Dollar stays weak in early US session as economic data provide little inspiration. Initial jobless claims were unchanged at 245k in the week ended December 23, above expectation of 241k. Four week moving average rose 1.75k to 237.75k. Continuing claims rose 7k to 1.94m in the week ended December 14. Wholesales sales rose 0.7% in November. Trade deficit widened to USD -69.7b in November. With the broad-based selloff in Dollar, EUR/USD should now be heading for a test on 1.1960 resistance.

ECB monthly bulletin noted that the economic recovery in the Eurozone is solid and broad based. While inflation pressure remained subdued, it’s expect to pick up gradually. Overall, ample degree of monetary accommodation is still needed to drive inflation back to target. Also, ECB left open the option to extend the asset purchase program beyond September 2018 if necessary.

Summary of opinions of December BoJ meetings showed that due to improving economic outlook, there were calls for discussions on raising interest rate or cutting ETF purchases. One member noted urged the central bank to consider whether "adjustments in the level of interest rates will be necessary" if inflation and economic outlook improves further. Another board member warned of side effects of ETF purchases.

Released from Japan today, retail sales rose 2.2% yoy in November, above expectation of 1.0% yoy. Industrial production rose 0.6% mom in November, above expectation of 0.5% mom.

EUR/USD Mid-Day Outlook

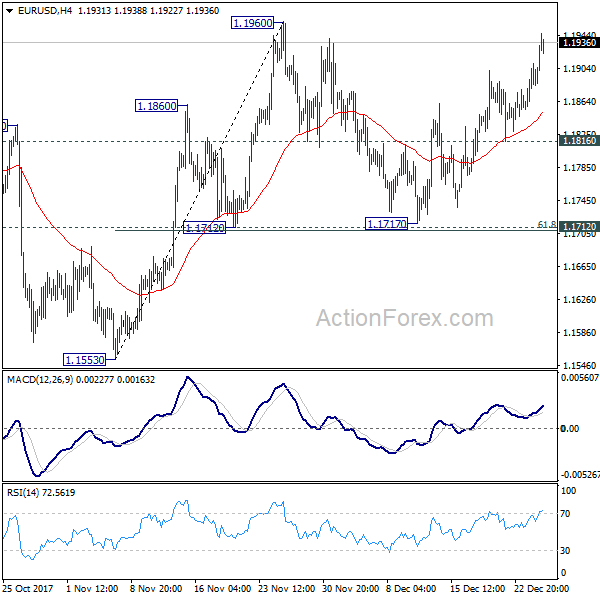

Intraday bias in EUR/USD remains on the upside for 1.1960 resistance. Break will resume whole rally from 1.1553 and target 1.2091 high. On the downside, break of 1.1816 minor support is needed to indicate completion of the rebound form 1.1717. Otherwise, near term outlook will stay cautiously bullish in case of retreat.

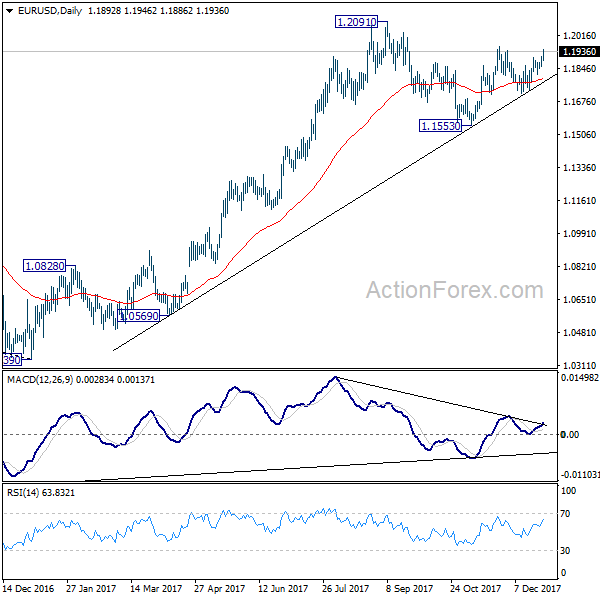

In the bigger picture, rise from 1.0339 medium term bottom is seen as a corrective move for the moment. Therefore, in case of another rally, we’d be expect 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516 to limit upside and bring reversal. Meanwhile, sustained trading below 55 week EMA (now at 1.1435) will suggest that such medium term rebound is completed and could then bring retest of 1.0339 low.