Yen remains the strongest major currency for today as BoJ operates spurred speculations of stimulus exit. Dollar also follow closely as the second strongest one. On the other hand, European majors are under much selling pressure as recent rally fails to sustain momentum. Euro continue to shrug off positive economic data while EUR/USD’s fall gathers steam. Elsewhere, commodity currencies are generally mixed. Speculations for a January BoC rate hike continue to grow. But Loonie’s rally is looking stretched.

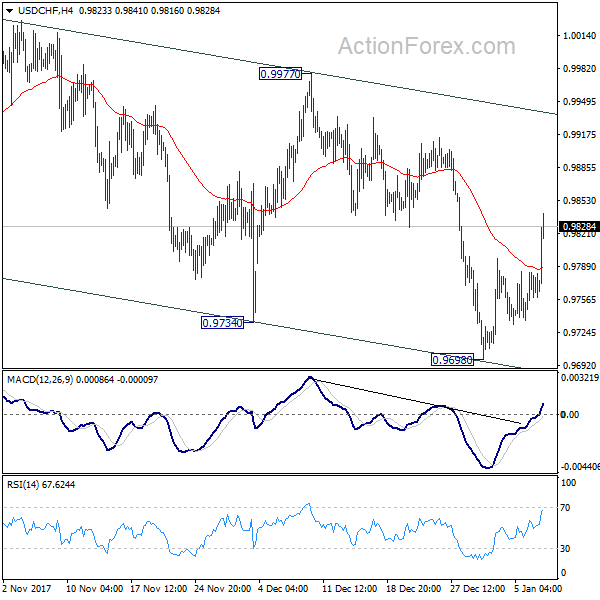

Technically, USD/CHF takes out 4 hour 55 EMA firmly today. That’s accompanied by strong break of 4 hour 55 EMA in EUR/USD too. Both suggests near term reversal and favors more gain in Dollar. EUR/JPY’s break of 134.39 also indicates near term reversal and puts 132.04 support back into focus. But USD/JPY is holding in range above 112.02 support, maintaining mild near term bullishness.

Eurozone unemployment hit almost 9 years low

Eurozone unemployment rate dropped to 8.7% in November, down from 8.8% and met expectations. That’s also the lowest level in nearly 9 years since 2009. Strength in the economy is translating into jobs and would hopefully into inflation too. While at the last forecast, ECB is not expecting inflation to return to 2% target at least till 2020, there are already calls for exit of stimulus. A key argument is that even if the asset purchase program ends in September, monetary accommodations are still there. Some ECB officials argued that would just mean putting the foot off the gas a little bit, instead of pressing on the break.

Also released from Europe, German industrial production rose 3.4% mom in November. German trade surplus widened to EUR 22.3b in November. Swiss unemployment rate dropped to 3.0% in December, foreign currency reserves rose to CHF 744b. Swiss retail sales dropped -0.2% yoy in November.

BoJ cut 10-25 years JGB purchase by JPY 10b, spurred stimulus exit talks

Yen surges broadly today as data showed BoJ has cut its long-dated JGB purchases in market operations. That’s seen as a sign by many of BoJ is finally moving towards stimulus exit. Today, BoJ offered to buy JPY 190b of JGBs with 10 to 25 years maturity. That’s JPY 10b lower from the prior tender on December 28. Besides, BoJ also lower the offer on 25 to 40 years maturity JGBs by JPY 10b to JPY 90b. Nonetheless, it should be emphasized that it’s far still early for BoJ to start stimulus exit as inflation remains way off target.

Also, it’s still uncertain whether BoJ Governor Haruhiko Kuroda’s term would be renewed this year. Prime Minister Shinzo Abe said during the weekend that "Gov. Kuroda has met my expectations with job availability at a 43-year high," and "I want him to keep up his efforts". But Abe also noted that "I haven’t made up my mind" on who’s going to lead BoJ after Kuroda’s term expires in April.

Released from Japan, labor cash earnings rose 0.9% yoy in November, above expectation of 0.6% yoy.

