Dollar ended the week broadly lower, except versus Sterling, after US president-elect Donald Trump disappointed the markets by not giving any details on his policies during the first post election press conference. Dollar index reached as low as 100.72 before recovering to close at 101.18. Meanwhile, the greenback also took out key near term support level against Euro, Yen and Canadian Dollar, which carries some bearish implications. However, treasury yields staged a strong rebound on Friday, which could provide some relieves to Dollar bullish. 10 year yield closed at 2.380, after dipping to as low as 2.309, comparing to prior week’s close at 2.418. Stocks were also resilient with NASDAQ closing a fresh record of 5574.12. DJIA stayed in tight range of around 200 pts. below 20000 handle. There are still prospects for the greenback to strike back is Trump delivers in his inauguration on January 20.

Technically, Dollar index’s correction from 103.82 extended lower last week and breached 55 day EMA (now at 101.04), and 38.2% retracement of 95.88 to 103.82 at 100.79. Such decline is still seen as a near term corrective pull back only. And hence, strong support should be seen at 100.79 fibonacci level and bring rebound. A break above 102.95 resistance will turn focus back to 103.82. However, considering bearish divergence condition in daily MACD, sustained break of 100.79 will argue that whole rise from 91.91 is also finished . And in that case, deeper fall should be seen to 99.43 support and below.

10 year yield seems to be losing some downside momentum ahead of 55 day EMA (now at 2.281). Immediate focus will be on 2.432 minor resistance this week. Break there would possibly bring retest of 2.621 resistance. At this point, we don’t expect an upside breakout yet and more consolidation would be seen. Meanwhile, below 55 day EMA will likely extend the correction lower to 38.2% retracement of 1.336 to 2.621 at 2.130.

S&P 500 lost much momentum as it faces resistance from upper channel line. Nonetheless, SPX is holding well above 2233.62 key near term support level. Hence, the rise fro 2083.79 is still intact. Such rise is still expected to continue to next medium term projection level at 61.8% projection of 1074.77 to 2134.71 from 1810.10 at 2465.14. But a break of 2233.62 will bring deeper fall to lower channel line (now at 2128).

Hence to conclude, which the greenback was down, it isn’t out yet. Resilience in stocks and yields would provide support to Dollar in general. But Dollar’s fate will heavily depend on whether Trump would turn his words into actions. Regarding trading strategies, our positives were both stopped by the unexpected weakness in Dollar. We will keeps our hands off this week and see whether the greenback is in genuine trend reversal, or it’s just a blip.

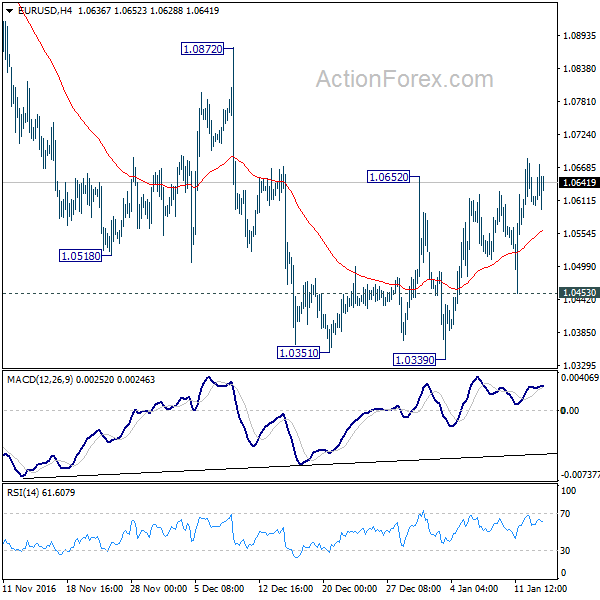

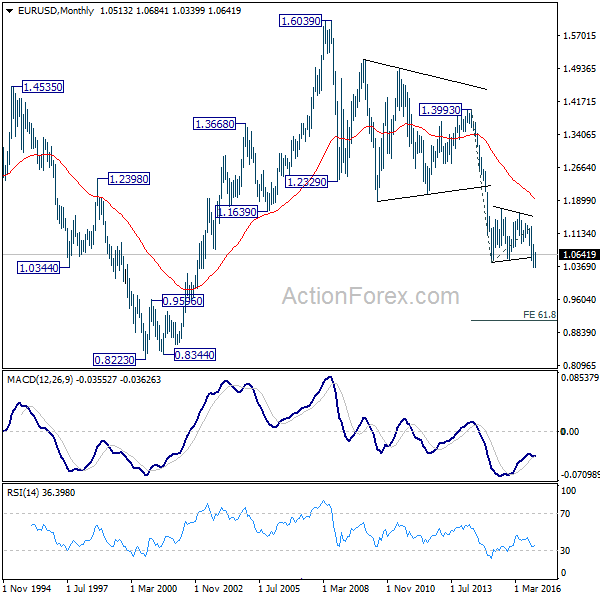

EUR/USD Weekly Outlook

EUR/USD’s rebound from 1.0339 extended higher last week. Break of 1.0652 resistance indicates bottoming. Initial bias stays mildly on the upside this week for 1.0872 resistance and possibly above. On the downside, below 1.0453 minor support will turn bias back to the downside for 1.0339 support. Break there will extend the larger down trend towards parity.

In the bigger picture, whole down trend from 1.6039 (2008 high) is in progress. Such down trend is expected to extend to 61.8% projection of 1.3993 to 1.0461 from 1.1298 at 0.9115. On the upside, break of 1.1298 resistance is needed to confirm medium term bottoming. Otherwise, outlook will stay bearish in case of rebound.

In the long term picture, the down trend from 1.6039 (2008 high) is still in progress and there is no clear sign of completion. We’d expect more downside towards 0.8223 (2000 low) as long as 1.1298 resistance holds.

Subscribe to our daily and mid-day newsletter to get this report delivered to your mail box