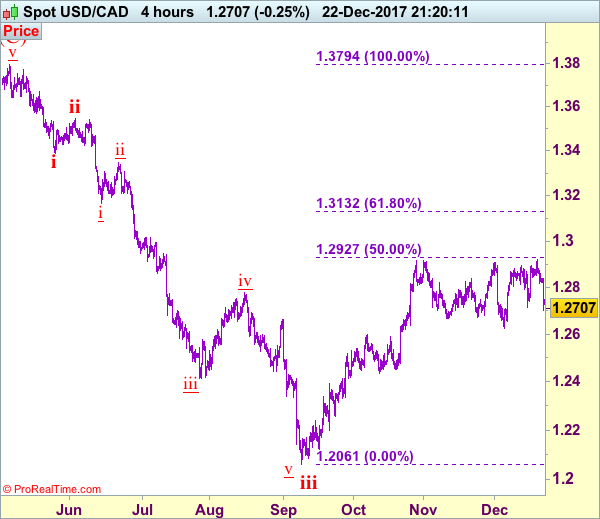

USD/CAD – 1.2705

Trend: Near term up

New strategy :

Stand aside

Position: –

Target: –

Stop:-

FINAL UPDATE, HOPE TO SEE U ALL AGAIN SOON

Despite this week’s anticipated resumption of recent rise, as the greenback has retreated sharply after faltering below indicated dynamic level at 1.2927 (50% Fibonacci retracement of 1.3547-1.2061), suggesting top has possibly been formed at 1.2920, hence downside risk is seen for weakness to 1.2650-55, however, as broad outlook remains consolidative, reckon support at 1.2623 would remain intact, bring rebound later.

As near term outlook is still mixed, would be prudent to stand aside in the meantime. Above 1.2750-55 would bring recovery to 1.2790-00, however, reckon upside would be limited to 1.2835-40 and 1.2880-85 should hold from here, price should falter well below 1.2920-27 level and bring another retreat later.

To recap, wave B from 1.3066 is unfolding as an a-b-c and is sub-divided as a: 1.2192, b: 1.2716 and wave c is a 5-waver with i: 1.1983, ii: 1.2506, extended wave iii with minor iii at 1.0206, wave iv ended at 1.0781 and wave v as well as wave iii has ended at 0.9931, hence the subsequent choppy trading is the wave iv which is unfolding as (a)-(b)-(c) with (a) leg of iv ended at 1.0854, followed by (b) leg at 1.0108 and (c) leg as well as the wave iv ended at 1.0674. The wave v is sub-divided by minor wave (i): 0.9980, (ii): 1.0374, (iii): 0.9446, (iv): 0.9913 and (v) as well as v has possibly ended at 0.9407, therefore, consolidation with upside bias is seen for major correction, indicated target at 1.3700 and 1.4000 had been met and further gain to 1.4700 would be seen later.