GBP/JPY – 148.55

New strategy :

Stand aside

Position: –

Target: –

Stop:-

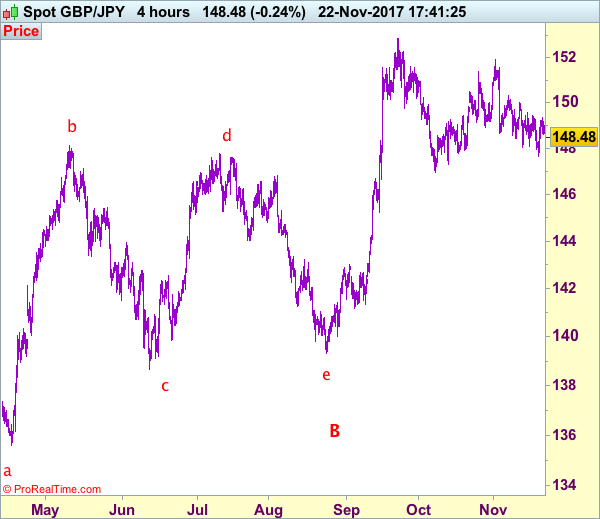

Although sterling fell to 147.65 earlier this week, the subsequent rebound suggests consolidation above this level would be seen and recovery to149.00, then 149.45-55 cannot be ruled out, however, reckon resistance at 149.70 would cap upside and bring retreat later. Only a break above this level would signal the fall from 151.90 top has ended and bring further subsequent gain to 150.00 resistance, then towards another previous resistance at 150.30 which is likely to hold from here.

On the downside, below 148.00-10 would bring retest of said support at 147.65, break there would signal the erratic decline from 151.90 top is still in progress, bring retracement of early rise to support at 147.30, then 146.90-00 but oversold condition should limit downside to 146.40-50, bring another rebound later. As near term outlook is still mixed, would be prudent to stand aside for now.

Our preferred count is that larger degree wave V with circle is unfolding from 251.12 with wave (I) 219.34, (II): 241.38 and wave (III) is subdivided into 1: 192.60, 2: 215.89 (23 Jul 2008) and wave 3 ended at 118.87 earlier in 2009. The correction from there to 162.60 is wave 4 which itself is a double three and is labeled as first a-b-c ended at 151.53, followed by wave x at 139.03, 2nd a ended at 162.60, 2nd b at 146.75 and 2nd c leg of wave 4 ended at 163.00. Therefore, the decline from 163.00 to 116.85 is now treated as wave 5 which also marked the end of larger degree wave (III), hence wave (IV) major correction has commenced for retracement of the wave (III) from 241.38 and upside target at 183.95-00 (50% Fibonacci retracement of the wave (II) from 241.38) had been met, a drop below 160.00 would suggest wave (IV) has ended at 195.85, bring decline in wave (V) for initial weakness to 130 (already met) and 120.