The forex markets are generally trading within yesterday’s range today as markets turn into consolidation mode. Dollar is trying to pare back some losses but there is no indication of bottoming yet. The greenback remains the weakest major currency for the week so far. Commodity currencies, in particular Aussie, stays strong. Elsewhere, markets are also in general risk seeking mode. At the time of writing, German DAX is up 0.95%, French CAC 40 is up 0.28%. FTSE 100 is nearly flat, though. US futures point to sharply higher open as markets come back from bank holiday. DOW would extend recent record run and would likely take on 26000 handle.

Released from US, Empire State Manufacturing index dropped to 17.7 in January, down from 18, missed expectation of 19.

ECB won’t change communications at next week’s meeting

Euro pares some recent gains after Reuters reported that ECB is unlikely to change it’s communication at next week’s meeting on January 25. Instead, it would wait until March meeting, after getting the new economic projections, to make a decision. One unnamed source said that ECB policy makers would need "more thorough analysis before making any change" to the communications. Another one said that markets’ reactions to the minutes were "excessive". It referred to Euro’s sharp rally after released of December monetary policy accounts published last week.

Yesterday, ECB Governing Council Member Ardo Hansson said in an interview that there was "need for action in our communication." This echoed the views noted in December ECB minutes released last week. Hansson said that "there are certainly good reasons to reduce the importance of the net purchases in our communication soon — also with a view to a potential end to these purchases." And should incoming data show that the economy evolve in line with ECB’s own projections, it would "certainly be conceivable and also appropriate to end the purchases after September." Also, he said that the "last step to zero" asset purchase is "not a big deal anymore". And "we can go to zero in one step without any problems". He also talked down Euro’s rising exchange rate and said it’s "not a threat to the inflation outlook" and one "shouldn’t overdramatize" it.

Released from Eurozone, German CPI was finalized at 1.7% yoy in December, unrevised.

UK CPI slowed to 3% in December

UK headline CPI slowed to 3.0% yoy in December, down from 3.1% yoy, meeting expectation. CPI is still at the upper end of BoE’s target rate of 2-3%. Core CPI also slowed to 2.5% yoy, down from 2.7% yoy and missed expectation of 2.6% yoy. RPI, on the other hand, accelerated to 4.1% yoy, up from 3.9% yoy and beat expectation of 3.9% yoy. PPI input slowed to 4.9% yoy, PPI output rose to 3.3% yoy, PPI output core rose to 2.5% yoy. House price index rose 4.1% yoy in November.

BoE MPC member Silvana Tenreyro said in speech yesterday that she "concurred" with the central bank’s projections in the November inflation report. However, "in the medium-term, the risks to productivity may be skewed to the upside." She pointed to the drags on productivity from deleveraging in the financial sector and slowdown in manufacturing. However, the former is a process that would soon end. Meanwhile, global growth would help boost demand and manufactured goods from the UK. And productivity growth could beat BoE’s forecasts once these two drags fade. She also noted that based on the November forecasts, BoE would need two more rate hikes over the next three years. But a better development in the economy could also change the rate outlook.

EUR/USD Mid-Day Outlook

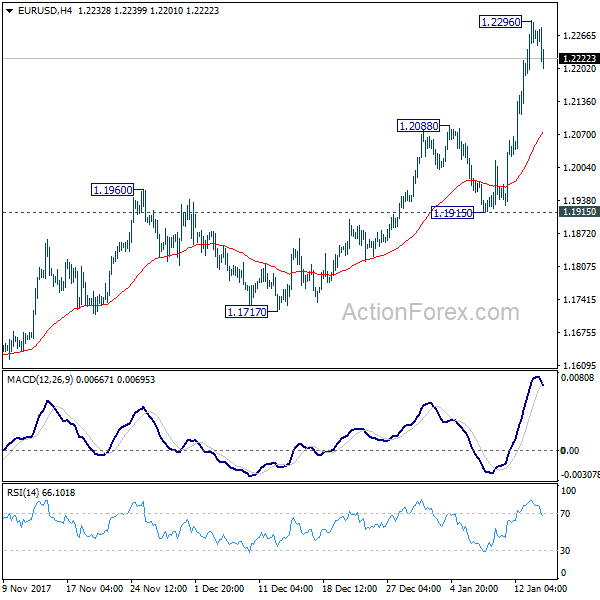

Daily Pivots: (S1) 1.2202; (P) 1.2249 (R1) 1.2311; More….

