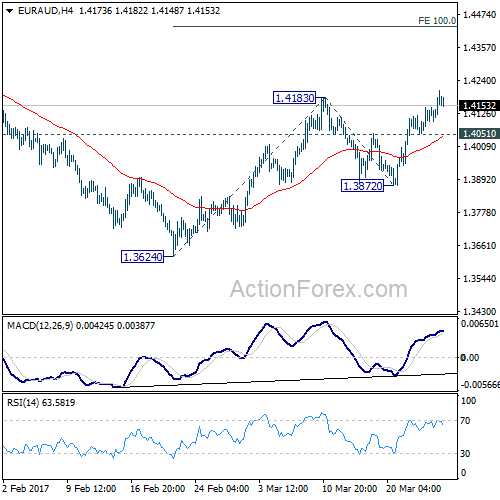

EUR/AUD’s pull back was continued at 1.3872 last week. Subsequent rally and break of 1.4183 resistance indicates resumption hole rebound from 1.3624. The development also affirms our bullish view. That is, medium term trend is reversing after defending 1.3671 key support level, on on bullish convergence condition in daily MACD.

Initial bias in EUR/AUD is back on the upside this week. Further rally should now be seen to 100% projection of 1.3624 to 1.4183 from 1.3872 at 1.4431. Decisive break there will indicate upside acceleration and target 1.4721 key resistance next. On the downside, below 1.4051 minor support will turn focus back to 1.3872 support instead.

In the bigger picture, price actions from 1.6587 medium term top are viewed as a corrective pattern. Such correction could be completed after testing 1.3671 support. Break of 1.4721 cluster resistance (38.2% retracement of 1.6587 to 1.3624 at 1.4756) should confirm this case and target 61.8% retracement at 1.5455 and above. Overall, we’d expect the up trend from 1.1602 to resume later. However, sustained break of 1.3671 will invalidate our bullish view and would turn focus back to 1.1602 long term bottom.

In the longer term picture, the rise from 1.1602 long term bottom isn’t over yet. We’ll keep monitoring the development but there is prospect of extending the rise to 61.8% retracement of 2.1127 to 1.1602 at 1.7488 and above. However, sustained trading below 1.3671 should confirm trend reversal and target 1.1602 long term bottom again.