Dollar tumbled broadly after FOMC rate hike as most likely an extended selloff after core CPI miss. News on the progress in Republican’s tax bill provided little support to the Dollar. Technically, Dollar index should have confirmed the rejection from 94.16 resistance. Equivalently, EUR/USD has defended 1.1712 key near term support. more downside is now likely in the greenback in near term with EUR/USD heading back to 1.1960 and possibly have a go at 1.2 handle before year end. Staying in the currency markets, Aussie is propelled higher by a stunning job report. European majors are generally firm too, ahead of SNB, BoE and ECB rate announcement.

Fed announcement wasn’t dovish at all

Fed’s announcement overnight wasn’t exactly a dovish one. Federal funds rate was raised by 25bps to 1.25% to 1.50% as widely expected. In the new economic projections, GDP forecast for 2018 was raised to 2.5%, up from 2.1%. For 2019, GDP forecast was raised to 2.1%, up from 2.0%. Unemployment rate projections for 2018 and 2019 were lowered to 3.9%, down from 4.1%. Inflation forecasts were kept unchanged. That is, PCE is projected to be at 1.9% at 2018 and 2.0 at 2019. Core PCE is projected to be at 1.9% in 2018 and 2.0% at 2019.

Mostly importantly, federal funds rate projections were also kept unchanged. That is, to be at 2.1% at 2018 and 2.7% at 2019. That’s equivalent to more than three more hikes in both 2018 and two to three hikes in 2019. Indeed, for 2020, rate is now projected to be at 3.1%, revised up from September’s forecast of 2.9%.

Updated Fed projections

The negative reaction in Dollar was probably firstly due to one more dissenter to the hike. But dissenters Minneapolis Fed President Neel Kashkari and Chicago Fed President Charles Evans are two known doves. And Evans has already hinted in his recent comments that he’d vote "no". So that shouldn’t be a surprise to anyone who followed closely. Secondly, there were speculations that Fed could accelerate the path next year to have four hikes. And people were disappointed by the lack of hints for that. Again, given the lack of inflationary pressure, there is little chance for Fed to hit the brake harder than it should be. Three hikes will remain the base case scenario unless there is a clear pick up in inflation. Thirdly, the more probably reason, Dollar was just extending the post CPI selloff as Fed event risks were cleared.

Republicans agreed on 21% corporate tax rate, starts in 2018

Republicans were making important progresses on the tax bill. One of the most sticky topic of corporate tax cut should have been solved. House and Senate Republicans have agreed to cut corporate tax rate from 35% to 21% (instead of 20%), and starts in 2018 (Senate originally wanted it in 2019). Top individual rate is lowered to 38% for the highest earners (down from House 39.6% and Senate 38.5%). The so-called Corporate Alternative Minimum Tax will be repealed (Senate wanted to maintain). Obamacare individual mandate will also be repealed. There could be some more minor issues to resolve. But the bill should be ready for vote before Christmas.

Aussie surges on stunning job data

Australian Dollar surges broadly today after a stunning employment report. The job market grew 61.6k in November, more than triple of expectation of 19.2k. Full time jobs grew 41.9k while part time jobs grew 19.7k. Unemployment rate was unchanged at 5.4% as participation rate jumped from 65.2% to 65.5%. Nonetheless, there is no change in the general view that RBA will stand pat throughout 2018, unless there is a pickup in wage growth. Also from Australia consumer inflation expectation rose 3.7% in December.

Release from China, retail sales rose 10.2% yoy in November, below expectation of 10.3% yoy. Fixed assets investments rose 7.2% yoy, in line with consensus, industrial production rose 6.1% yoy, below expectation of 6.2% yoy.

Busy calendar ahead

The economic calendar is extremely busy today. SNB, BoE and ECB rate decision will be the main focuses. Nonetheless, no change in monetary policy is expected from all of the three. And, BoE has just hiked last month. ECB will start tapering in January. There is little chance of any surprise today. So, these three announcement could be non-events.

On the data front, Eurozone PMIs will be the main focuses while UK will release retail sales. US will release jobless claims, retail sales import price and PMIs later today. Canada will release new housing price index.

EUR/USD Daily Outlook

Daily Pivots: (S1) 1.1759; (P) 1.1795 (R1) 1.1861; More….

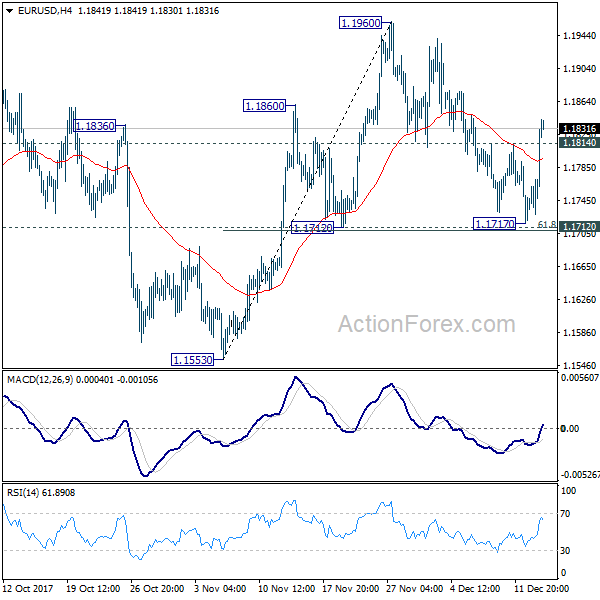

EUR/USD’s strong break of 1.1814 resistance suggest that corrective pull back from 1.1960 has completed at 1.1717 already. Also, as the pair defended 1.1712 cluster support (61.8% retracement of 1.1553 to 1.1960 at 1.1708), near term bullish outlook is retained. Intraday bias is back on the upside for 1.1960 first. Break will target 1.2029 high next. And even in case of retreat, outlook will remain bullish as long as 1.1708/12 cluster support holds.

