Sunrise Market Commentary

- Rates: Core bond sell-off to slow with key yield resistance levels looming?

US investors return from the long weekend, but they don’t have much catching up to do. Only hawkish comments from ECB Hansson inflicted some Bund losses towards the end of European dealings. Today’s eco calendar probably won’t impact trading. Risk sentiment on stock markets and technical factors (looming resistance in yields) are the main considerations. - Currencies: Dollar decline slows, but no sign of a sustained U-turn yet.

Yesterday, the EUR/USD rally continued after Friday’s break above a key resistance area. US investors return from a long weekend. The eco calendar probably provides no high profile trigger for a trend reversal on the FX market. Even so, USD/JPY showed a cautious rebound this morning. The focus for sterling trading turns to the UK price data

The Sunrise Headlines

- US stock markets were closed yesterday because of Martin Luther King Day. Asian stock market sentiment is positive overnight with Japan and China outperforming.

- The ECB should adjust its policy guidance before the summer and shouldn’t have any problems ending net asset purchases in one swoop after September, Governing Council member Hansson said.

- Japanese Finance Minister Aso said that he did not see problems with USD/JPY weakening to around 110.80 yen, but that big swings in currencies would be problematic.

- The EU has toughened up its conditions for a post-Brexit transition deal for the UK, demanding that Britain abide by stricter terms on immigration, external trade agreements and fishing rights for nearly two years after it leaves the bloc.

- Greek lawmakers approved an omnibus package of labour, energy and fiscal reforms needed to wrap up the penultimate review of its €86bn bailout, as police clashed with leftwing demonstrators outside the parliament building.

- Republican congressional leaders don’t believe they have the time to complete a fiscal year spending deal by Friday, according to a person familiar with the talks. They are weighing legislation for a short-term extension until Feb. 16.

- Today’s eco calendar contains UK inflation data (Dec) and US empire manufacturing (Jan). The Belgian debt agency is expected to launch a new 10-yr bond (OLO 85 Jun2028) by syndication

Currencies: Dollar Decline Slows, But No Sign Of A Sustained U-Turn Yet

Dollar decline slows, but no U-turn yet

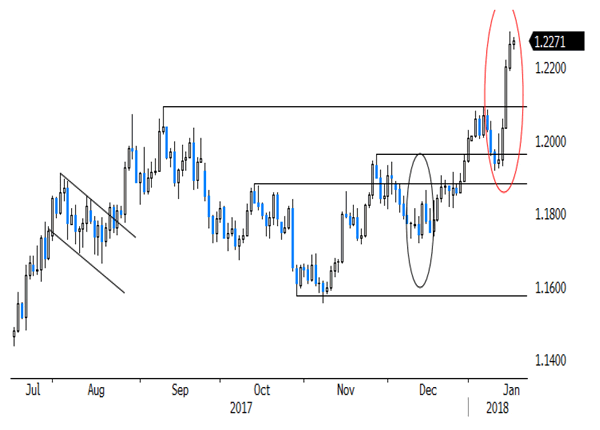

Last week’s trends in the dollar and the euro continued yesterday even as US markets were closed (Martin Luther King Day). EUR/USD made further followthrough gains after Friday’s break above 1.2092/1.2167, reaching a 3 year top. There was little news. Investors continued adjusting as the December minutes indicated that the ECB will probably soon prepare markets for a gradual scaling back of policy stimulation. Euro strength coincided with broader USD weakness. USD/JPY also declined further on optimistic comments of BOJ Kuroda. EUR/USD came close to 1.23 and finished the day at 1.2264. USD/JPY closed at 110.54.

Overnight, Asian markets continue the risk rally with Australia and India underperforming. Japan Fin Min Aso said that the current USD/JPY level is no problem but warned on sudden FX-moves. USD/JPY returned to the high 110 area. EUR/USD stabilizes in the 1.2265 area. ECB’s Hanson indicated that the ECB could change guidance before Summer and that it could end asset purchases in one step in September. The Yuan (USD/CNY 6.43) trades near the strongest level in 2-years. Later today, the calendar is again thin with the final German CPI and the US Empire manufacturing survey. The Empire survey is expected slightly higher at 19.0. Recent US sentiment indicators were mixed, despite the approval of the tax reform. The report will only be of intraday significance.

Global Picture. Euro strength still prevails as markets prepare for a change in policy from major central banks outside the US, including the ECB and even the BOJ. Especially the ECB is signalling a gradual turn. Looking at the fundamentals/interest rate differentials (2-y US/German spread at +250 bps), the euro rise/dollar decline has gone quite far. However, there is no trigger for a ST change in sentiment. The technicals turned USD negative as EUR/USD cleared 1.2090/1.2167 resistance. The dollar is a failing knife and there is no sign of a reversal. 1.2598 (62% Retracement) is next important resistance on the charts.

Sterling traded resilient of late, supported by hope that the EU could turn less hard in the Brexit negotiations. Today, the focus turns to the UK price data. Headline and core CPI are expected to decline slightly to respectively 3.0% Y/Y and 2.6% Y/Y. A scenario of a gradual easing of inflation might convince markets that little additional BoE action is needed anytime soon. Short term sterling sentiment was constructive of late, but we expect EUR/GBP 0.8700/60 to be a solid support.

EUR/USD holds near recent top. Euro strength/USD softness persist for now.