Markets open another week rather steadily. Canadian Dollar remains the strongest one as supported by rate hike expectations. Dollar is trying to recover again, in particular as EUR/USD is feeling heavy ahead of 1.2091 key near term resistance. But more evidence is needed to confirm underlying strength in the greenback. Strong global risk appetite is keeping Yen and Swiss Franc soft. But Aussie is so far the weakest one after the government forecasts 20% drop in iron ore price this year.

Australia Department of Industry, Innovation and Science said in the latest commodities outlook paper that iron ore price would drop 20% from 2017. The paper noted that "the iron ore price is expected to experience some ongoing volatility in early 2018, as the market responds to uncertainty regarding the impact of winter production restrictions on iron ore demand." But over the course course, there would be increase in global supply and moderation in demand from China. Iron ore is priced at around USD 75 a ton currently. Price averaged at around USD 64 in 2017. And Australia government expected it to drop to average USD 51.5 in 2018.

Bundesbank Weidmann urged to set an end date to QE

Bundesbank head Jens Weidmann called for an end date to ECB’s asset purchase program. He said to Spanish newspaper Elmundo that "the prospects for the evolution of prices correspond to a return of inflation to a level sufficient to maintain the stability of prices." Therefore, "it would be justifiable to put a clear end to the buying of debt bonds by establishing a concrete date". Starting this month, ECB halved monthly asset purchase to EUR 30b and keeps the programing running till September. In recent communications, the central bank also maintained openness to extend the program if needed.

Besides, Weidmann also called for banks to reduce non-performing loans. He noted that he so called European deposit insurance scheme (EDIS) "could help to strengthen financial security in the euro zone." "The problem is, however, many banks carry substantial amounts of bad debt."

Preliminary grand coalition talks underway in Germany

In Germany, preliminary negotiations between Chancellor Angela Merkel’s CDU and the SPD got underway over the Sunday. Merkel assured that her team will work "very swiftly and very intensively" of reforming the grand coalition. SPD general secretary said that the teams have met for almost 12 hours and emphasized that they are aware of the "responsibility for Germany and for Europe". It’s believed both sides are targeting to complete the exploratory talks by Thursday. And if things go well, SPD would call for a party convention on January 21 to back full-fledged negotiations.

EEF-AIG survey found more optimism in UK manufacturers

In UK, manufacturer’s organization EEF and insurance firm AIG’s join poll found that manufacturers are more upbeat on the economy. The poll found 40% of companies surveyed were planning for growth in 2018. Only 19% were expecting a downturn. But there were still worries regarding Brexit and this could dominate this year. EEF’s chief executive, Stephen Phipson noted that "Manufacturers left 2017 in an upbeat mood and are set to outpace the rest of the economy again this year as the growth in global trade continues to gain momentum.. But Brexit "has put the investment outlook on a knife edge. As such, it is essential that the government gets a transition deal as a matter of urgency and sets out with utmost clarity as to what kind of final deal it is looking for."

On the data front

German factory orders, Eurozone Sentix investor confidence and other confidence indicators and retail sales will be featured in European session. Swiss will release CPI. BoC will release business outlook survey later in the day. Looking ahead, the calendar is busy but there are not many market moving events. ECB monetary policy accounts is a feature. But the central bank has so far been doing marvelously in managing expectations. So the accounts will likely not reveal anything that the markets don’t know.

Regarding data, US inflation, CPI and PPI will probably be mostly watched ones. Meanwhile, UK productions, Australia retail sales, and some China data could also prompt volatility. Here are some highlights for the week ahead

- Monday: German factory orders; Eurozone Sentix investor confidence, business climate, retail sales; Swiss CPI

- Tuesday: Japan labor cash earnings, consumer confidence; Australia building approvals; Swiss unemployment rate, retail sales, foreign currency reserves; German industrial production, trade balance; Eurozone unemployment rate; Canada housing starts

- Wednesday: China CPI, PPI; UK productions, trade balance; Canada building permits; US import prices

- Thursday: Australia retail sales; Japan leading indicators; Eurozone industrial production, ECB monetary policy accounts; Canada new housing price index; US PPI, jobless claims

- Friday: China trade balance; US CPI, retail sales

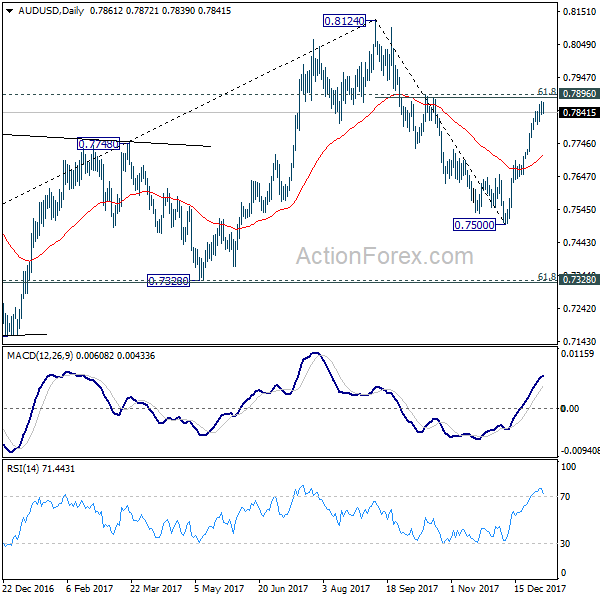

AUD/USD Daily Outlook

Daily Pivots: (S1) 0.7840; (P) 0.7857; (R1) 0.7879; More…

AUD/USD weakens today but downside is contained above 0.7804 minor support. Intraday bias remains neutral first. Considering bearish divergence condition in 4 hour MACD, even in case of another rise, upside should be limited by 0.7896 cluster resistance (61.8% retracement of 0.8124 to 0.7500 at 0.7886) resistance zone to bring short term topping. Break of 0.7804 minor support will turn bias to the downside for 55 day EMA (now at 0.7711).

In the bigger picture, we’re still slightly favoring the case that corrective rise from 0.6826 medium term bottom is completed at 0.8124, after hitting 55 month EMA (now at 0.8032). But stronger than expected rebound from 0.7500 is dampening this bearish view. On the downside, break of 0.7500 will target 0.7328 key cluster support (61.8% retracement 0.6826 to 0.8124 at 0.7322) to confirm this bearish case. But break of 0.8124 will extend the rise from 0.6826 to 38.2% retracement of 1.1079 (2011 high) to 0.6826 (2016 low) at 0.8451 before completion.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 07:00 | EUR | German Factory Orders M/M Nov | 0.00% | 0.50% | ||

| 08:15 | CHF | CPI M/M Dec | -0.10% | -0.10% | ||

| 08:15 | CHF | CPI Y/Y Dec | 0.80% | 0.80% | ||

| 09:30 | EUR | Eurozone Sentix Investor Confidence Jan | 31.3 | 31.1 | ||

| 10:00 | EUR | Eurozone Retail Sales M/M Nov | 1.30% | -1.10% | ||

| 10:00 | EUR | Eurozone Consumer Confidence Dec F | 0.5 | 0.5 | ||

| 10:00 | EUR | Eurozone Economic Confidence Dec | 114.8 | 114.6 | ||

| 10:00 | EUR | Eurozone Business Climate Indicator Dec | 1.5 | 1.49 | ||

| 10:00 | EUR | Eurozone Industrial Confidence Dec | 8.4 | 8.2 | ||

| 10:00 | EUR | Eurozone Services Confidence Dec | 16.5 | 16.3 |