North and South Korea agreed military talks to ease tensions

The highly anticipated meeting between North and South Korea officials ended with some fruitful results. The high level meeting was the first time in more than two years, at the Korean peninsula’s heavily fortified demilitarized zone known as "peace village". IN a joint closing statement, it’s noted that North Korea will send a high-level delegation comprising athletes, a cheering squad, an art troupe, a visitors’ group, a Taekwondo demonstration team and a press corps, to the Winter Olympic in South next month.

Also, the two nations announce military talks "to ease the current military tensions between the two Koreas." South Korean unification vice minister Chun Hae-sung said that "We expressed the need to promptly resume dialogue for peace settlement, including denuclearization, and based on the mutual respect (the two Koreas) cooperate and stop activities that would raise tensions on the Korean Peninsula." And that was agreed by the North.

USD/CHF Mid-Day Outlook

Daily Pivots: (S1) 0.9745; (P) 0.9764; (R1) 0.9791; More….

USD/CHF’s strong break of 4 hour 55 EMA argues that correction from 1.0037 has completed with three waves down to 0.9698. Intraday bias is back on the upside for 0.9977 resistance first. Break there will likely resume whole rise from 0.9420 through 1.0037 high. For now this will be the favored case as long as 0.9698 support holds.

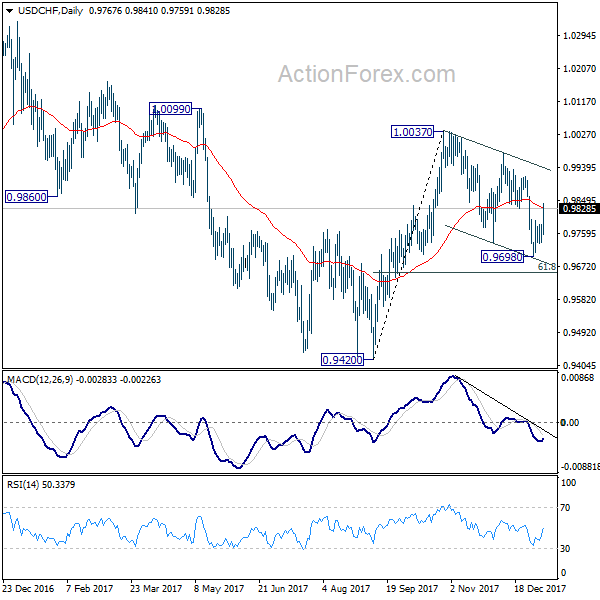

In the bigger picture, range trading continues between 0.9420/1.0342. At this point, 0.9420 appears to be a strong support level. Therefore, in case of decline attempt, we don’t expect a firm break of this level. Nonetheless, strong break of 1.0342 is also needed to confirm upside momentum. Otherwise, medium term outlook will stay neutral.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:00 | JPY | Labor Cash Earnings Y/Y Nov | 0.90% | 0.60% | 0.60% | 0.20% |

| 00:01 | GBP | BRC Retail Sales Monitor Y/Y Dec | 0.60% | 0.30% | 0.60% | |

| 00:30 | AUD | Building Approvals M/M Nov | 11.70% | -1.00% | 0.90% | -0.10% |

| 05:00 | JPY | Consumer Confidence Index Dec | 44.7 | 45 | 44.9 | |

| 06:45 | CHF | Unemployment Rate Dec | 3.00% | 3.00% | 3.00% | 3.10% |

| 07:00 | EUR | German Industrial Production M/M Nov | 3.40% | 1.80% | -1.40% | -1.20% |

| 07:00 | EUR | German Trade Balance Nov | 22.3B | 20.7B | 19.9B | |

| 08:00 | CHF | Foreign Currency Reserves Dec | 744B | 738B | ||

| 08:15 | CHF | Retail Sales Real Y/Y Nov | -0.20% | -2.50% | -3.00% | -2.60% |

| 10:00 | EUR | Eurozone Unemployment Rate Nov | 8.70% | 8.70% | 8.80% | |

| 13:15 | CAD | Housing Starts Dec | 217K | 240K | 252K |