While the it looks like Dollar couldn’t care less, global equities seem to be responding very well to the developments on the US tax plan. House and Senate Republicans are expected to pass the final bill mid-week. And the bill could then be on President Donald Trump’s desk before Christmas. Nikkei closed up 1.55% at 22901.77 earlier today. European indices follow and gains broadly. In particular, DAX is up 1.6% at the time of writing while CAC 40 is up 1.2%. In the currency markets, major pairs and crosses are generally stuck in range with exception in weakness in Canadian Dollar. Euro is trading broadly higher with Nov Eurozone CPI finalized at 1.5% yoy.

DOW to extend record run on tax optimism

DOW futures point to triple digit gain at open, in response to tax bill optimism. With that strong momentum, DOW should finally take out 161.8% projection of 20379.55 to 22179.11 from 21731.12 at 24642.80. While the index is clearly overbought, as seen in daily MACD, more upside acceleration could follow to 200% projection at 25330.24. It’s early to talk about topping yet.

BoJ to stand pat this week, Kataoka might dissent again

BoJ will start its two day monetary policy meeting on Wednesday and announce the decision on Thursday. With core CPI standing at 0.8%, there is little room for BoJ to talk about exiting stimulus. It’s widely expected to keep policy unchanged. That is, short-term policy interest rate will be kept at -0.1%. And under the yield curve control framework, BoJ will continues with the annual pace of JPY 80T JGB purchases to keep 10 year yield at around zero. Goushi Kataoka will likely dissent the decision again and continues his push for more stimulus. Also, Kataoka will also maintain his put to target 15 year yield to less than 0.2% too.

Japan adjusted trade surplus widened to JPY 364b in November, above expectation of JPY 270b. Exports rose 14.7% yoy while import rose 17.2% yoy. Increase in exports were broad based. Exports to China rose 25% yoy, to US rose 13% yoy, to EU also rose 13% yoy. The data adds to the case that the export-led Japanese economy is on track for gradual recovery.

RBA minutes to watch in upcoming Asian session.

RBA minutes will be a focus in the upcoming Asian session. Aussie was strong last week as boosted by stellar job data. But after all the job growth, wage growth remained sluggish. And that’s a key factor in keeping inflation low, and holding RBA’s hand. Indeed, markets are expecting the central bank to stand pat throughout 2018. Hence, until a turnaround is seen incoming data, we’ll view current rebound in the Aussie as a corrective move at most

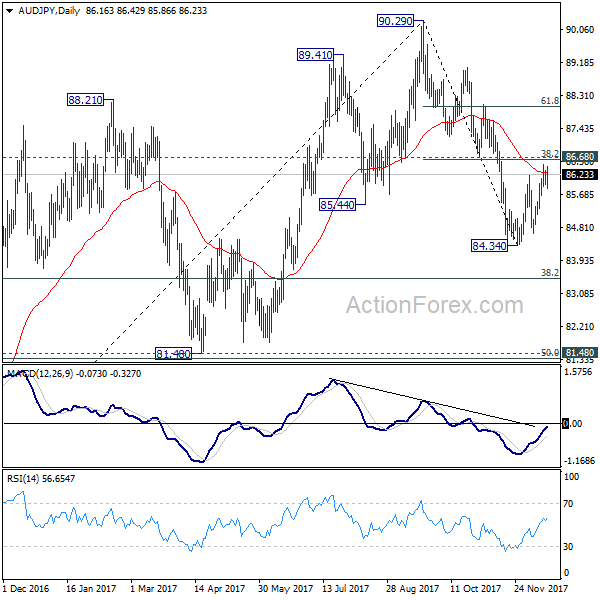

This is also inline with the technical picture in AUD/JPY too. The rebound from 84.34 is held below 86.68 cluster resistance (38.2% retracement of 90.29 to 84.34 at 86.61). Such rebound is seen as a correction. Fall from from 90.29 is expected to resume later through 84.34 to 38.2% retracement of 72.39 to 83.45, and possibly to 81.48 cluster support (50% retracement at 81.34). However, sustained break of 86.61/8 will dampen our bearish view.

China’s hike last week partly driven by Fed’s move

Last week, China’s PBOC lifted the 7-day and 28-day OMO reverse repo rates by 5 bps to 2.5% and 2.8% respectively. It also raised the 1-year MLF rates by 5 bps to 3.25%. These were in response to the Fed’s 25-bps rate hike in the prior day. Note that the PBOC has raised the policy rates for three times this year. The previous two times were the 10-bps hikes in the OMO and MLF rates in February and March.

