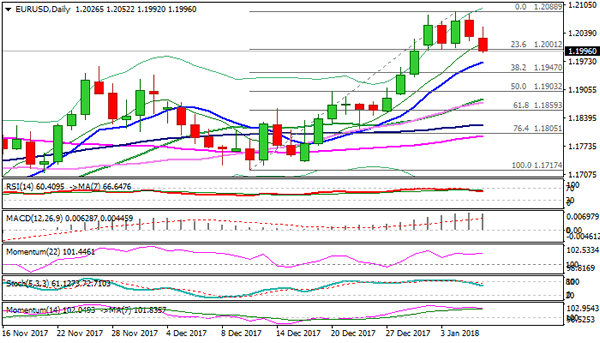

The Euro stands at the back foot in early Monday’s trading and pressures the top of key near-term support zone between 1.2000 and 1.1970 (last week’s triple-bottom / rising 10SMA).

As I mentioned in previous comments, repeated failures under pivotal 1.2100 resistance zone could result in corrective action.

The pullback was also signaled by reversal of daily RSI / slow stochastic from overbought zone.

The indicators are heading south and showing room for further extension of pullback from 1.2080 zone peaks, with sustained break below 1.2000/1.1970 to generate bearish signal.

Next good support lies at 1.1947 (Fibo 38.2% of 1.1717/1.2088 upleg, where corrective action should be ideally contained, before broader bulls resume.

Extension below 1.1947 would risk test of pivotal support at 1.1900 (daily Kijun-sen / 50% retracement) loss of which would signal reversal.

Res: 1.2000, 1.2052, 1.2088, 1.2100

Sup: 1.1961, 1.1947, 1.1928, 1.1900