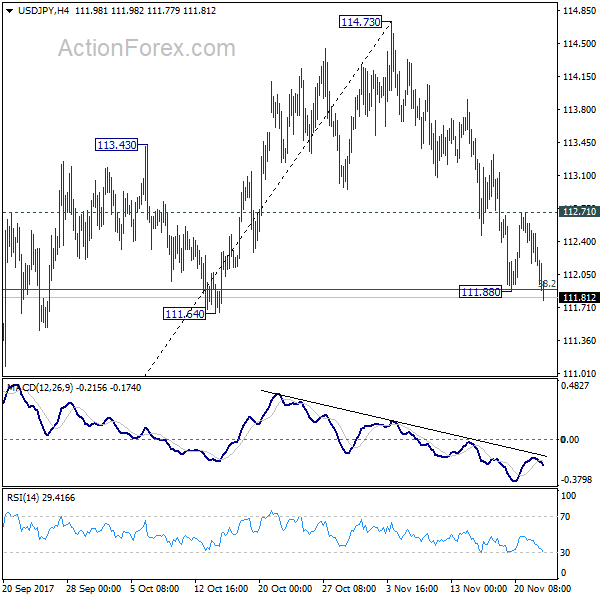

Daily Pivots: (S1) 112.17; (P) 112.43; (R1) 112.70; More…

USD/JPY’s break of 111.88 indicates resumption of fall from 114.73. Intraday bias is back on the downside with focus on 111.64 support. Decisive break of 111.64 support will argue that whole rebound from 107.31 has completed. In that case, deeper fall would be seen to 61.8% retracement of 107.31 to 114.73 at 101.14 and below. On the upside, break of 112.71 minor resistance will indicate near term reversal and turn bias back to the upside for retesting 114.73 high.

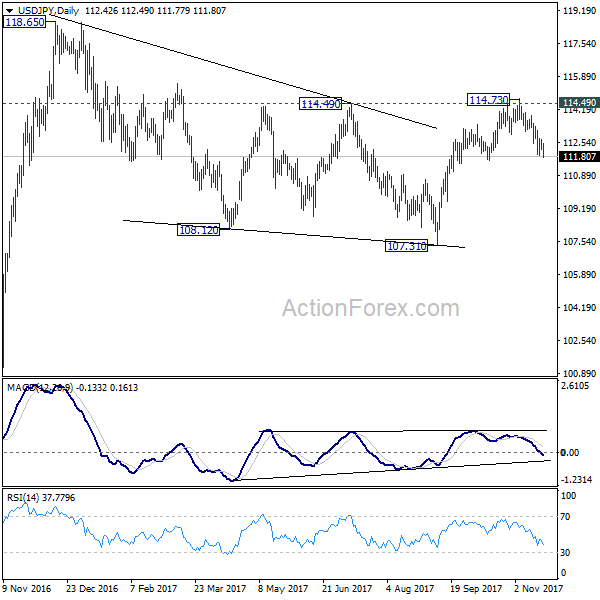

In the bigger picture, medium term rise from 98.97 (2016 low) is not completed yet. It should resume after corrective fall from 118.65 completes. Break of 114.49 resistance will likely resume the rise to 61.8% projection of 98.97 to 118.65 from 107.31 at 119.47 first. Firm break there will pave the way to 100% projection at 126.99. This will be the key level to decide whether long term up trend is resuming. However, firm break of 111.64 support will dampen this view and turn focus back to 107.31 instead.