Mid-Day Report: Dollar Turns Cautious as Senate Tax Vote Eyed, Euro Shrugged Off CPI Miss

Quick update:

- Dollar tumbles after Republican Senator Susan Collins said "I am not committed to voting for this bill", referring to the tax bill.

- Pressure on dollar eased abit after John McCain said he supports

Dollar stays firm in early US session, except versus Sterling and Euro. Forex traders are turning a bit cautious as economic data from US provide little inspiration. Focus will turn to the Republican’s tax plan debate and vote in Senate. Meanwhile, Euro reversed earlier dip on disappointing inflation data as buyers emerged. Sterling, on the other hand, remains the start performer this week as more positive Brexit news come out. In other markets, WTI crude oil recover mildly and is back above 57.7 after OPEC agrees to extend production cut. Gold, on the other handle is pressured and breaches 1280 handle. Stocks traders are still partying with DOW futures pointing to another record high today.

Released from US, personal income rose 0.4% in October, above expectation of 0.3%. Personal spending rose 0.3%, in line with consensus. Headline PCE slowed to 1.7% yoy but beat expectation of 1.5% yoy. Core PCE was unchanged at 1.4% yoy. Initial jobless claims dropped 2k to 238k in the week ended November 25. Continuing claims rose 42k to 19.6m in the week ended November 18. From Canada, current account deficit widened to CAD -19.4b in Q3.

UK-EU close to an Irish border agreement

Positive Brexit development continues to support Sterling. It’s reported that UK and EU are close to agreement on the topic of Irish border. Ireland’s EU commissioner Phil Hogan was quoted "in the same way as we have seen movement in the last 24 hours in relation to the financial settlement, I expect that we will see movement in this regard in the next few days as well." Earlier this week, it’s reported that UK and EU have already agreed on the divorce bill at EUR 45-55b. The negotiation teams now look more likely than ever to make sufficient progress for EU leaders to approve moving on to trade talks in the December 14/15 summit.

Euro dipped briefly after CPI miss

Euro is weighed down by inflation data today, but it quickly recovered. CPI flash rose to 1.5% yoy in November, up fro 1.4% but missed expectation of 1.6% yoy. CPI core was unchanged at 0.9% yoy, below expectation of 1.0% yoy. Nonetheless, Eurozone unemployment rate dropped to 8.8% in October, down from 8.9% and hit the lowest level since 2009. From Germany, unemployment dropped -18k in November, better than expectation of -10k. German unemployment rate was unchanged at 8.8%.

ECB officials delivered upbeat comments

Comments from ECB officials were upbeat. Bundesbank head Jens Weidmann said that "evidence is mounting the economic outlook will be at least as good as previously forecast, if not even better." He added that "the development of domestic price pressures shown in the forecasts is in line with a path to our definition of price stability." And he also emphasized that "even after the end of net purchases, monetary policy in the euro area will continue to be very expansionary."

ECB Governing Council member Klaas Knot said yesterday that "with deflation risk clearly off the radar, the main rationale for employing the APP (asset purchase program) has therefore ceased to exist." He added that "fear of relapse owing to an allegedly premature discontinuation of net purchases seems rather overdone." Hence, he urged a "full phasing" out of the program "from September onwards". Back in October, ECB extended the asset purchase program to September next year, but halved the purchase size to EUR 30b a month starting January.

Swiss KOF indicates increasing growth momentum

Swiss KOF economic barometer rose to 110.3 in November, up from 109.8 and beat expectation of 109.5. That’s the third straight months of gains in the indicator and stayed comfortably above long term average at 100. It also indicates that the economy continues to gain momentum towards the end of the year. Manufacturing continued to be responsible a "substantial part of the increase". However, banking slowed down the positive developments. Also from Swiss, GDP grew 0.6% qoq in Q3, in line with expectations. However, retail sales dropped sharply by -3.0% yoy in October versus consensus of 0.3% yoy rise.

