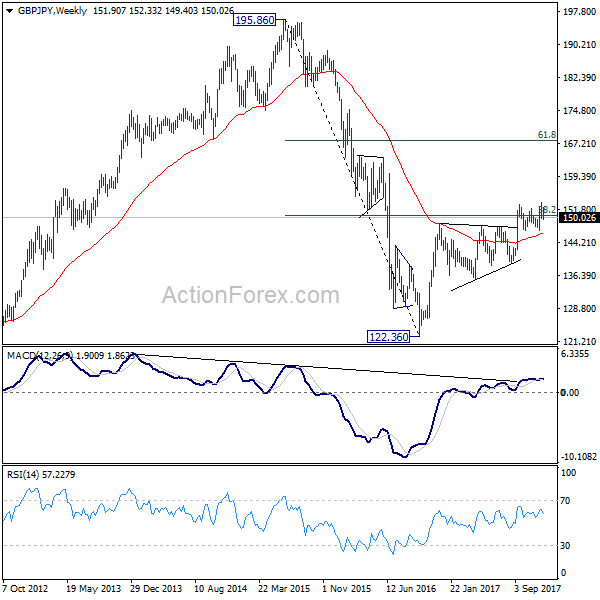

GBP/JPY’s fall from 153.39 accelerated lower last week and broke 149.74 support. Initial bias is on the downside this week for 146.96 key support level. We’d look for strong support from there to bring rebound. On the upside, above 151.85 minor resistance will indicate that the pull back is finished. And intraday bias will be turned back to the upside for 153.39.

In the bigger picture, outlook is mixed up a bit with last week’s sharp decline. But still, as long as 146.96 key support holds, medium term outlook remains bullish. Rise from 122.36 is in favor to extend to 61.8% retracement of 195.86 to 122.36 at 167.78. However, break of 146.96 support will indicate trend reversal. And the corrective structure of rebound from 122.36 will argue that larger down trend is resuming for a new low below 122.26.

In the longer term picture, current rebound argues that the down trend from 195.86 (2015 high) has already completed at 122.36. Focus is now on 55 month EMA (now at 154.71). Firm break there will suggest that rise from 122.36 is developing into a long term move that target 195.86 again. And, price actions from 116.83 (2011 low) is indeed a sideway pattern that could last more than a decade. However, firm break of 139.29 will suggest that the long term down trend is still in progress and could break 116.83 low ahead.