US stocks were once again boosted by optimism on Senate passing the tax bill. DOW gained 331.67 pts or 1.39% to close at 24272.35. S&P 500 rose 21.51 pts or 0.82% to end at 2647.58. Both were at record highs. NASDAQ lagged behind but still gained 49.58 pts or 0.73%. Though, Asian markets don’t follow and are trading mixed at the time of writing. It should also be pointed out that treasury yield also staged strong rally. 10 year yield closed up 0.041 at 2.417 and looks very safe from key near term support at 2.273. More positive news on tax bill could push 10 year yield through near term resistance at 2.475, which will give support to Dollar, in particular USD/JPY.

In the currency markets, Sterling remains the strongest one for the week. News about agreement on Brexit divorce bill and Irish border raised optimism that there will be sufficient progress made before December 14/15 EU summit. That is, UK and EU could be very ready to move on to trade talks soon. Dollar and Euro follow closely, competing to be the second strongest. Canadian Dollar is trading as the weakest one for the week so far and will look into GDP and employment data for a little help.

Senate to continue marathon debate on tax bill on Friday

The Senate didn’t vote on the bill on Thursday and the marathon debate will continue on Friday. There was some jitters in the markets after Susan Collins expressed that she’s still noted "committed" to the bill. However, sentiments were then lifted as John McCain, a wild card, expressed his support. There was call for a trigger to raise tax if growth induced rise in revenue couldn’t cover the loss. That was raised by Bob Corker, Jeff Flake and James Lankford to avoid ballooning deficit. But the idea was rejected and Republicans are left to find other ways, including raising some taxes down the road to help offset the costs. Developments in the Senate will continue to catch attention during the weekend.

As coalition talks started, SPD Gabriel pleaded "not to put pressure on us"

German Chancellor Angela Merkel and Social Democratic Party leader Martin Schulz met at the presidential palace for more than two hours, kicking the grand coalition talks. President Frank-Walter Steinmeier, who arranged the meeting, said before that "I expect everyone to be willing to negotiate and to make it possible to form a government in the foreseeable future". But the negotiation could take more than just a few weeks.

SPD Foreign Minister Sigmar Gabriel, who was not at the meeting, emphasized that "we’re now in a process orchestrated by the president, in which we first need to look at what the possibilities are but no one can expect it to go quickly." Gabriel pointed out that "the conservatives, Greens and FDP took months to get nothing off ground so I’d ask people not to put pressure on us." Latest poll by Allensbach found that nearly two-thirds of Germans, surveyed between November 22/27, wanted SPD to start coalition talks with CDU/CSU.

China economy may come under pressure in 2018

China Caixin PMI manufacturing dropped to 50.8 in November, down from 51.0 and below expectation of 51.0. That’s also the lowest level in five months. In the statement, Zhengsheng Zhong, director of macroeconomic analysis at CEBM Group, a subsidiary of Caixin, said that "for the most part, the manufacturing sector remained stable in November, although some signs of weakness emerged." And, "in the fourth quarter, the economy is likely to maintain the stability observed since the start of the second half of the year" and "economic growth in 2017 is expected to be higher than last year". However, he also warned that "it may come under downward pressure in 2018."

Elsewhere

Japan national CPI rose to 0.8% yoy in October, Tokyo CPI was unchanged at 0.6% yoy in November. Inflation stays well below the 2% target and justify BoJ’s massive stimulus. Also from Japan, unemployment rate was unchanged at 2.8% in October, household spending rose 0.0%. Japan capital spending rose 4.2% in Q3. PMI manufacturing was revised down to 50.8 in November. Also released, New Zealand terms of trade index rose 0.7% qoq in Q3, below expectation of 0.7% qoq.

Looking ahead: PMI manufacturing will be main focus in European session. UK and Swiss will release PMI manufacturing while Eurozone will release PMI manufacturing revision. Later in the day, Canada will release GDP and employment. US will release ISM manufacturing and construction spending.

USD/CAD Daily Outlook

Daily Pivots: (S1) 1.2822; (P) 1.2847; (R1) 1.2890; More….

