Dollar’s data inspired rally overnight was brief and weak. The greenback is still set to end as the weakest major currency for the week despite a Fed rate hike. It seems like markets are rather worried on passage of the reconciled tax bill in the Senate. Euro is indeed trading as the second weakest one for the week. Even though ECB raised both growth and inflation forecasts, it’s still not going to meet 2% inflation target before 2020. Commodity currencies are trading broadly higher for the week. Canadian Dollar was given a boost by BoC Governor Stephen Poloz’s upbeat comment. But it’s overwhelmed by Aussie and Kiwi.

More on this week’s central bank activities:

- ECB Review: Christmas Mood Leaves QE Exit Decisions for 2018

- BOE Stands on Sideline after November Hike, Attributing Inflation Overshoot to Weak Currency

- SNB Raised CPI Forecasts, Acknowledged Franc’s Weakness But Pledged To Stay Cautious

- Bank of Canada Steals the Show Despite Not Making Rate Decision

- BoC: Poloz Worries, But Feels We’re Still "Close to Home"

- Fed Raises Rates, Maintains Normalization Path

- FOMC Hikes Rate For Third Time, With Two Dissents

- The FOMC Takes Another Step Toward Normal

- Fed Delivers December Hike, With More Tightening in Store Next Year

- FOMC Review: Broadly Unchanged Fed Signal

- Federal Reserve Hikes Rates in December

Japan large manufacturing confidence hit 11 year high

Japan Tankan survey showed improvements in large manufacturing business confidence in Q4. The results support BoJ’s upbeat assessment on the economy. And they will likely add to the central bank’s confidence that inflation will eventually return to 2% target as economy improves. However, considering the slowdown in capex growth and slower improvement in other readings, there is still a long way to go for the BoJ. Large manufacturing index rose 3 pts to 25 in Q4, beating expectation of 24. That’s also the highest level in 11 years since Q4 of 2006. Large manufacturing outlook was unchanged at 19, below expectation of 22. Large non0manufacturing index was unchanged at 23, below expectation of 24. Large non-manufacturing outlook rose to 20, but missed expectation of 21. All industry capex spending rose 7.4%, slowed from 7.7% and missed expectation of 7.5%.

BoC Poloz raised expectations of Q1 hike

Canadian Dollar was given a strong lift overnight by upbeat comments from BoC Governor Stephen Poloz. Poloz said that the economy made "tremendous" progress in 2017. And, It’s now "close to reaching its full potential". He also said that policymakers are "growing increasingly confidence that the economy will need less monetary stimulus over time". Markets took that as confirmation that the next move is still a hike. More importantly, it wouldn’t be too far away. His comments affirmed the expectation of another rate hike by BoC in Q1 next year.

UK PM May in Brussels EU summit

UK Prime Minster Theresa May arrived in Brussels yesterday for the highly anticipated EU summit. Brexit negotiation is widely expected to be given a go-ahead into trade talks. However, it’s believe that the formal discussions on post Brexit trade relationship will not start until March. Also, according to a leaked European Council document, there will be "additional guidelines" for the negotiations onward, in particular regarding the "framework for the future relationship". Meanwhile, UK Parliament voted 309 to 305 on an amendment to the Brexit bill. And the Parliament must be given on vote on the final agreement with EU before withdrawal begins. That is seen as further weakening May’s position.

Looking ahead

The economic calendar is much lighter today. Eurozone will release trade balance. Canada will release manufacturing sales. US Empire state manufacturing and industrial production will also be featured.

USD/CAD Daily Outlook

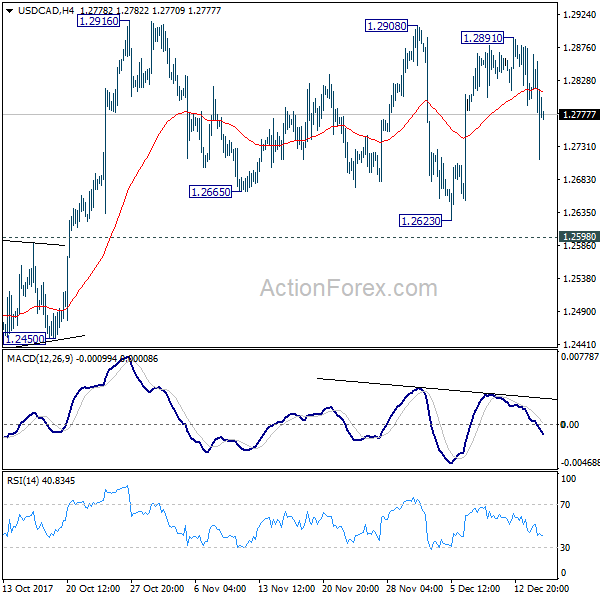

Daily Pivots: (S1) 1.2717; (P) 1.2791; (R1) 1.2869; More….

