Dollar’s rally gathers momentum in early US session. Q3 GDP growth was revised higher to 3.3% annualized, up from 3.0% annualized and beat expectation of 3.2% annualized. The 3.3% annualized growth was the fastest in three years. More importantly, US growth has topped 3% for two quarters in a row. Considering the current momentum, it’s possibly that the economy will make it three for the first time since 2004/5. There is little doubt that Fed will raise interest rate again in December. Solid growth momentum will most likely push wage and inflation and ease some Fed doves’ concerns. Senate Republican’s tax bill has already passed the Budget Committee and could be put to floor vote on Thursday.

Quick update: There is additional support to Dollar from Fed Chair Janet Yellen, who’s having her last Congressional testimony. She said that the economy has strengthened further this year" and growth "is increasingly broad-based." Also, "we continue to expect that gradual increases in the federal funds rate will be appropriate to sustain a healthy labor market and stabilize inflation around 2% objective."

Sterling stays strong on Brexit optimism

Sterling is trading as the strongest on as boosted higher by reports that agreement was made between UK and EU on the divorce bill, and will add up to EUR 45-55b. That would be made in time for EU leaders to approve in the December 14/15 summit to move the negotiations to trade relationship. Though, EU chief negotiator sounded cautious in his comments and said "we are still working. The only comment I can make." Released from UK, mortgage approvals dropped to 65k in October, M4 rose 0.6% mom. BRC shop price index dropped -0.1% yoy in November.

Eurozone confidence improved but missed expectations

Eurozone business climate rose to 1.49 in November, up from 1.44 but missed expectation of 1.51. Economic confidence rose to 114.6, up from 114.1, meeting consensus, and hit the highest since 2000. Industrial confidence rose to 8.0, up from 8.0 but missed expectation of 8.6. Services confidence rose to 16.3, up from 16.2, also missed expectation of 16.7. Consumer confidence was finalized at 0.1. European Commission said that "employment plans saw significant upward revisions in retail trade and industry, both indicators reaching the highest levels in more than 30 years. In construction, employment plans improved more moderately, while also reaching a 10-year high. Employment plans worsened slightly in the services sector."

Also from Eurozone, French GDP rose 0.5% qoq in Q3. German CPI accelerated to 1.8% yoy in November.

ECB warned of financial markets risk taking

ECB warned in its semi-annual Financial Stability Review that "continued compression of risk premia, subdued volatility and signs of increased risk-taking behavior in global financial markets are all sources of concern, as they may sow the seeds for large asset price corrections in the future." Also, "higher interest rates may trigger concerns about sovereigns’ debt-servicing capacity." And, "distrust in mainstream political parties continues to rise, leading to fragmentation of the political landscape away from the established consensus."

BoJ Nakaso: No immediate threat to financial stability

BoJ Deputy Governor Hiroshi Nakaso said that the central bank can learn a lot from Fed’s experience on stimulus exit. Nonetheless, "what tools we will use and in what sequence would depend on economic, price and financial conditions at the time." Also, "regional financial institutions have sufficient capital and liquidity at present. Thus, there are no immediate threats to the stability of the financial system." Released from Japan, retail sales rose 0.8% yoy in October.

RBNZ to unwind home loan restrictions

RBNZ indicates today that it would to unwind some restrictions on home loans. The loan-to-value ratio restrictions could be modestly eased starting January 1 next year. Governor Grant Spencer said that "over the past six months, pressures in the housing market have continued to moderate due to the tightening of LVR restrictions in October 2016." And, "the market has been coming off really since mid-last year and so we have been considering it particularly as Auckland was flattening out and indeed going negative." Also, "housing market policies announced by the government are also expected to have a dampening effect on the housing market."

USD/CAD Mid-Day Outlook

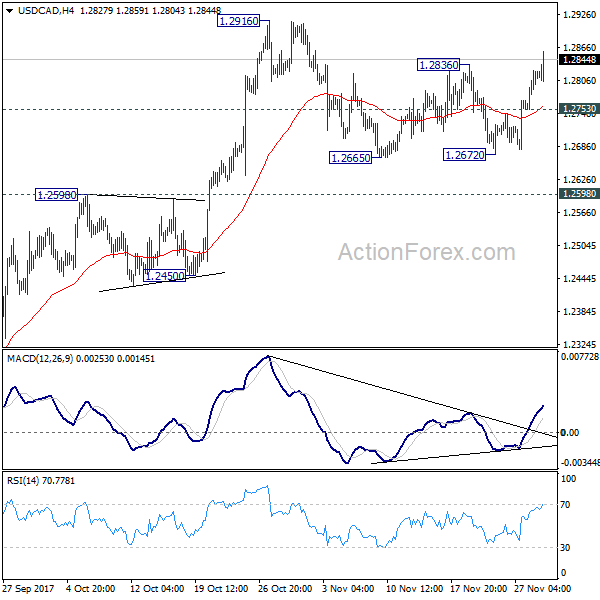

Daily Pivots: (S1) 1.2771; (P) 1.2797; (R1) 1.2842; More….