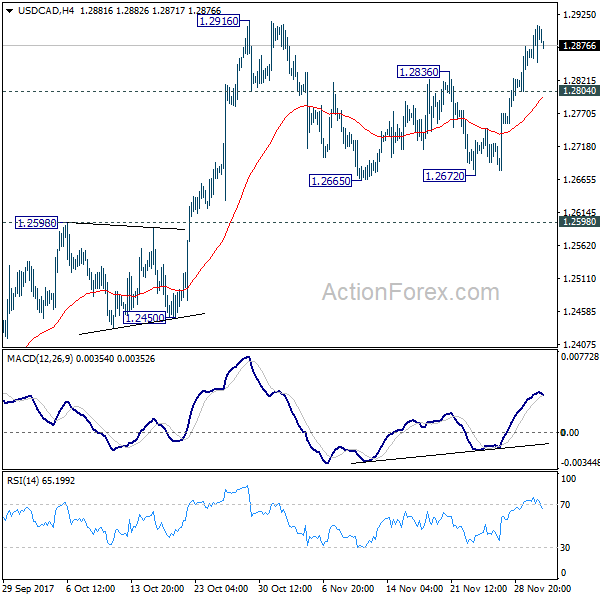

USD/CAD’s rise is still in progress and intraday bias remains on the upside for 1.2916 high. Decisive break there will confirm resumption of whole rally from 1.2061. In that case, USD/CAD should target 1.3065 medium term fibonacci level next. On the downside, though, below 1.2804 will argue that consolidation from 1.2916 is extending with another falling leg. And intraday bias will be turned back to the downside for 1.2672 support. But still, we’d expect downside to be contained by 1.2598 resistance turned support and bring rise resumption.

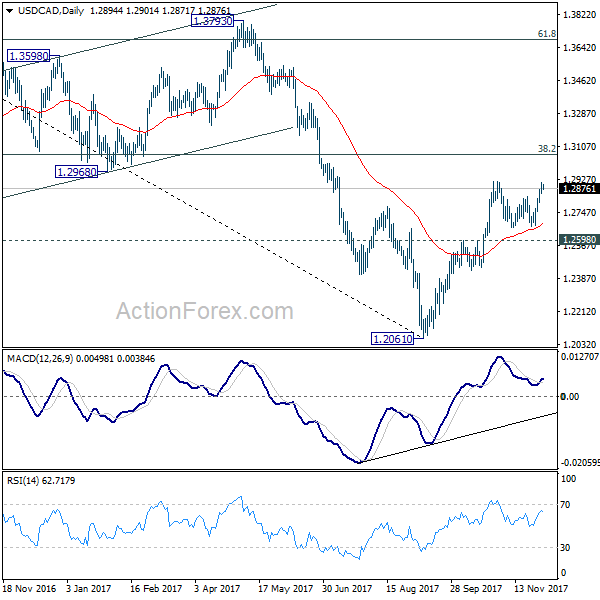

In the bigger picture, USD/CAD should have defended 50% retracement of 0.9406 (2011 low) to 1.4689 (2016 high) at 1.2048. And with 1.2048 intact, we’d favor the case that fall from 1.4689 is a correction. Rise from 1.2061 medium term bottom should now target 38.2% retracement of 1.4689 to 1.2061 at 1.3065. Firm break there will target 1.3793 key resistance next (61.8% retracement at 1.3685). We’ll now hold on to this bullish view as long as 1.2450 support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Terms of Trade Index Q/Q Q3 | 0.70% | 1.30% | 1.50% | 1.40% |

| 23:30 | JPY | Unemployment Rate Oct | 2.80% | 2.80% | 2.80% | |

| 23:30 | JPY | Overall Household Spending Y/Y Oct | 0.00% | -0.30% | -0.30% | |

| 23:30 | JPY | National CPI Core Y/Y Oct | 0.80% | 0.80% | 0.70% | |

| 23:30 | JPY | Tokyo CPI Core Y/Y Nov | 0.60% | 0.60% | 0.60% | |

| 23:50 | JPY | Capital Spending Q3 | 4.20% | 3.20% | 1.50% | |

| 0:30 | JPY | PMI Manufacturing Nov F | 53.6 | 53.8 | 53.8 | |

| 1:45 | CNY | Caixin PMI Manufacturing Nov | 50.8 | 51 | 51 | |

| 8:30 | CHF | PMI Manufacturing Nov | 62.5 | 62 | ||

| 8:45 | EUR | Italy Manufacturing PMI Nov | 58.3 | 57.8 | ||

| 8:50 | EUR | France Manufacturing PMI Nov F | 57.5 | 57.5 | ||

| 8:55 | EUR | Germany Manufacturing PMI Nov F | 62.5 | 62.5 | ||

| 9:00 | EUR | Eurozone Manufacturing PMI Nov F | 60 | 60 | ||

| 9:30 | GBP | PMI Manufacturing Nov | 56.5 | 56.3 | ||

| 13:30 | CAD | GDP M/M Sep | 0.10% | -0.10% | ||

| 13:30 | CAD | Net Change in Employment Nov | 10.0k | 35.3k | ||

| 13:30 | CAD | Unemployment Rate Nov | 6.20% | 6.30% | ||

| 14:30 | CAD | Manufacturing PMI Nov | 54.3 | |||

| 14:45 | USD | Manufacturing PMI Nov F | 53.8 | 53.8 | ||

| 15:00 | USD | ISM Manufacturing Nov | 58.3 | 58.7 | ||

| 15:00 | USD | ISM Prices Paid Nov | 67.8 | 68.5 | ||

| 15:00 | USD | Construction Spending M/M Oct | 0.50% | 0.30% |