Dollar’s broad based selloff continues as 2018 starts. In particular, EUR/USD reaches as high as 1.2080 and is set to take on 1.2091 key resistance. USD/JPY is holding above 112.02 support for the moment, but it looks vulnerable. Among the currencies, Euro is so far trading as the strongest one, followed by Sterling. But Swiss Franc clearly lags behind its European rivals.

UK PMI manufacturing dropped more than expected

UK PMI manufacturing dropped to 56.3 in December, down from 58.2 and missed expectation of 57.9. Markit Director Rob Dobson said in the release that "expansion remained comfortably above long-term trend rates." And, "the sector has therefore broadly maintained its solid boost to broader economic expansion in the fourth quarter." Besides, "the outlook is also reasonably bright, with over 50 percent of companies expecting production to be higher one year from now."

From Eurozone, PMI manufacturing was finalized at 60.6 in December, unrevised. Germany PMI manufacturing was finalized at 63.3, unrevised. France PMI manufacturing was revised lower to 58.8. Italy manufacturing dropped to 57.4 in December.

China Caixin PMI manufacturing improved

China Caixin PMI manufacturing rose to 51.5 in December, up from 50.8 and beat expectation of 50.7. That’s the highest level in four months. Zhengsheng Zhong, director of macroeconomic analysis at CEBM Group said in the release that "manufacturing operating conditions improved in December, reinforcing the notion that economic growth has stabilized in 2017 and has even performed better than expected,." However, he also warned of the "downward pressure on growth due to tightening monetary policy and strengthening oversight on local government financing."

EUR/USD Daily Outlook

Daily Pivots: (S1) 1.1949; (P) 1.1987 (R1) 1.2039; More….

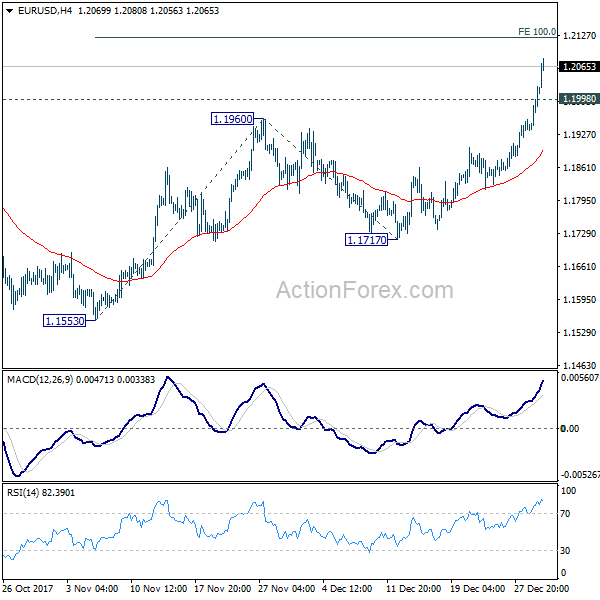

EUR/USD accelerates to as high as 1.2080 so far. Intraday bias remains on the upside for near term target at 100% projection of 1.1553 to 1.1960 from 1.1717 at 1.2124, which is above 1.2091 high. On the downside, below 1.1998 minor support will turn intraday bias neutral and bring consolidation before staging another rally.

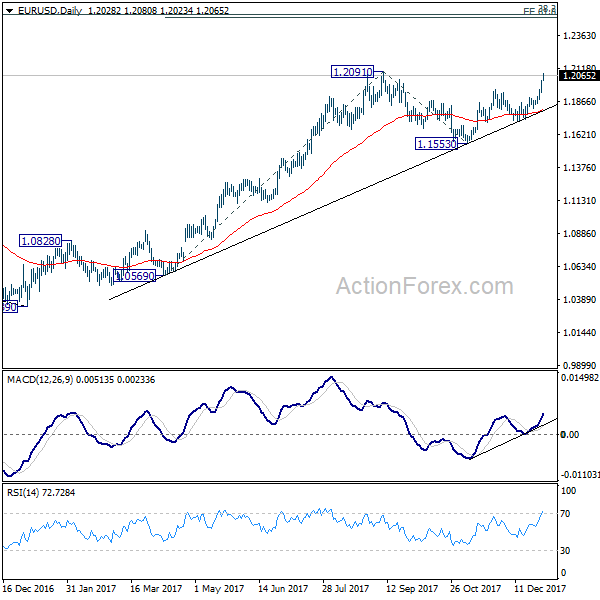

In the bigger picture, rise from 1.0339 medium term bottom is seen as a corrective move for the moment. Therefore, in case of another rally, we’d be expect 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516 to limit upside and bring reversal. That is also close to 61.8% projection of 1.0569 to 1.2091 from 1.1553 at 1.2494.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 1:45 | CNY | Caixin PMI Manufacturing Dec | 51.5 | 50.7 | 50.8 | |

| 8:45 | EUR | Italy Manufacturing PMI Dec | 57.4 | 58.5 | 58.3 | |

| 8:50 | EUR | France Manufacturing PMI Dec F | 58.8 | 59.3 | 59.3 | |

| 8:55 | EUR | Germany Manufacturing PMI Dec F | 63.3 | 63.3 | 63.3 | |

| 9:00 | EUR | Eurozone Manufacturing PMI Dec F | 60.6 | 60.6 | 60.6 | |

| 9:30 | GBP | PMI Manufacturing Dec | 56.3 | 57.9 | 58.2 | |

| 14:30 | CAD | RBC Manufacturing PMI Dec | 54.4 | |||

| 14:45 | USD | US Manufacturing PMI Dec F | 55 | 55 |