Fed hiked as expected with ECB and BoE keeping monetary policy untouched

The USD will finish the week mixed against major pairs. The much awaited December rate hike came, but with no further guidance the US dollar remains vulnerable to the outcome of the Republican tax reform vote. A simple majority is needed to pass the bill, but health issues and some last minute changes could derail the Trump administration’s pro growth policy and have a negative impact on the currency.

- Bank of Japan (BOJ) expected to stand pat

- Canadian inflation and retail sales data

- US final GDP and possible tax reform vote

- Catalan elections on Thursday

The EUR/USD lost 0.8 percent in the last five days. The single currency is trading at 1.1760 as the US tax reform moves closer to reality. Republicans are getting closer to having a bill and the votes needed to pass it by next week. The US dollar had started the year with a bang on the back of Donald Trump’s pro growth policy promises such as tax reform and infrastructure spending. The administration took a detour and it was only in the fall that tax reform was back on the table. The tax cuts being discussed are expected to boost US economic growth and appreciated the USD in the final stretch of the year.

The tax reform vote is the last major event still ongoing as traders start to wind down their activity ahead of the holidays. The Bank of Japan (BOJ) is the last major central bank to hold its December meeting and it is anticipated it will follow the path of the Bank of England (BoE) and the European Central Bank (ECB) which did not make any changes to their monetary policy.

The U.S. Federal Reserve lifted the Fed funds rate by 25 basis points and economist still expect three rate hikes in 2018 under Jerome Powell’s leadership.

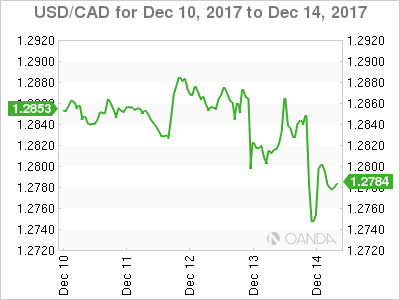

The USD/CAD gained 0.25 percent in the last five days. The currency pair is trading at 1.2878 after the U.S. Federal Reserve raised rates as expected to a 1.25 to 1.50 basis points range. The optimism surrounding the US tax reform passing this year has kept the dollar bid. Bank of Canada (BoC) spoke in Toronto yesterday and he was criticized for expressing two different views in separate appearances. As part of his speech to the Canada club in Toronto he was seen as hawkish and not overtly concerned as the Canadian economy was in a good part of the cycle even though the title of his speech was the three things keeping him up at night. Later while talking to the Canadian Broadcasting Corporation (CBC) he recapped his talk, but focused more on the headwinds and the limits of central bank policy to make the right call.

While the gap between Canadian and American interest rates is expected to grow in 2018 the BoC Governor is not terribly concerned as the collapse in oil prices forced Canada to cut twice in 2015, while the Fed embarked in rate hikes. The divergence in monetary policies has put Canada a year or two behind. This comment contrasted heavily to what was said earlier as Mr. Poloz made it clear that current interest rates were still low and would hike although he was in no rush to do so.

The loonie’s weekly high and low came on the back of the comments of Poloz. His optimism took the Canadian dollar close to 1.2740, but his dovish reframing of earlier topics now has the CAD near 1.2875. The Canadian economic calendar will have a strong week to close the year before the quiet of the holidays. Canadian inflation and retail sales data will be released on Thursday, December 21 at 8:30 am EST. Monthly GDP data will be publish on Friday, December 22 at 8:30 am EST. After a smashing second quarter the Canadian economy slowed down in Q3 but any signs of improvement would be a positive for the Canadian currency.

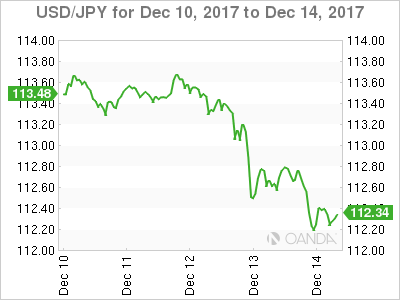

The USD/JPY lost 0.74 percent during the week. The currency pair is trading at 112.61 after Business sentiment in Japan hit an 11 year high and the FOMC meeting did not bring anything to get excited about. The Fed as expected raised rates by 25 basis points in what was Fed Chair Janet Yellen’s last press conference. Jerome Powell will take the reigns of the central bank in February and will host the next press conference at the end of the March FOMC meeting.

The tankan survey by the Bank of Japan (BOJ) shows that exports are solid thanks to the depreciation of the yen and a pick up in global demand. The BOJ is not expected to make any changes to its monetary policy next week. The election victory of Shinzo Abe’s party puts the current QE program in more solid footing regardless of how it has fallen short of achieving a 2 percent inflation target.

Market events to watch this week:

Monday, December 18

- 7:30 pm AUD Monetary Policy Meeting Minutes

Tuesday, December 19

- 8:30 am USD Building Permits

Wednesday, December 20

- 10:30 am USD Crude Oil Inventories

- 4:45 pm NZD GDP q/q

- Midnight JPY Monetary Policy Statement

Thursday, December 21

- 1:30 am JPY BOJ Press Conference

- 8:30 am CAD CPI m/m

- 8:30 am CAD Core Retail Sales m/m

- 8:30 am USD Final GDP q/q

- 8:30 am USD Unemployment Claims

Friday, December 22

- 4:30 am GBP Current Account

- 8:30 am CAD GDP m/m

- 8:30 am USD Core Durable Goods Orders m/m

*All times EST