Investors expressed their vote of confidence overnight as they await the highly anticipated FOMC rate decision and press conference. DOW closed at record high at 24504.80, up 118.77 pts or 0.49%. S&P 500 followed closely and gained 4.12 pts or 0.15% at 2664.11, also a record. 10 year yield closed above 2.4 handle at 2.403, up 0.018. The dollar index breached 94.10 key near term resistance. However, EUR/USD is still holding on to equivalent support at 1.1712. The greenback is trading mixed only as traders seem to be cautious before Fed showing whether it’s still on track for three hike next year. In the currency markets, New Zealand Dollar remain the strongest one for the week and helped keep Aussie up. Euro and Sterling are generally soft.

Fed to hike, eyes on voting and projections

Fed is widely expected to raise federal funds rate by 25bps to 1.25-1.50% today. There is little doubt about that. Janet Yellen will deliver her last press conference as Fed chair, before Jerome Powell takes over the job next year. The surprise elements could be found in the voting and the new projections. Minneapolis Fed President Neel Kashkari, who dissented the prior hikes, would very likely dissent again. Chicago Fed President Charles Evans could be another dissenter. The vote split could be seen as hawkish if only Kashkari dissents. However, three or more dissenting will signals spreading of the worries on slow inflations among policymakers. And that would be dovish. Fed will mostly upgrade GDP forecast for 2018 and 2019 while lower unemployment rate estimates. The keys will lie in the changes in inflation projections and interest rate projections. So far, hawks inside the FOMC are still expecting three more rate hikes next year.

FOMC September Projections

Before FOMC announcement, CPI release from US will also be a volatility driver. Headline CPI is expected to accelerate to 2.2% yoy in November. Core CPI is expected to be unchanged at 1.8% yoy. Dollar traders could jump the gun should there be any surprise there. Separately, US President Donald Trump will speak today to pitch the Republican’s tax plan.

Australia consumer confidence improved, but not enough for RBA hike in 2018

Australia Westpac consumer confidence rose solidly by 3.6% in December. According to Westpac, that’s a "surprisingly strong result" that appears to be boosted by "less threatening outlook for interest rates". Nonetheless, while expectation for an RBA hike in 2018 cooled, Westpac "doubt whether this welcome lift to confidence will be sufficient to see the Bank achieve its ambitious growth forecast in 2018 of 3.25%." And, with inflation projected to be below target in 2018, and a cooling Sydney property market, Westpac maintained the view that RBA will stand pat through 2018.

RBA Lowe: Cryptocurrencies "feels more like a speculative mania"

Staying in Australia, RBA Governor Philip Lowe criticized that current fascinations with cryptocurrencies "feels more like a speculative mania". And when though of "purely as a payment instrument", crytopcurrencies are "more likely to be attractive to those who want to make transactions in the black or illegal economy, rather than everyday transactions." Lowe also added that "the value of Bitcoin is very volatile, the number of payments that can currently be handled is very low, there are governance problems."

Elsewhere

Japan machine orders rose 5.0% mom in October. UK will release job data in European session. Eurozone will release industrial production, employment and German CPI final.

EUR/USD Daily Outlook

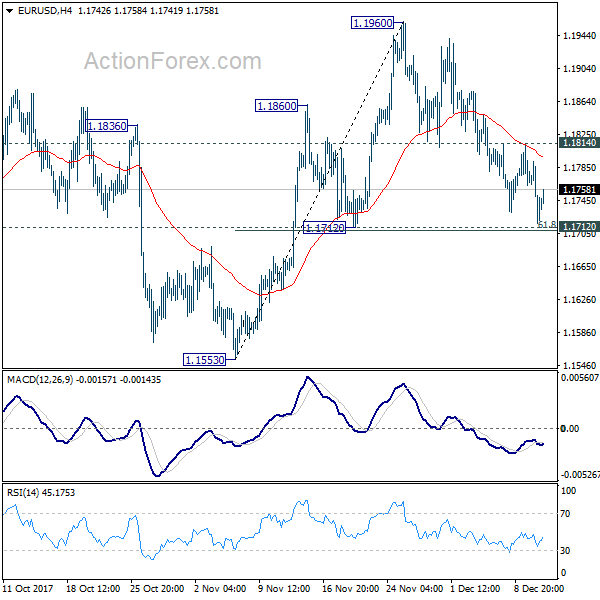

Daily Pivots: (S1) 1.1708; (P) 1.1750 (R1) 1.1783; More….

