Sunrise Market Commentary

- Rates: Focus on US inflation this week

US Treasuries eventually lost some ground on Friday despite disappointing headline payrolls and non-manufacturing ISM. Today’s eco calendar contains EMU EC confidence data and a speech by Atlanta Fed Bostic. The latter has market-moving potential, but investors are already eying US inflation releases at the end of the week. Inflation expectations are rising. - Currencies: Dollar survives mediocre US payrolls

On Friday, the dollar was hardly affected by a disappointing US payrolls report. The overall picture of the US currency remains fragile, but EUR/USD 1.2092 resistance wasn’t broken. We start the week with a neutral bias on the dollar. US price data later this week may guide the next directional move of the US currency.

The Sunrise Headlines

- US stock markets ended the week with a bang, adding 0.8% to close the first week of the year 2.3% to 3.3% higher. Asian risk sentiment remains positive overnight with Japan closed for coming-of-age day.

- San Francisco Fed Williams, FOMC voter, said that something like three rate hikes this year made sense, confirming the Fed’s median view. Philly Fed Harker, no voter, revealed his dovish feathers, putting forward 2 hikes in 2018.

- Britain is pushing to remain under EU regulation for medicines after Brexit, the latest sign ministers want to stay close to Europe in some sectors despite the bloc warning the UK cannot “cherry-pick” parts of the single market.

- ECB Weidmann told Spain’s El Mundo newspaper he believes setting a clear end for institution’s bond-buying program is justifiable. Monetary policy will remain very expansive, even after the end of net purchases, he added.

- Faster factory inflation and higher industrial profits in the past year have created space for an increase in overall interest rates, PBOC researcher Ji Min said, according to a report by China Daily.

- China’s FX reserves rose to their highest in more than a year in December ($3.14 tn), blowing past economists’ estimates, as tight regulations and a strong yuan continued to discourage capital outflows.

- Today’s eco calendar contains EC confidence indicators. Fed governors Bostic, Williams and Rosengren are scheduled to speak

Currencies: Dollar Survives Mediocre US Payrolls

Dollar ‘survives’ mediocre payrolls

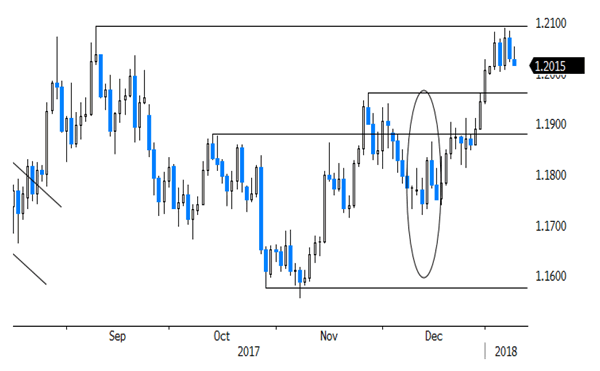

The dollar was in the defensive early last week, but regained a few ticks going into the payrolls. Investors were apparently positioned a bit too much USD short. Employment growth disappointed, but the key wage data were as expected. The dollar spiked briefly lower upon the release. EUR/USD jumped to the 1.2080 area, but the 1.2092 range top was again left intact. The dollar soon reversed post-payrolls’ loss. EUR/USD even returned below the pre-payrolls’ level and closed the session at (1.2029). USD/JPY failed to regain the pre-payroll level, but still closed the day in positive territory (113.05). So, the payrolls disappointed but caused little damage for the dollar.

The dollar shows no clear trend overnight. EUR/USD was initially well bid, maybe supported by hawkish comments from ECB Weidmann. However, the moved had no strong legs. EUR/USD trades again in the 1.2020 area. USD/JPY maintains a cautious bid as global risk sentiment stays constructive. The eco calendar is only modestly interesting today. EC confidence data will confirm the strong growth momentum in the region. Fed members Bostic, Williams and Rosengren speak. We keep an eye at the comments of Fed’s Bostic, but don’t expect them to really change the outlook on the Fed’s intentions in 2018. We start the week with a neutral dollar bias. Slightly disappointing payrolls didn’t cause additional damage and EUR/USD 1.2092 resistance survived. This week’s US price/CPI data might be a next tipping point for the dollar. Recently, the greenback suffered as the global recovery might force other major CB’s (including ECB) to join policy normalisation. For now, we maintained the working hypothesis that enough good news on the euro/’bad news’ on the dollar was discounted and that a sustained break beyond the 1.2092 cycle top is not evident.

Sterling was in better shape compared to earlier last week on Friday. EUR/GBP returned below 0.89, but stayed within established ranges. This weekend, there was a lot of talk about a UK Cabinet reshuffle. If May succeeds, it might be an indication that she is regaining some grip on her party. Signs of more political stability in the UK might be slightly supportive for sterling. However, we don’t see a strong case for a sustained sterling rebound (against EUR) anytime soon. GBP Medium Term: Recent UK data were mixed. We don’t expect the BoE to raise rates soon. EUR/GBP 0.8700/60 support looks solid. Euro strength or soft UK data might keep EUR/GBP 0.90 on the radar further down the road. We keep a EUR/GBP buy-on-dips in case of return action to 0.87

EUR/USD 1.2092 range top survives despite disappointing payrolls