USD is ‘treading water’ ahead of the expected enactment of President Trump’s tax bill. The initial euphoria of lower corporation tax, that many believed would see a repatriation of USD back into the US has begun to come into doubt. With the bill likely to be passed into law before the end of the year, many believe there will be no rush for Corporations to move funds back to the US as the repatriation of foreign profits is a permanent measure that companies will avail themselves of over a period of time. Additionally, whilst many US policymakers expect the economy to get a boost from the bill, analysts are suggesting that growth will be 2% by 2020, significantly lower than the Trump Administration’s predictions of growth around 3%. USD is little changed overnight.

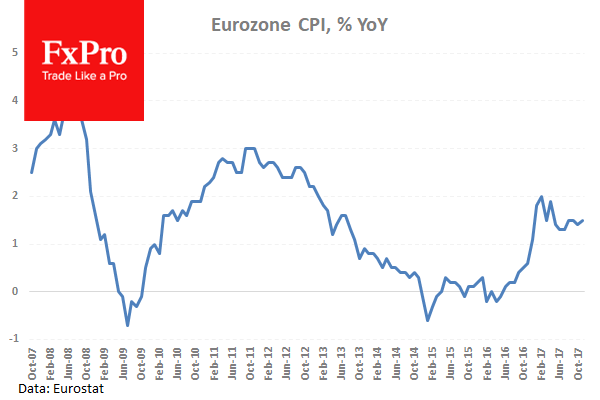

Eurostat released Eurozone CPI on Monday that showed inflation inched higher in November but was still below the ECB target rate. CPI rose, in November, at an annualized rate of 1.5%, a slight increase on October’s 1.4%. Core inflation, the more closely watched by policymakers, remained unchanged at an annualized rate of 0.9%. EUR climbed steadily both before and after the release before retracing lower.

The Reserve Bank of Australia (RBA) released the minutes from its latest policy meeting earlier on Tuesday. The RBA has adopted a pessimistic outlook for consumer spending as household debt levels remain high and the economy experiences sluggish wage growth. The minutes stated; ‘However, growth in consumption was expected to have slowed in the September quarter and the outlook for household consumption continued to be a significant risk, given that household incomes were growing slowly and debt levels were high,’ However, the RBA has a more optimistic outlook on the economy, as the global conditions have improved throughout 2017 and employment in Australia is growing at its fastest pace in more than 10 years. AUD is little changed in early Tuesday trading.

EURUSD is little changed overnight, trading around 1.1790.

USDJPY is unchanged, trading around 112.62.

GBPUSD is unchanged overnight, trading around 1.3383.

Gold is trading around $1,262.50.

WTI is 0.1% higher in early Tuesday trading at around $57.32.

Major data releases for today:

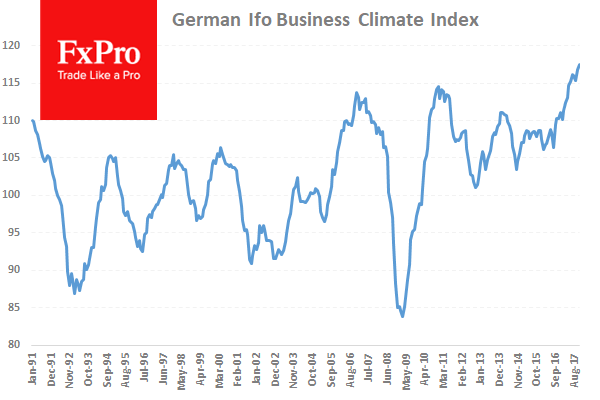

At 08:00 GMT: the CESifo Group will release IFO Expectations, Business Climate and Current Assessment for Germany for December. Expectations are forecast to come in at 110.5, a slight reduction from the previous release of 111.0. Business Climate is forecast to come in unchanged at 117.5, and the Current Assessment is forecast to come in at an improved 124.7 from the previous 124.4. Any significant deviation from forecasts will see EUR volatility in the markets.

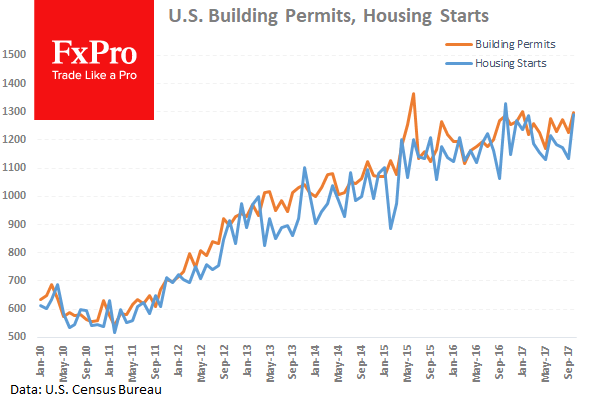

At 13:30 GMT: the US Census Bureau, at the Department of Commerce, will release Housing Starts, Housing Starts Change, Building Permits & Building Permits Change month-on-month for November. Building Permits are forecast to come in slightly lower at 1.275M from the previous reading of 1.297M, and Housing Starts are forecast to come in at 1.23M lower than the previous reading of 1.29M. Any significant deviation from forecasts will see USD volatility in the markets.