USD/CAD’s strong rally and break of 1.2836 resistance suggests that corrective pattern from 1.2916 has completed at 1.2672 already. Intraday bias is turned back to the upside for 1.2916 first. Break will resume whole rise from 1.2061 and target 1.3065 medium term fibonacci level. On the downside, below 1.2753 will delay the bullish case and extend the correction from 1.2916 with another fall. But still, we’d expect downside to be contained by 1.2598 resistance turned support and bring rebound.

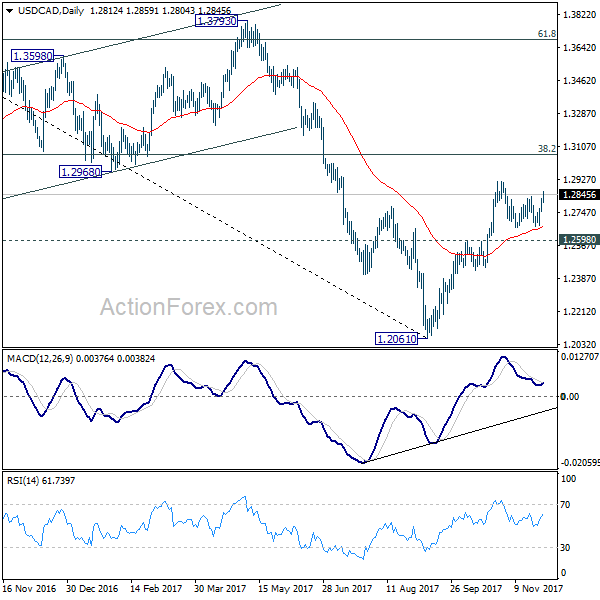

In the bigger picture, USD/CAD should have defended 50% retracement of 0.9406 (2011 low) to 1.4689 (2016 high) at 1.2048. And with 1.2048 intact, we’d favor the case that fall from 1.4689 is a correction. Rise from 1.2061 medium term bottom should now target 38.2% retracement of 1.4689 to 1.2061 at 1.3065. Firm break there will target 1.3793 key resistance next (61.8% retracement at 1.3685). We’ll now hold on to this bullish view as long as 1.2450 support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Retail Trade Y/Y Oct | 0.80% | 0.00% | 2.20% | |

| 00:01 | GBP | BRC Shop Price Index Y/Y Nov | -0.10% | -0.10% | ||

| 07:00 | CHF | UBS Consumption Indicator Oct | 1.54 | 1.56 | 1.51 | |

| 07:45 | EUR | French GDP Q/Q Q3 P | 0.50% | 0.50% | 0.50% | |

| 09:30 | GBP | Mortgage Approvals Oct | 65K | 65K | 66K | |

| 09:30 | GBP | M4 Money Supply M/M Oct | 0.60% | 0.30% | -0.20% | -0.10% |

| 10:00 | EUR | Eurozone Business Climate Indicator Nov | 1.49 | 1.51 | 1.44 | |

| 10:00 | EUR | Eurozone Economic Confidence Nov | 114.6 | 114.6 | 114 | 114.1 |

| 10:00 | EUR | Eurozone Industrial Confidence Nov | 8.2 | 8.6 | 7.9 | 8 |

| 10:00 | EUR | Eurozone Services Confidence Nov | 16.3 | 16.7 | 16.2 | |

| 10:00 | EUR | Eurozone Consumer Confidence Nov F | 0.1 | 0.1 | 0.1 | |

| 13:00 | EUR | German CPI M/M Nov P | 0.30% | 0.30% | 0.00% | |

| 13:00 | EUR | German CPI Y/Y Nov P | 1.80% | 1.70% | 1.60% | |

| 13:30 | USD | GDP Annualized Q/Q Q3 S | 3.30% | 3.20% | 3.00% | |

| 13:30 | USD | GDP Price Index Q3 S | 2.10% | 2.20% | 2.20% | |

| 15:00 | USD | Pending Home Sales M/M Oct | 1.20% | 0.00% | ||

| 15:30 | USD | Crude Oil Inventories | -2.5M | -1.9M |