As suggested in the accompanying statement, the rate hikes last week was partly driven by the Fed’s rate hike. The PBOC stressed that it does not follow closely the monetary policy of the Fed, citing the inaction after Fed’s June rate hike. More importantly, the rate hike was in response to the market rates which have been markedly higher than those guided by the central bank. Despite the fact that the rate hikes came in lower than consensus, PBOC believed that it would help discourage leveraging and excessive credit expansion. More in PBOC’s Rate Hike Is Consistent With The Deleveraging Theme That Would Be Reiterated At CEWC

USD/CHF Mid-Day Outlook

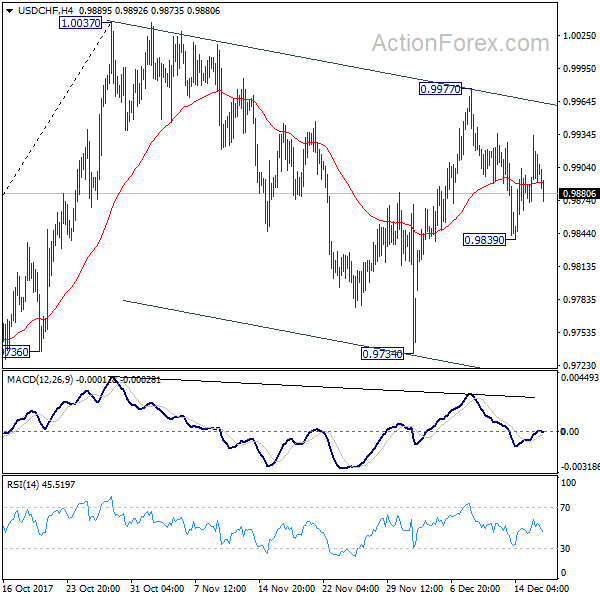

Daily Pivots: (S1) 0.9870; (P) 0.9902; (R1) 0.9931; More….

USD/CHF drops slightly today but intraday bias remains neutral at this point. On the upside, above 0.9977 will resume the rebound from 0.9734 for 1.0037 resistance. Break there will resume whole rally from 0.9420 and target 1..0342 key resistance next. On the downside, below 0.9839 will likely extend the correction from 1.0037 through 0.9734. But in that case, we’d expect strong support from 61.8% retracement of 0.9420 to 0.1.0037 at 0.9656 to contain downside and bring rebound.

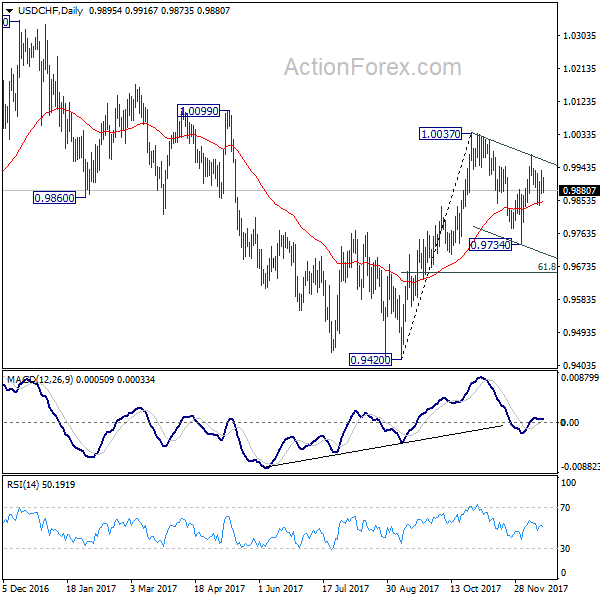

In the bigger picture, range trading continues between 0.9420/1.0342. At this point, 0.9420 appears to be a strong support level. Therefore, in case of decline attempt, we don’t expect a firm break of this level. Nonetheless, strong break of 1.0342 is also needed to confirm upside momentum. Otherwise, medium term outlook will stay neutral.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Trade Balance Nov | 0.36T | 0.27T | 0.32T | 0.35T |

| 10:00 | EUR | Eurozone CPI M/M Nov | 0.10% | 0.10% | 0.10% | |

| 10:00 | EUR | Eurozone CPI Y/Y Nov F | 1.50% | 1.50% | 1.50% | |

| 10:00 | EUR | Eurozone CPI Core Y/Y Nov F | 0.90% | 0.90% | 0.90% | |

| 11:00 | GBP | CBI Trends Total Orders Dec | 17 | 15 | 17 | |

| 13:30 | CAD | International Securities Transactions (CAD) Oct | 16.81B | |||

| 15:00 | USD | NAHB Housing Market Index Dec | 70 | 70 |