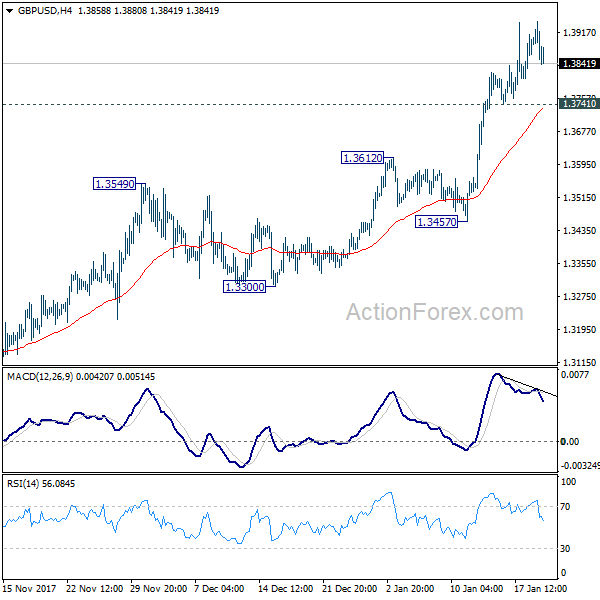

GBP/USD surged to as high as 1.3944 last week and broken 1.3835 key resistance. At this point, the pair seems to be struggling to find follow through buying this level. But still, as long 1.3741 minor support holds, further rally is expected. Sustained trading above 1.3835 could trigger upside acceleration to 100% projection of 1.2108 to 1.3651 from 1.3038 at 1.4581 next. However, on the downside, break of 1.3741 minor support will indicate rejection from 1.3835 and turn bias to the downside for 1.3457.

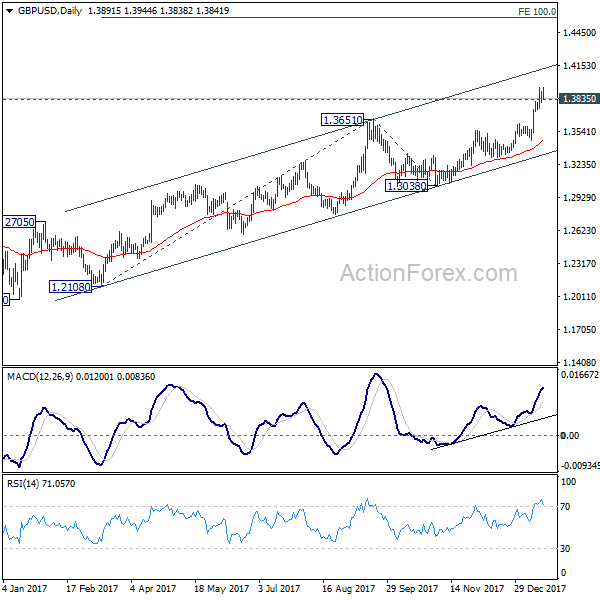

In the bigger picture, sustained break of 1.3835 key resistance level will indicate that rebound from 1.1946 is at least correcting the long term down from from 2007 high at 2.1161. In that case, further rise should be seen back to 38.2% retracement of 2.1161 (2007 high) to 1.1946 (2016 low) at 1.5466. Nonetheless, rejection from 1.3835 will maintain medium term bearishness and thus, the risk retesting 1.1946 ahead.

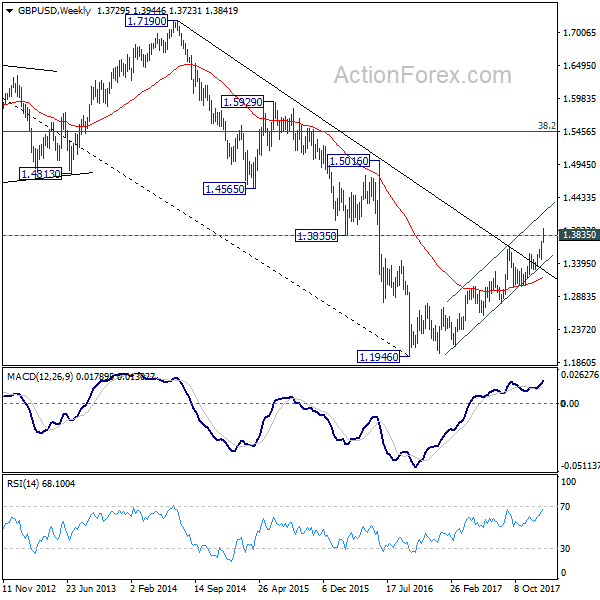

In the longer term picture, long term bullish outlook is starting to get more conviction now. Still, sustained break of 1.3835 resistance is needed to confirm. And in that case, rise from 1.1946 should at least be correction whole long term down trend form 2.1161 and should target 38.2% retracement of 2.1161 (2007 high) to 1.1946 (2016 low) at 1.5466.