A temporary top is in place at 1.2296 with the current retreat. Intraday bias in EUR/USD is turned neutral for consolidations. Near term outlook will remain bullish as long as 1.1915 support holds. Above 1.2296 will extend the medium term rally to 1.2494/2516 key resistance zone next. At this point, we’d expect strong resistance from there to limit upside and bring reversal. Meanwhile, firm break of 1.1915 will argue that the medium term trend is reversing earlier than expected.

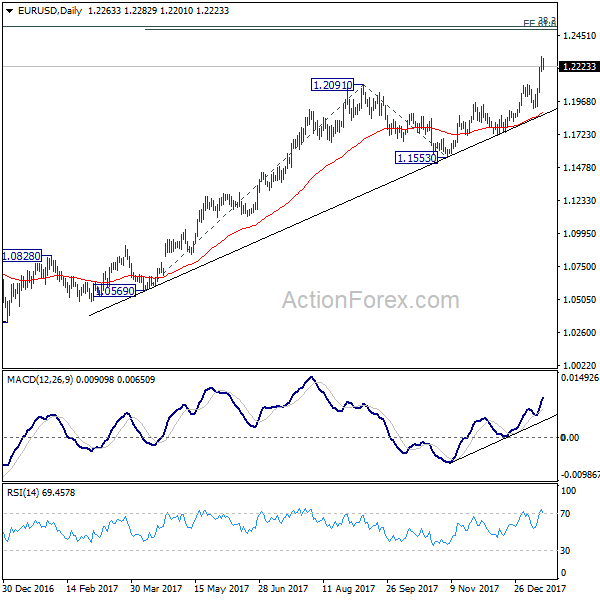

In the bigger picture, rise from 1.0339 medium term bottom is still seen as a corrective move for the moment. Therefore, in case of another rally, we’d be expect 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516 to limit upside and bring reversal. That is also close to 61.8% projection of 1.0569 to 1.2091 from 1.1553 at 1.2494. Break of 1.1553 support will confirm completion of the rise. However, sustained break of 1.2516 will carry larger bullish implication and target 38.2% retracement of 1.6039 to 1.0339 at 1.3862.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Domestic CGPI Y/Y Dec | 3.10% | 3.20% | 3.50% | 3.60% |

| 04:30 | JPY | Tertiary Industry Index M/M Nov | 1.10% | 0.30% | 0.30% | 0.20% |

| 07:00 | EUR | German WPI M/M Dec | -0.30% | 0.30% | 0.50% | |

| 07:00 | EUR | German CPI M/M Dec F | 0.60% | 0.60% | 0.60% | |

| 07:00 | EUR | German CPI Y/Y Dec F | 1.70% | 1.70% | 1.70% | |

| 09:30 | GBP | CPI M/M Dec | 0.40% | 0.40% | 0.30% | |

| 09:30 | GBP | CPI Y/Y Dec | 3.00% | 3.00% | 3.10% | |

| 09:30 | GBP | Core CPI Y/Y Dec | 2.50% | 2.60% | 2.70% | |

| 09:30 | GBP | RPI M/M Dec | 0.80% | 0.60% | 0.20% | |

| 09:30 | GBP | RPI Y/Y Dec | 4.10% | 3.90% | 3.90% | |

| 09:30 | GBP | PPI Input M/M Dec | 0.10% | 0.40% | 1.80% | 1.60% |

| 09:30 | GBP | PPI Input Y/Y Dec | 4.90% | 5.30% | 7.30% | |

| 09:30 | GBP | PPI Output M/M Dec | 0.40% | 0.20% | 0.30% | 0.40% |

| 09:30 | GBP | PPI Output Y/Y Dec | 3.30% | 2.90% | 3.00% | 2.90% |

| 09:30 | GBP | PPI Output Core M/M Dec | 0.30% | 0.20% | 0.20% | |

| 09:30 | GBP | PPI Output Core Y/Y Dec | 2.50% | 2.30% | 2.20% | |

| 09:30 | GBP | House Price Index Y/Y Nov | 4.10% | 4.20% | 4.50% | 5.40% |

| 13:30 | USD | Empire State Manufacturing Index Jan | 17.7 | 19 | 18 |