The Canadian dollar fell 0.62 percent on Wednesday after reports circulated about the Trump administration pulling the US out of NAFTA. The loonie had a positive return this year versus the greenback, but the NAFTA setback has it now at negative 0.11 percent YTD. Canadian officials anonymously agreed that there is a rising probability of the White House giving a six month notice on the trade agreement.

The White House made an official announcement that there hasn’t been any change in the Trump’s administration position on NAFTA, but given the lack of real progress on the talks between Canada, Mexico and the United States there was little hope of a successful renegotiation to begin with.

The CAD has been surging after a strong Canadian jobs report put the odds of a rate hike by the Bank of Canada (BoC) at 80 percent for the January monetary policy meeting. The outcome of the NAFTA renegotiations is one of the identified unknowns by Stephen Poloz which could keep the central bank from raising interest rates.

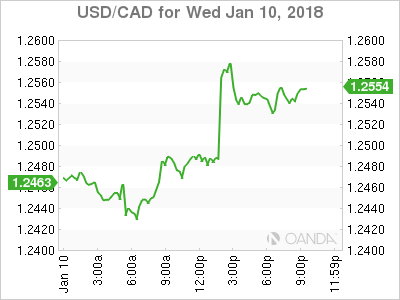

The USD/CAD gained 0.65 percent on Wednesday. The currency pair is trading at 1.2543 after the impact of the report by Reuters who cited two unknown sources within the Canadian government on the probability of the end of NAFTA. The trade agreement renegotiations will enter its sixth round of talks.

The process has been slow and painful as the United States opened negotiations with a very one sided demands that were met with shock from their counterparts in Canada and Mexico and they have not backed down. Mexico has said it would back out if tariffs were introduced and Canada has also questioned the higher US content rules on vehicles.

The Canadian dollar was on the rise with strong fundamentals and a higher oil price sustaining the move, but it all changed with the open secret that Canadian officials foresee its largest trading partner backing out of the two decade deal. The resulting uncertainty on the two partner NAFTA deal and bilateral trade with the US, outstanding disputes in mind, puts downward pressure on the prospects for the Canadian economy. The USD is having a terrible start of the year, but very swiftly the CAD could underperform optimistic expectations.

The Bank of Canada (BoC) Business survey released this week showed that Canadian companies are not suffering extra anxiety in their outlook due to their trade agreement, but as evidenced today the market does not share that optimism.

Governor Poloz ended the year with a speech focusing on the topics that kept him up at night but the solid December jobs report and the BoC Survey have all but convinced the market that a rate hike will be announced on the January 17 central bank meeting.

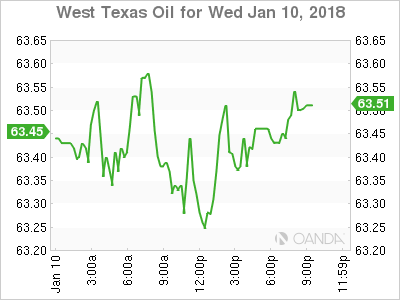

The price of oil rose to $63.380 after the release of the US crude inventory data by the Energy Information Administration (EIA). A bigger than expected crude drawdown of 4.9 million barrels was almost double the forecast of 2.5 million barrels. Gasoline and distillates showed a buildup of inventories with gasoline stocks rising 4.1 million barrels versus the 2.5 million estimate. Distillates rose 4.2 million barrels destroying the forecast of 1 million.

Market events to watch this week:

Thursday, January 11

8:30am USD PPI m/m

8:30am USD Unemployment Claims

Friday, January 12

8:30am USD CPI m/m

8:30am USD Core CPI m/m

8:30am USD Core Retail Sales m/m

8:30am USD Retail Sales m/m