New Zealand confidence tumbled

New Zealand Dollar suffered selling pressure as ANZ Business Confidence tumbled to -39.3 in November, down from -10.1. That’s also the worst reading in 8 years. ANZ noted that "uncertainty around changing Government policy, a softer housing market, and difficulty getting credit are likely culprits." Also, "the economy is at a delicate juncture as migration, construction and housing run out of steam as growth drivers. Commodity prices are strong and a fiscal boost will come through in time, but at such times of transition, sentiment is more vulnerable." Separately released, building permits dropped -9.6% mom in October.

Elsewhere, Australia private capital expenditure rose 1.0% in Q3, building approvals rose 0.9% mom. Japan industrial production rose 0.5% mom in October, housing starts dropped -4.8% yoy. China manufacturing PMI rose 0.2 pt to 5.18 in November, non-manufacturing PMI rose 0.5 to 54.8.

OPEC to extend production cut to end of 2018

Oil price strengthens mildly today as OPEC agreed to extend its production cut to the end of next year. The current agreement to cut supply by around 1.8 bpd originally expires in March. Saudi Energy Minister Khalid al-Falih said before the meeting that it’s premature to talk about exit. But "when we get to an exit, we are going to do it very gradually … to make sure we don’t shock the market." Iraq, Iran and Angola also expressed willingness to review the cut again at next OPEC meeting in June.

EUR/USD Mid-Day Outlook

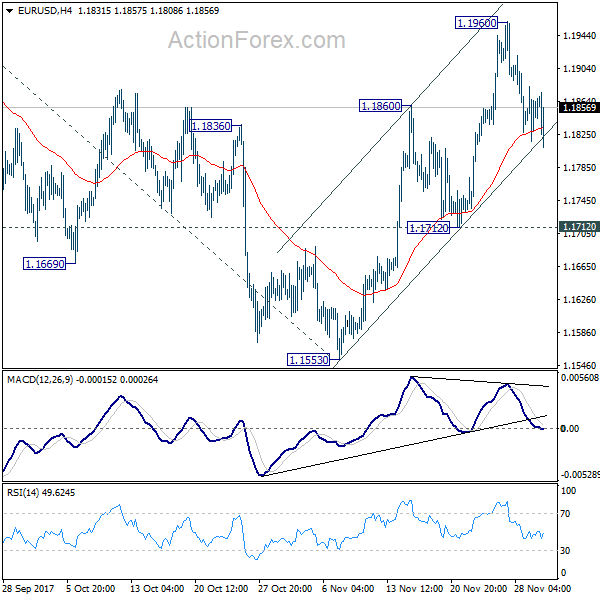

Daily Pivots: (S1) 1.1814; (P) 1.1849 (R1) 1.1881; More….

EUR/USD is staying in consolidation from 1.1960 and intraday bias remains neutral. With 1.1712 support intact, rise from 1.1553 is expected to resume later. Break of 1.1960 will turn bias to the upside for retesting 1.2091 high first. Break there will resume medium term up trend from 1.0339 and target 61.8% projection of 1.0569 to 1.2091 from 1.1553 at 1.2494, which is close to 1.2516 long term fibonacci level. We’d expect strong resistance from there to bring reversal. On the downside, break of 1.1712 will indicate completion of the rise from 1.1553 and turn near term outlook bearish.

