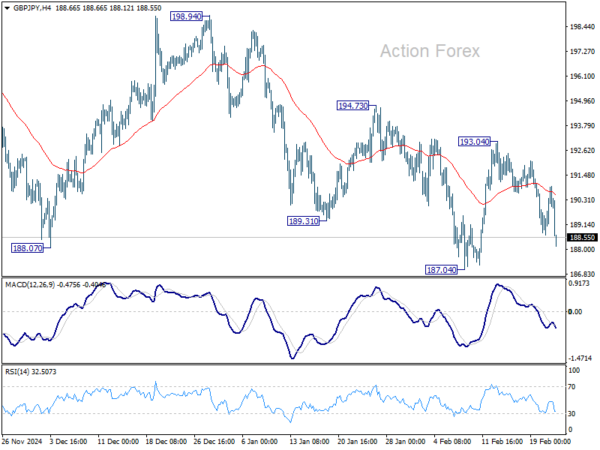

GBP/JPY’s decline last week should confirm prior rejection by 55 D EMA (now at 192.44) which is a bearish sign. However, downside is still contained well above 187.04 support. Initial bias remains neutral this week first. On the downside, firm break of 187.04 will extend the fall from 199.79 towards 180.00 support.

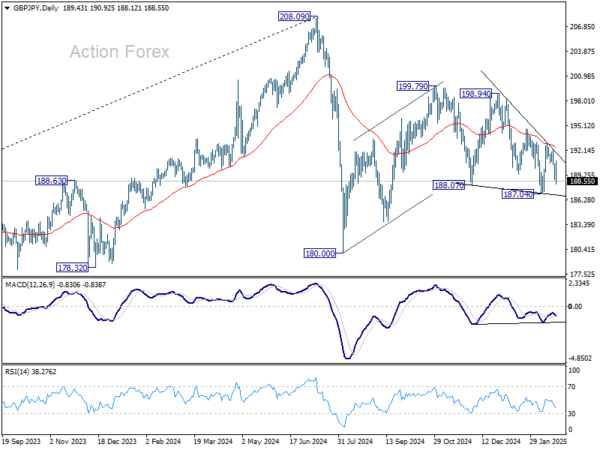

In the bigger picture, price actions from 208.09 are seen as a correction to rally from 123.94 (2020 low). Strong support should be seen from 38.2% retracement of 123.94 to 208.09 at 175.94 to contain downside. However, sustained break of 152.11 will bring deeper fall even still as a correction.

In the longer term picture, while a medium term top was formed at 208.09 (2024 high), it’s still early to conclude that the up trend from 122.75 (2016 low) has completed. But GBP/JPY is at least in a medium term corrective phase, with risk of correction to 55 M EMA (now at 173.92).