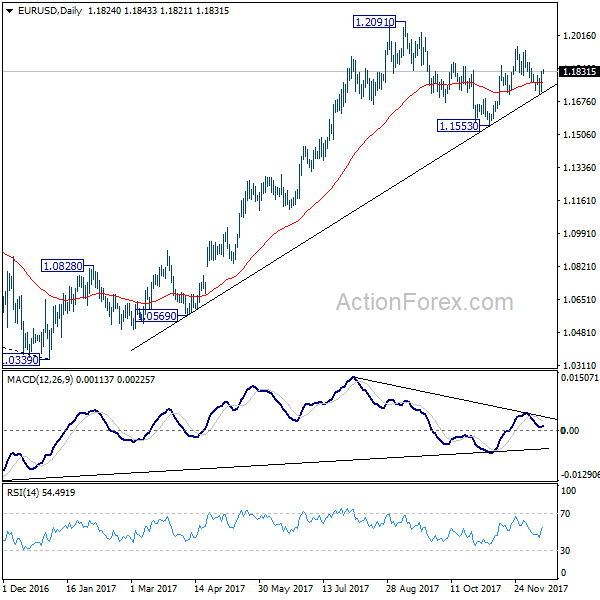

In the bigger picture, rise from 1.0339 medium term bottom is seen as a corrective move for the moment. Therefore, in case of another rally, we’d be expect 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516 to limit upside and bring reversal. Meanwhile, sustained trading below 55 week EMA (now at 1.1423) will suggest that such medium term rebound is completed and could then bring retest of 1.0339 low.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 0:00 | AUD | Consumer Inflation Expectation Dec | 3.70% | 3.70% | ||

| 0:01 | GBP | RICS House Price Balance Nov | 0% | 0% | 1% | |

| 0:30 | AUD | Employment Change Nov | 61.6K | 19.2K | 3.7K | 7.8K |

| 0:30 | AUD | Unemployment Rate Nov | 5.40% | 5.40% | 5.40% | |

| 2:00 | CNY | Retail Sales Y/Y Nov | 10.20% | 10.30% | 10.00% | |

| 2:00 | CNY | Fixed Assets Ex Rural YTD Y/Y Nov | 7.20% | 7.20% | 7.30% | |

| 2:00 | CNY | Industrial Production Y/Y Nov | 6.10% | 6.20% | 6.20% | |

| 4:30 | JPY | Industrial Production M/M Oct F | 0.50% | 0.50% | ||

| 8:00 | EUR | France Manufacturing PMI Dec P | 57.2 | 57.7 | ||

| 8:00 | EUR | France Services PMI Dec P | 59.9 | 60.4 | ||

| 8:15 | CHF | Producer & Import Prices M/M Nov | 0.30% | 0.50% | ||

| 8:15 | CHF | Producer & Import Prices Y/Y Nov | 1.20% | |||

| 8:30 | CHF | SNB Sight Deposit Interest Rate | -0.75% | -0.75% | ||

| 8:30 | CHF | SNB 3-Month Libor Upper Target Range | -0.25% | -0.25% | ||

| 8:30 | CHF | SNB 3-Month Libor Lower Target Range | -1.25% | -1.25% | ||

| 8:30 | EUR | Germany Manufacturing PMI Dec P | 62 | 62.5 | ||

| 8:30 | EUR | Germany Services PMI Dec P | 54.6 | 54.3 | ||

| 9:00 | EUR | Eurozone Manufacturing PMI Dec P | 59.7 | 60.1 | ||

| 9:00 | EUR | Eurozone Services PMI Dec P | 56 | 56.2 | ||

| 9:30 | GBP | Retail Sales M/M Nov | 0.40% | 0.30% | ||

| 12:00 | GBP | BoE Bank Rate | 0.50% | 0.50% | ||

| 12:00 | GBP | BOE Asset Purchase Target Dec | 435B | 435B | ||

| 12:00 | GBP | MPC Official Bank Rate Votes | 0–0–9 | 7–0–2 | ||

| 12:00 | GBP | MPC Asset Purchase Facility Votes | 0–0–9 | 0–0–9 | ||

| 12:45 | EUR | ECB Rate Decision | 0.00% | 0.00% | ||

| 13:30 | EUR | ECB Press Conference | ||||

| 13:30 | CAD | New Housing Price Index M/M Oct | 0.20% | 0.20% | ||

| 13:30 | USD | Initial Jobless Claims (DEC 09) | 239K | 236K | ||

| 13:30 | USD | Retail Sales Advance M/M Nov | 0.30% | 0.20% | ||

| 13:30 | USD | Retail Sales Ex Auto M/M Nov | 0.70% | 0.10% | ||

| 13:30 | USD | Import Price Index M/M Nov | 0.80% | 0.20% | ||

| 14:45 | USD | US Manufacturing PMI Dec P | 54.2 | 53.9 | ||

| 14:45 | USD | US Services PMI Dec P | 54.6 | 54.5 | ||

| 15:00 | USD | Business Inventories Oct | -0.10% | 0.00% | ||

| 15:30 | USD | Natural Gas Storage | 2B |