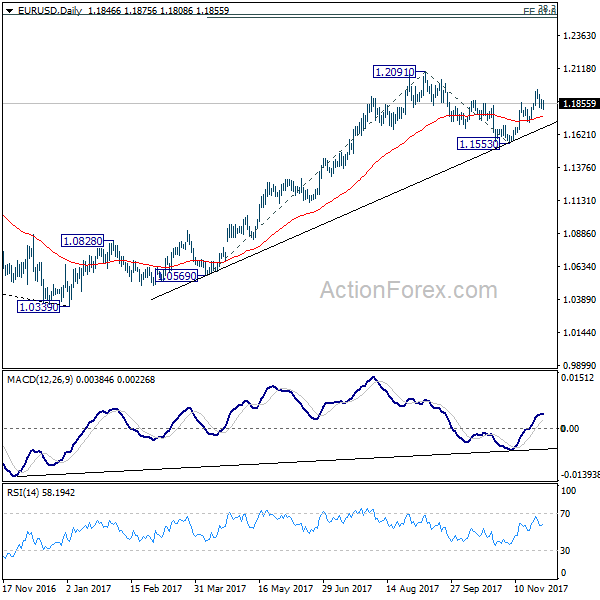

In the bigger picture, rise from 1.0339 medium term bottom is seen as a corrective move for the moment. Therefore, in case of another rally, we’d be expect 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516 to limit upside and bring reversal. Meanwhile, sustained trading below 55 week EMA (now at 1.1393) will suggest that such medium term rebound is completed and could then bring retest of 1.0339 low.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Building Permits M/M Oct | -9.60% | -2.30% | -2.50% | |

| 23:50 | JPY | Industrial Production M/M Oct P | 0.50% | 1.80% | -1.00% | -1.00% |

| 00:00 | NZD | ANZ Business Confidence Nov | -39.3 | -10.1 | ||

| 00:01 | GBP | GfK Consumer Confidence Nov | -12 | -11 | -10 | |

| 00:30 | AUD | Private Capital Expenditure Q3 | 1.00% | 1.00% | 0.80% | 1.10% |

| 00:30 | AUD | Building Approvals M/M Oct | 0.90% | -1.00% | 1.50% | 0.60% |

| 01:00 | CNY | Manufacturing PMI Nov | 51.8 | 51.5 | 51.6 | |

| 01:00 | CNY | Non-manufacturing PMI Nov | 54.8 | 54.3 | ||

| 05:00 | JPY | Housing Starts Y/Y Oct | -4.80% | -2.80% | -2.90% | |

| 06:45 | CHF | GDP Q/Q Q3 | 0.60% | 0.60% | 0.30% | 0.40% |

| 08:00 | CHF | KOF Leading Indicator Nov | 110.3 | 109.5 | 109.1 | 109.8 |

| 08:15 | CHF | Retail Sales Real Y/Y Oct | -3.00% | 0.30% | -0.40% | |

| 08:55 | EUR | German Unemployment Change Nov | -18K | -10K | -11K | -12K |

| 08:55 | EUR | German Unemployment Claims Rate Nov | 5.60% | 5.60% | 5.60% | |

| 10:00 | EUR | Eurozone Unemployment Rate Oct | 8.80% | 8.90% | 8.90% | |

| 10:00 | EUR | Eurozone CPI Estimate Y/Y Nov | 1.50% | 1.60% | 1.40% | |

| 10:00 | EUR | Eurozone CPI Core Y/Y Nov A | 0.90% | 1.00% | 0.90% | |

| 13:30 | CAD | Current Account Balance (CAD) Q3 | -19.4B | -20.3B | -16.3B | -15.6B |

| 13:30 | USD | Initial Jobless Claims (NOV 25) | 238K | 241K | 239K | 240K |

| 13:30 | USD | Personal Income Oct | 0.40% | 0.30% | 0.40% | |

| 13:30 | USD | Personal Spending Oct | 0.30% | 0.30% | 1.00% | 0.90% |

| 13:30 | USD | PCE Deflator M/M Oct | 0.10% | 0.10% | 0.40% | |

| 13:30 | USD | PCE Deflator Y/Y Oct | 1.60% | 1.50% | 1.60% | 1.70% |

| 13:30 | USD | PCE Core M/M Oct | 0.20% | 0.20% | 0.10% | 0.20% |

| 13:30 | USD | PCE Core Y/Y Oct | 1.40% | 1.40% | 1.30% | 1.40% |

| 14:45 | USD | Chicago PMI Nov | 62.3 | 66.2 | ||

| 15:30 | USD | Natural Gas Storage | -46B |