EUR/USD dipped to as low as 1.1717 but recovered ahead of 1.1712 cluster support (61.8% retracement of 1.1553 to 1.1960 at 1.1708). Intraday bias remains neutral first. On the downside, decisive break of 1.1708/12 will indicate that rebound from 1.1553 has completed at 1.1960. In that case, deeper fall would be seen to 1.1553 and possibly below to extend the decline from 1.2091. On the upside, break of 1.1814 minor resistance will retain near term bullishness. And in that case, intraday bias will be turned back to the upside for 1.1960. Break will target 1.2091 high.

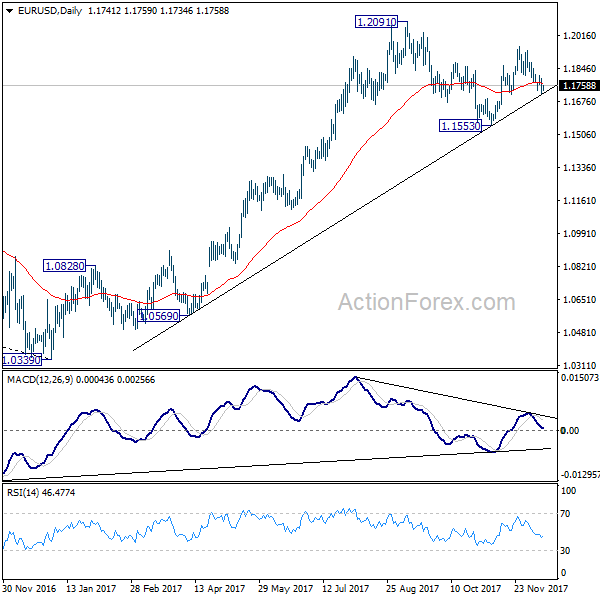

In the bigger picture, rise from 1.0339 medium term bottom is seen as a corrective move for the moment. Therefore, in case of another rally, we’d be expect 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516 to limit upside and bring reversal. Meanwhile, sustained trading below 55 week EMA (now at 1.1423) will suggest that such medium term rebound is completed and could then bring retest of 1.0339 low.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | AUD | Westpac Consumer Confidence Dec | 3.60% | -1.70% | ||

| 23:50 | JPY | Machine Orders M/M Oct | 5.00% | 2.70% | -8.10% | |

| 07:00 | EUR | German CPI M/M Nov F | 0.30% | 0.30% | ||

| 07:00 | EUR | German CPI Y/Y Nov F | 1.80% | 1.80% | ||

| 09:30 | GBP | Jobless Claims Change Nov | 0.4K | 1.1K | ||

| 09:30 | GBP | Claimant Count Rate Nov | 2.30% | |||

| 09:30 | GBP | ILO Unemployment Rate 3M Oct | 4.20% | 4.30% | ||

| 09:30 | GBP | Average Weekly Earnings 3M/Y Oct | 2.50% | 2.20% | ||

| 10:00 | EUR | Eurozone Industrial Production M/M Oct | 0.10% | -0.60% | ||

| 10:00 | EUR | Eurozone Employment Q/Q Q3 | 0.40% | 0.40% | ||

| 13:30 | USD | CPI M/M Nov | 0.40% | 0.10% | ||

| 13:30 | USD | CPI Y/Y Nov | 2.20% | 2.00% | ||

| 13:30 | USD | CPI Core M/M Nov | 0.20% | 0.20% | ||

| 13:30 | USD | CPI Core Y/Y Nov | 1.80% | 1.80% | ||

| 15:30 | USD | Crude Oil Inventories | -5.6M | |||

| 19:00 | USD | FOMC Rate Decision | 1.50% | 1.25% | ||

| 19:30 | USD | FOMC Press Conference |