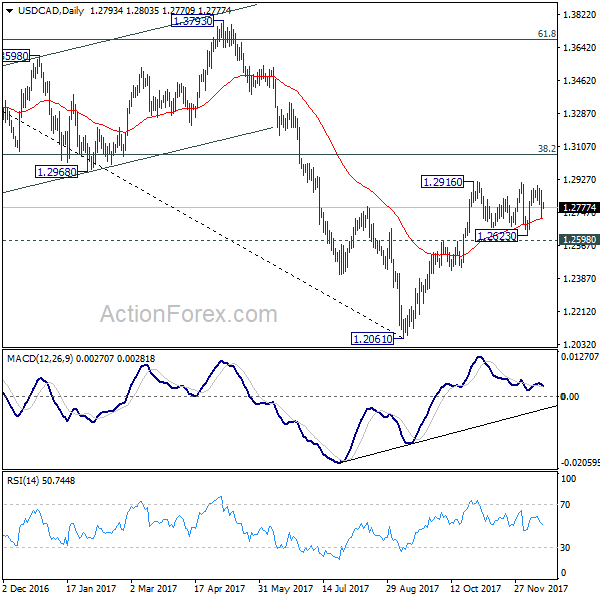

USD/CAD dropped sharply from 1.2891, but still it’s staying in range below 1.2916. Consolidation from there is in progress and intraday bias remains neutral. Also, outlook remains bullish with 1.2598 resistance turned support intact. On the upside, firm break of 1.2916 will resume whole rally from 1.2061 and target 1.3065 medium term fibonacci level next. However, sustained break of 1.2598 will argue that rebound from 1.2061 has completed after hitting 55 week EMA (now at 1.2888). Near term outlook will be turned bearish in this case.

In the bigger picture, USD/CAD should have defended 50% retracement of 0.9406 (2011 low) to 1.4689 (2016 high) at 1.2048. And with 1.2048 intact, we’d favor the case that fall from 1.4689 is a correction. Rise from 1.2061 medium term bottom should now target 38.2% retracement of 1.4689 to 1.2061 at 1.3065. Firm break there will target 1.3793 key resistance next (61.8% retracement at 1.3685). We’ll now hold on to this bullish view as long as 1.2450 support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:30 | NZD | Business NZ Manufacturing PMI Nov | 57.7 | 57.2 | 57.3 | |

| 23:50 | JPY | Tankan Large Manufacturing Index Q4 | 25 | 24 | 22 | |

| 23:50 | JPY | Tankan Large Manufacturers Outlook Q4 | 19 | 22 | 19 | |

| 23:50 | JPY | Tankan Large Non-Manufacturing Index Q4 | 23 | 24 | 23 | |

| 23:50 | JPY | Tankan Non-Manufacturing Outlook Q4 | 20 | 21 | 19 | |

| 23:50 | JPY | Tankan Large All Industry Capex Q4 | 7.40% | 7.50% | 7.70% | |

| 23:50 | JPY | Tankan Small Manufacturing Index Q4 | 15 | 11 | 10 | |

| 23:50 | JPY | Tankan Small Manufacturing Outlook Q4 | 11 | 9 | 8 | |

| 23:50 | JPY | Tankan Small Non-Manufacturing Index Q4 | 9 | 9 | 8 | |

| 23:50 | JPY | Tankan Small Non-Manufacturing Outlook Q4 | 5 | 5 | 4 | |

| 10:00 | EUR | Eurozone Trade Balance Oct | 24.6B | 25.0B | ||

| 13:30 | CAD | Manufacturing Sales M/M Oct | 0.50% | |||

| 13:30 | USD | Empire State Manufacturing Index Dec | 18 | 19.4 | ||

| 14:15 | USD | Industrial Production M/M Nov | 0.30% | 0.90% | ||

| 14:15 | USD | Capacity Utilization Nov | 77.20% | 77.00% | ||

| 21:00 | USD | Net Long-term TIC Flows Oct | 80.9B |